Get the free Mortgage Cancellation

Show details

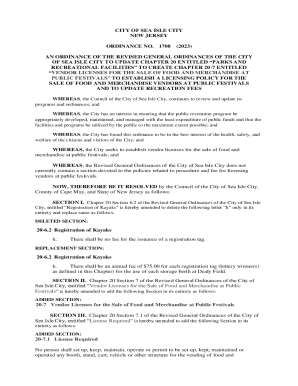

COUNTY of CAPE MAY RITA MARIE FULMINATE, COUNTY CLERK DIANA L. EVENER DEPUTY COUNTY CLERK Location: 7 North Main Street Cape May Court House New Jersey 082105000 Telephone: (609) 4651010 Fax: 4658625

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage cancellation

Edit your mortgage cancellation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage cancellation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

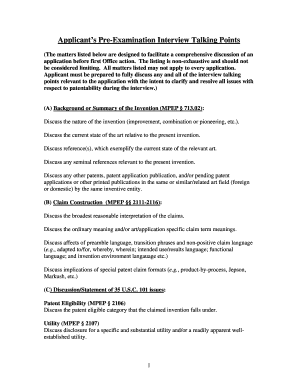

Editing mortgage cancellation online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mortgage cancellation. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage cancellation

How to fill out mortgage cancellation:

01

Obtain the necessary documents: Gather all the relevant paperwork for your mortgage, including the mortgage agreement, loan statement, and any other supporting documents.

02

Review the terms and conditions: Thoroughly read through the terms and conditions of your mortgage agreement to understand the cancellation policy and any fees or penalties associated with cancelling the mortgage.

03

Contact your mortgage lender: Get in touch with your mortgage lender and inform them about your intention to cancel the mortgage. They will guide you through the cancellation process and provide you with the required forms to fill out.

04

Fill out the cancellation form: Complete the mortgage cancellation form accurately and provide all the requested information, including your personal details, mortgage account number, and the reason for cancellation.

05

Provide supporting documents: Attach any necessary supporting documents as requested by the lender, such as proof of identification, loan statement, or any other relevant paperwork.

06

Review and double-check: Before submitting the cancellation form, carefully review all the information you have provided. Make sure it is accurate and complete to avoid any delays or complications.

07

Submit the form: Once you are satisfied with the information provided, submit the filled-out cancellation form to your mortgage lender. Follow their instructions on how to submit it, whether through mail, email, or an online portal.

08

Confirm the cancellation: Contact your mortgage lender again after submitting the cancellation form to verify that they have received it and that the cancellation process has been initiated. Keep a record of any confirmation numbers or emails for future reference.

Who needs mortgage cancellation:

01

Homeowners selling their property: If you are selling your property, you may need to cancel your existing mortgage to clear the title and transfer ownership to the buyer.

02

Refinancing borrowers: When refinancing a mortgage, the existing mortgage may need to be cancelled in order to replace it with a new loan.

03

Homeowners paying off their mortgage: If you have fully paid off your mortgage, you may want to cancel it officially to release any liens on the property and gain full ownership rights.

04

Homeowners transitioning to a different lender: In some cases, homeowners may choose to switch to a different mortgage lender for better terms or rates, necessitating the cancellation of the current mortgage.

05

Homeowners going through foreclosure or short sale: In unfortunate situations where foreclosure or a short sale is necessary, mortgage cancellation may be required to settle the outstanding debt with the lender.

Overall, the need for mortgage cancellation arises in various situations, depending on the homeowner's circumstances and their desired financial or property-related transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete mortgage cancellation online?

Easy online mortgage cancellation completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an eSignature for the mortgage cancellation in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your mortgage cancellation right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit mortgage cancellation on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign mortgage cancellation on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is mortgage cancellation?

Mortgage cancellation is the process of terminating or paying off a mortgage loan, usually when the property is sold or the loan is refinanced.

Who is required to file mortgage cancellation?

The borrower or property owner is typically required to file mortgage cancellation when the loan is paid off or terminated.

How to fill out mortgage cancellation?

To fill out mortgage cancellation, the borrower must typically submit a written request to the lender, provide proof of payment, and sign necessary documents to release the mortgage lien on the property.

What is the purpose of mortgage cancellation?

The purpose of mortgage cancellation is to legally release the property from the mortgage lien, which allows the property owner to sell or refinance the property without any encumbrances.

What information must be reported on mortgage cancellation?

The mortgage cancellation typically includes the borrower's information, property details, loan account number, amount paid, and the release of the lien.

Fill out your mortgage cancellation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Cancellation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.