Get the free Health Savings Custodial Account Agreement - chcoc

Show details

This document outlines the establishment and management of Health Savings Accounts (HSAs) for Federal employees, encouraging Federal credit unions to offer such accounts and providing guidance on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign health savings custodial account

Edit your health savings custodial account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your health savings custodial account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing health savings custodial account online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit health savings custodial account. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

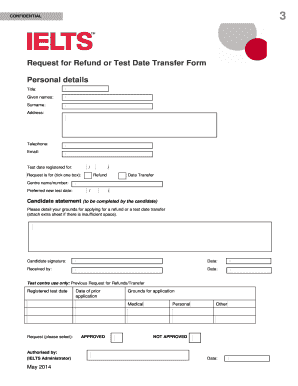

How to fill out health savings custodial account

How to fill out Health Savings Custodial Account Agreement

01

Obtain the Health Savings Custodial Account Agreement form from your financial institution or online.

02

Read through the agreement thoroughly to understand its terms and conditions.

03

Enter your personal information in the designated fields, including your name, address, social security number, and contact information.

04

Provide information regarding your health insurance plan that qualifies for HSA eligibility.

05

Designate a beneficiary by filling in their information, in case of account holder's death.

06

Review the funding options available for your HSA and choose your preferred method (e.g., transfer, contribution).

07

Sign and date the agreement at the bottom to confirm your understanding and acceptance of the terms.

08

Submit the completed agreement to your financial institution along with any required documentation.

Who needs Health Savings Custodial Account Agreement?

01

Individuals who have a high-deductible health plan (HDHP) and want to save for out-of-pocket medical expenses.

02

People looking for tax-advantaged savings options to manage healthcare costs.

03

Employees whose employers offer Health Savings Accounts (HSA) as a part of their benefits package.

04

Self-employed individuals seeking to lower their taxable income while saving for medical expenses.

Fill

form

: Try Risk Free

People Also Ask about

What is an HSA custodial agreement?

With a custodial agreement, a nominee holds assets or property on behalf of the real owner. Examples include employee benefit programs such as 401(k) plans or health savings accounts in which a company hires a third party to administer the plan.

What is an HSA agreement?

An HSA allows you to put money away and withdraw it tax free, as long as you use it for qualified medical expenses, like deductibles, copayments, coinsurance, and more.

What is the purpose of a custodial account?

A custodial agreement is an arrangement wherein one holds an asset or property on behalf of the actual owner (beneficial owner). Such agreements are generally entered into by state agencies, or companies to administer various benefit programs.

What is a custodial account agreement?

Imagine a retirement fund entrusts a financial institution with its investment assets. A custodial agreement outlines that the financial institution will hold the assets, process transactions, and provide regular reports to the fund's managers.

What is a custodial agreement?

You Can't Take the Money Back Once you've transferred assets into a custodial account, you're not permitted to take them back. Those assets belong to the child. Never transfer assets to a custodial account if you have any concern that you may need to recover those assets later.

Is an HSA a custodial account?

An HSA is a tax-exempt trust or custodial account that a taxpayer sets up with a qualified HSA trustee. Distributions from an HSA are nontaxable if the funds are used for qualified medical expenses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Health Savings Custodial Account Agreement?

A Health Savings Custodial Account Agreement is a legal document that outlines the terms of a health savings account (HSA), which is a tax-advantaged savings account designed to help individuals save for medical expenses.

Who is required to file Health Savings Custodial Account Agreement?

Individuals who wish to establish a Health Savings Account (HSA) typically need to file a Health Savings Custodial Account Agreement. This is usually done by those who have high-deductible health plans and want to take advantage of tax benefits associated with HSAs.

How to fill out Health Savings Custodial Account Agreement?

To fill out a Health Savings Custodial Account Agreement, individuals must provide personal information such as their name, address, Social Security number, and information regarding their HSA provider, as well as agreeing to the terms of the account.

What is the purpose of Health Savings Custodial Account Agreement?

The purpose of the Health Savings Custodial Account Agreement is to legally establish the HSA, outline the responsibilities of the account holder and the custodian, and ensure compliance with federal regulations regarding HSAs.

What information must be reported on Health Savings Custodial Account Agreement?

The information that must be reported on a Health Savings Custodial Account Agreement includes the account holder's personal details, the amount contributed to the HSA, information about the custodian, and any relevant terms and conditions associated with the account.

Fill out your health savings custodial account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Savings Custodial Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.