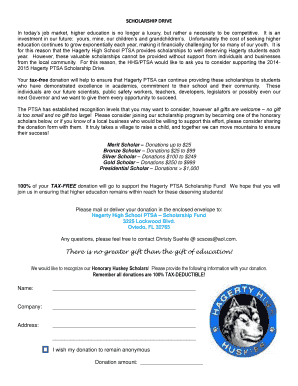

NZ IR119 2017-2025 free printable template

Show details

Use this form to formally object to a child support decision or assessment. If you're not sure whether you need to object, call us on 0800221221. Any person affected by a decision or who receives

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ird support area form

Edit your ird contact child form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ird contact area form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ird child decisions online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ird support assessment form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ird decisions form

How to fill out NZ IR119

01

Gather your financial records for the relevant tax year.

02

Download the NZ IR119 form from the New Zealand Inland Revenue website.

03

Fill in your personal details, including your name, address, and IRD number.

04

Indicate if you are filing as an individual or for a trust.

05

Complete the income section with all sources of income, including wages and investment income.

06

Deduct allowable expenses if applicable and indicate net profit or loss.

07

Review all information for accuracy before submitting.

08

Submit the completed form either online or by mail according to instructions provided.

Who needs NZ IR119?

01

Individuals or entities who need to apply for a tax refund.

02

Self-employed persons who need to report their income.

03

Trusts that need to declare their income for tax purposes.

Fill

area assessment

: Try Risk Free

People Also Ask about webpage makers

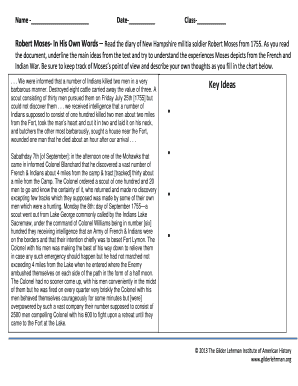

What happens if you don't pay child support NZ?

If you don't pay the child support you're meant to pay, Inland Revenue can ask the Family Court to make you come to court so it can check your finances. If you don't attend court when you're told to, the court can issue a warrant for your arrest.

What is the best start payment?

Best Start is a payment of $69 a week for families supporting a newborn baby. Families who qualify for Best Start can receive the payment until their baby turns 1, no matter how much they earn.

How can I avoid paying child support NZ?

Your obligation to pay child support stops when your child: Turns 19; Moves out of home and is self-supporting; Starts working at least 30 hours per week; Starts receiving a benefit or student allowance; Starts living in a de facto relationship, gets married or enters a civil union.

How far can child support be backdated Australia?

We can collect payments for you if the paying parent gets behind. We can collect overdue payments going back: up to 3 months in normal circumstances. up to 9 months in exceptional circumstances.

How do I avoid paying child support NZ?

Your obligation to pay child support stops when your child: Turns 19; Moves out of home and is self-supporting; Starts working at least 30 hours per week; Starts receiving a benefit or student allowance; Starts living in a de facto relationship, gets married or enters a civil union.

What is the purpose of child support NZ?

Money received through child support is used to cover the costs of raising the child or children. The amount of child support to be paid depends on how much each parent earns and how much time the child spends living with each parent.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the ird able in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your 2017 ir119 nz in seconds.

Can I create an electronic signature for signing my ird contact able in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your decision ird child and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit decision ird on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign ird contact assessment on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is NZ IR119?

NZ IR119 is a form used in New Zealand for reporting and calculating an individual's income tax liabilities.

Who is required to file NZ IR119?

Individuals who have received income that is not taxed at source, such as overseas income or self-employed income, are required to file NZ IR119.

How to fill out NZ IR119?

To fill out NZ IR119, gather your income information, complete the relevant sections about your income, deductions, and tax credits, and ensure that all amounts are reported accurately before submitting to the Inland Revenue Department.

What is the purpose of NZ IR119?

The purpose of NZ IR119 is to assess and report an individual's tax obligations to the Inland Revenue Department, ensuring compliance with New Zealand tax laws.

What information must be reported on NZ IR119?

The information that must be reported on NZ IR119 includes details of income received, any operating expenses, deductions claimed, and any tax credits the individual is eligible for.

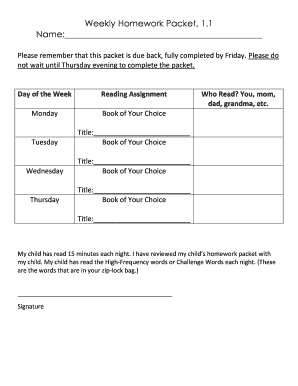

Fill out your ird contact support form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ird Contact Support Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.