Get the free CALIFORNIA-NEVADA J A T C

Show details

IMPORTANT PLEASE READ! INFORMATION SHEET FOR SUBMITTING APPLICATION COMPLETE ALL QUESTIONS ON THE ONLINE APPLICATION FORM. SUBMIT COMPLETED APPLICATION (once your application has been completed and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign california-nevada j a t

Edit your california-nevada j a t form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california-nevada j a t form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing california-nevada j a t online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit california-nevada j a t. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out california-nevada j a t

How to fill out California-Nevada J A T:

01

Start by gathering the necessary information: Before filling out the California-Nevada J A T (Joint Audit Team) form, make sure you have all the required information readily available. This may include details about the audited entity, its location, any existing audit documentation, and contact information.

02

Complete the header section: Begin by filling out the header section of the California-Nevada J A T form. This typically includes the name and address of the audited entity, the J A T team members' names and contact details, and the date of the J A T formation.

03

Identify the audited entity: Provide a brief description of the audited entity, including its name, type of business, and any relevant subsidiaries or affiliated organizations. This section helps provide context for the audit.

04

State the objective of the joint audit: Clearly state the objective of the joint audit. This could include assessing the audited entity's compliance with applicable laws, regulations, or industry standards, or evaluating the effectiveness of internal controls, among other purposes.

05

Detail the scope of the audit: Define the scope of the joint audit by specifying the areas or processes to be audited. This could involve financial statements, internal controls, specific business operations, or any other relevant focus areas. Be specific and comprehensive to ensure a thorough and effective audit.

06

Outline the audit methodology: Provide an overview of the audit methodology to be utilized during the joint audit. This may include the steps to be followed, the sampling techniques, data analysis methods, and any other relevant audit procedures. It is important to establish a clear and standardized approach to ensure consistency among the J A T team members.

07

Allocate responsibilities: Assign specific responsibilities to each J A T team member involved in the audit. This could involve designating team leaders, identifying the roles of each member, and outlining their respective responsibilities. Clearly defining responsibilities helps streamline the audit process and ensures efficient collaboration.

08

Establish a timeline: Develop a timeline for the joint audit, specifying key milestones, deadlines, and deliverables. This helps organize the audit process and ensures that all tasks are completed within a reasonable timeframe. Regularly monitor and update the timeline as needed throughout the audit.

Who needs California-Nevada J A T:

01

Organizations subject to regulatory requirements: Various organizations, particularly those operating in regulated industries such as finance, healthcare, and energy, may need to undergo a California-Nevada J A T. This is often required to demonstrate compliance with industry-specific regulations and standards.

02

Entities seeking independent verification: Businesses looking to validate their internal controls, financial statements, or operational processes may opt to undergo a joint audit. A California-Nevada J A T provides an independent assessment, offering additional assurance and credibility to the audited entity.

03

Companies undergoing mergers or acquisitions: In scenarios where two or more companies merge or acquire one another, a joint audit may be necessary. This helps evaluate and align the internal control systems, financials, and other critical aspects of both entities, ensuring a smooth integration process.

Note: The California-Nevada J A T process and its specific applicability may vary depending on the jurisdiction, industry, and organizational requirements. It is advisable to consult with relevant authorities or seek professional assistance to ensure compliance and accuracy in filling out the form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send california-nevada j a t for eSignature?

When your california-nevada j a t is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an eSignature for the california-nevada j a t in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your california-nevada j a t and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit california-nevada j a t on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute california-nevada j a t from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is california-nevada j a t?

California-Nevada Joint Audit Tax Program (JAT) is a program designed to promote efficient and effective tax auditing for businesses operating in both California and Nevada.

Who is required to file california-nevada j a t?

Businesses that operate in both California and Nevada are required to file California-Nevada JAT.

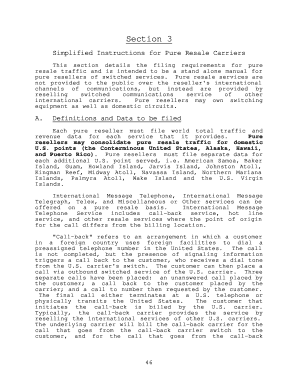

How to fill out california-nevada j a t?

California-Nevada JAT can be filled out by providing relevant tax information for both California and Nevada, based on the guidelines provided by the program.

What is the purpose of california-nevada j a t?

The purpose of California-Nevada JAT is to streamline tax auditing for businesses operating in both states, to ensure compliance and minimize duplication of efforts.

What information must be reported on california-nevada j a t?

California-Nevada JAT requires businesses to report income, expenses, deductions, and other relevant tax information for both California and Nevada.

Fill out your california-nevada j a t online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California-Nevada J A T is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.