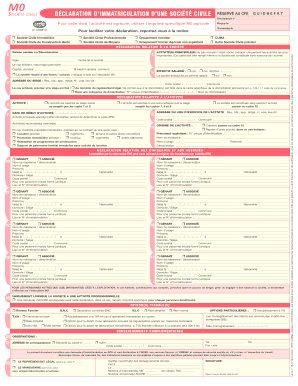

Get the free PUBL233.PS

Show details

PUBLIC LAW 110233MAY 21, 2008 122 STAT. 881 Public Law 110233 110th Congress An Act To prohibit discrimination on the basis of genetic information with respect to health insurance and employment.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign publ233ps

Edit your publ233ps form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publ233ps form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit publ233ps online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit publ233ps. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out publ233ps

01

Start by gathering all the necessary information and documents required for the completion of publ233ps. This may include personal details, contact information, financial statements, and any other relevant information.

02

Carefully read the instructions provided with publ233ps to understand the requirements and guidelines for filling it out. Make sure to follow the instructions precisely to avoid any errors or discrepancies.

03

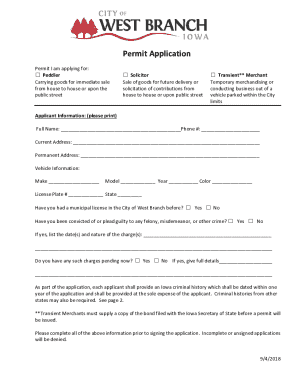

Begin by entering your personal information accurately at the top of the form. This may include your full name, address, social security number, and any other details requested.

04

Proceed to the next section of publ233ps, where you may be required to provide information regarding your income and financial status. This may include details about your employment, earnings, assets, and expenses. Ensure that all the information is accurate and up-to-date.

05

If applicable, fill out any additional sections or schedules that may be attached to publ233ps. These additional forms may require more specific information about certain aspects of your financial situation, such as investments, real estate properties, or business activities.

06

Double-check all the information provided on publ233ps for accuracy and completeness. Review each section and ensure that no fields have been left blank or contain incorrect data.

07

If necessary, seek professional assistance from an accountant or tax advisor to ensure the accuracy and compliance of your publ233ps. They can help you navigate any complex sections or provide guidance on maximizing any potential deductions or credits.

08

After completing the form, make sure to sign and date it as required. Verify if any additional documentation needs to be attached or if any fees or payments need to be made.

Who needs publ233ps:

01

Individuals who are US citizens or resident aliens (non-US citizens)

02

Those who need to report their income and claim deductions, credits, or exemptions for taxation purposes

03

Individuals who meet the specific criteria outlined by the Internal Revenue Service (IRS) for filing publ233ps, such as reaching a certain income threshold or having certain financial activities or investments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send publ233ps to be eSigned by others?

Once your publ233ps is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete publ233ps online?

Easy online publ233ps completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I fill out the publ233ps form on my smartphone?

Use the pdfFiller mobile app to fill out and sign publ233ps on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is publ233ps?

Publ233ps is a form used to report certain information by entities eligible to file Form 990 or 990-EZ.

Who is required to file publ233ps?

Entities eligible to file Form 990 or 990-EZ are required to file publ233ps.

How to fill out publ233ps?

Publ233ps can be filled out electronically or by paper, following the instructions provided by the IRS.

What is the purpose of publ233ps?

The purpose of publ233ps is to disclose certain information to the public and the IRS.

What information must be reported on publ233ps?

Information such as governance, program service accomplishments, and compensation of certain employees must be reported on publ233ps.

Fill out your publ233ps online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

publ233ps is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.