Get the free PAYDAY LOANS - ag ny

Show details

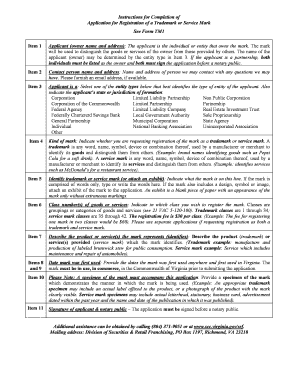

Dear New Yorkers: It sounds quick and easy: someone gives a personal check or account debit authorization in exchange for a loan plus a fee (which is actually interested on the loan). Payday lenders

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payday loans - ag

Edit your payday loans - ag form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payday loans - ag form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payday loans - ag online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit payday loans - ag. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payday loans - ag

How to fill out payday loans?

01

Research and compare different payday loan providers to find the best option for your needs. Look for reputable lenders with good customer reviews and reasonable interest rates.

02

Gather all the necessary documents and information required by the lender. This usually includes proof of income, identification, and proof of residency. Make sure you have everything prepared to streamline the application process.

03

Carefully read and understand the loan terms and conditions before signing any agreements. Pay attention to the interest rates, repayment terms, and any additional fees or charges that may be associated with the payday loan.

04

Fill out the application form accurately and honestly. Provide all the required information and make sure it is correct. Incomplete or false information can lead to delays in the approval process or even denial of the loan.

05

Submit the application to the payday loan provider either online or in person. If applying online, follow the instructions provided and submit any supporting documents electronically.

06

Wait for the loan approval decision. This can vary depending on the lender but usually doesn't take too long. If approved, review the loan agreement once again to ensure you understand all the terms and conditions.

07

If you agree with the loan terms, sign the agreement as directed. Be aware that by signing, you are legally obligated to repay the loan according to the specified terms.

08

After signing the agreement, the lender will typically deposit the loan amount directly into your specified bank account. This process can happen within a few hours or up to a couple of business days, depending on the lender and your bank.

09

Repay the payday loan according to the agreed-upon schedule. Make sure you have the necessary funds in your bank account on the due date to avoid additional fees or penalties.

10

Once you have repaid the loan in full, make sure to confirm the loan closure with the lender. Keep any relevant documentation or receipts for your records.

Who needs payday loans?

01

Individuals facing unexpected financial emergencies or short-term cash flow problems may turn to payday loans as a temporary solution until their next payday.

02

People who have limited or no access to traditional banking services or credit may rely on payday loans as a means to cover urgent expenses.

03

Individuals with bad credit scores or a lack of credit history may find it difficult to obtain loans from conventional lenders, making payday loans a viable option in such situations.

04

Some individuals opt for payday loans due to the convenience and quick access to funds they provide, especially when urgent expenses arise.

05

Small business owners or entrepreneurs who need immediate funding for their business operations may consider payday loans as a financing option.

Please note that payday loans should be used responsibly and only when no other alternatives are available. They often come with high interest rates and fees, so it's essential to carefully consider your financial situation and repayment capabilities before taking out a payday loan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send payday loans - ag for eSignature?

When your payday loans - ag is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find payday loans - ag?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific payday loans - ag and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit payday loans - ag in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your payday loans - ag, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is payday loans?

Payday loans are short-term loans with high interest rates that are typically due on the borrower's next payday.

Who is required to file payday loans?

Lenders who provide payday loans are required to file reports on these loans.

How to fill out payday loans?

To fill out a payday loan, borrowers typically need to provide personal information, employment details, and bank account information.

What is the purpose of payday loans?

Payday loans are usually used by individuals who need quick access to cash to cover unexpected expenses until their next payday.

What information must be reported on payday loans?

Information such as the loan amount, interest rate, fees, and repayment schedule must be reported on payday loans.

Fill out your payday loans - ag online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payday Loans - Ag is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.