Treasury Form 8885 2013 free printable template

Show details

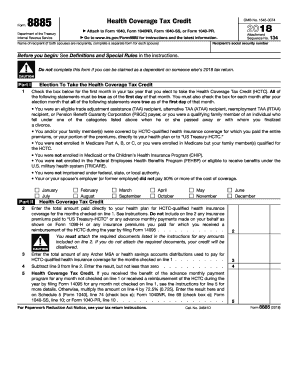

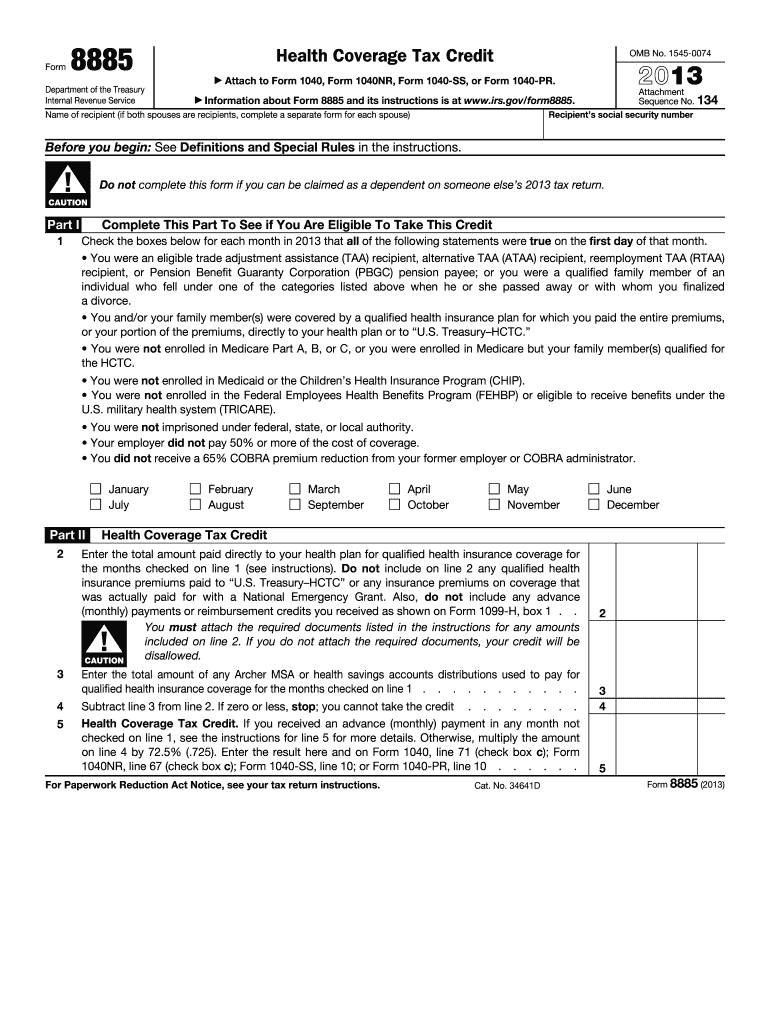

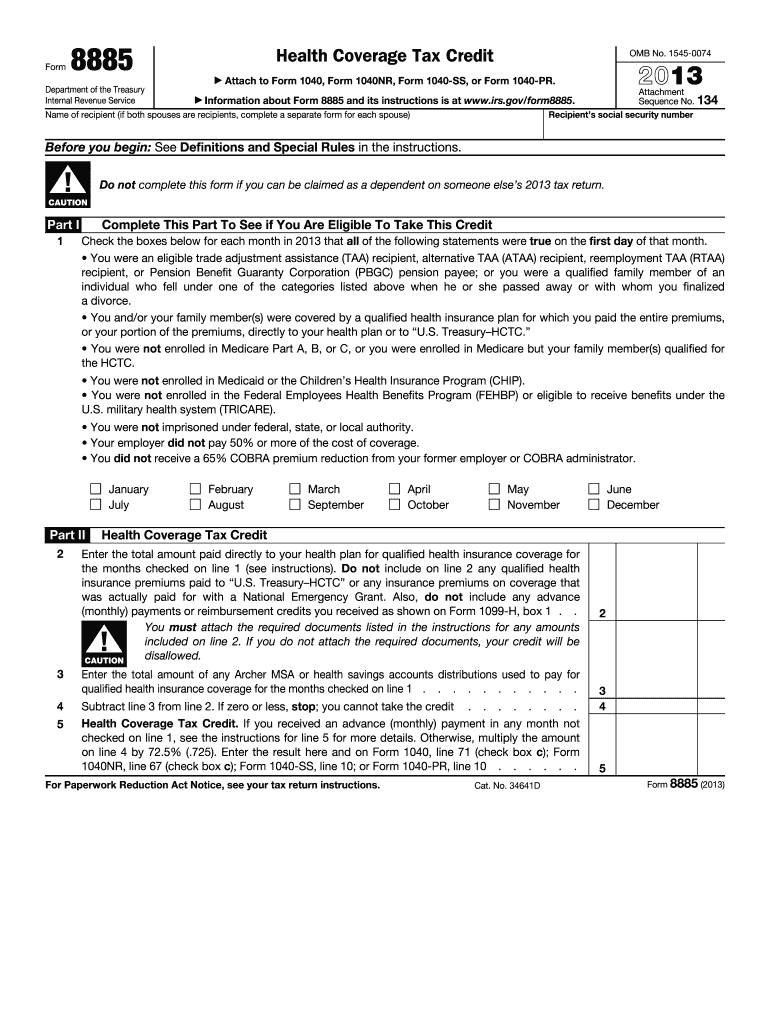

Form 8885 Department of the Treasury Internal Revenue Service Health Coverage Tax Credit ? OMB No. 1545-0074 2012 Attach to Form 1040, Form 1040NR, Form 1040-SS, or Form 1040-PR ? Information Attachment

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Treasury Form 8885

Edit your Treasury Form 8885 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Treasury Form 8885 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Treasury Form 8885 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Treasury Form 8885. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Treasury Form 8885 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Treasury Form 8885

How to fill out Treasury Form 8885

01

Download Treasury Form 8885 from the official IRS website.

02

Fill in your name, Social Security number, and the tax year for which you are filing.

03

Indicate whether you are claiming the credit for yourself or a qualifying individual.

04

Provide details regarding the type of qualifying health insurance coverage you had.

05

Complete the section relating to your monthly premiums and any advance premium tax credits you received.

06

Calculate the amount of credit you are eligible for based on the provided instructions.

07

Review the entire form for accuracy before signing and dating it.

08

Submit the completed form along with your tax return to the IRS.

Who needs Treasury Form 8885?

01

Individuals who have purchased health insurance through the Health Insurance Marketplace and are claiming a premium tax credit.

02

Taxpayers who wish to claim a reconciliation for the premium tax credits they received throughout the tax year.

03

People who experienced a change in coverage or status that may affect their eligibility for health coverage subsidies.

Fill

form

: Try Risk Free

People Also Ask about

Who needs to file form 8885?

Claiming the HCTC requires that you are an eligible recipient of a qualifying trade adjustment assistance program, currently on an approved break from such training or receiving unemployment insurance in lieu of training. You may also qualify if you are 55 or older and a PBGC payee.

What is form 8885 health coverage tax credit?

Use Form 8885 to elect and figure the amount, if any, of your HCTC. health plan administrator received from the IRS, as shown on Form 1099-H, Health Coverage Tax Credit (HCTC) Advance Payments.

What IRS form for healthcare subsidy?

Form 8962, Premium Tax Credit (Premium tax credits are sometimes known as “subsidies,” “discounts,” or “savings.”)

What is IRS form 8885 used for?

Use Form 8885 to elect and figure the amount, if any, of your HCTC. health plan administrator received from the IRS, as shown on Form 1099-H, Health Coverage Tax Credit (HCTC) Advance Payments.

What is the IRS Schedule 8885?

The Health Coverage Tax Credit (HCTC) is a tax credit that pays 72.5% of qualified health insurance premiums for eligible individuals and their families.

What happens if you don't have a 1095 form?

Q: What should I do if I don't receive a Form 1095-A? If you purchased coverage through the Marketplace and you have not received your Form 1095-A, you should contact the Marketplace from which you received coverage. You should wait to receive your Form 1095-A before filing your taxes.

What is the form 8885 taxpayer health coverage tax credit?

The Health Coverage Tax Credit (HCTC) is a tax credit that pays 72.5% of qualified health insurance premiums for eligible individuals and their families.

Who gets the health coverage tax credit?

To be eligible for the premium tax credit, your household income must be at least 100 percent and, for years other than 2021 and 2022, no more than 400 percent of the federal poverty line for your family size, although there are two exceptions for individuals with household income below 100 percent of the applicable

What is the form 8885 taxpayer health coverage tax credit?

Using Form 8885 In Part II you declare the total amount you paid directly to your qualified health insurance provider, omitting any premiums paid to the HCTC program directly, any advance payments or reimbursements you received or premiums paid through a national emergency grant.

Who fills out form 8885?

you received the benefit of advance monthly payments of the HCTC for at least 1 month of the year for individual(s) who were enrolled in a qualified health plan offered through a Marketplace for at least 1 other month of the year, after you complete Form 8962, line 27, complete Form 8885.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Treasury Form 8885 to be eSigned by others?

Treasury Form 8885 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I edit Treasury Form 8885 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute Treasury Form 8885 from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete Treasury Form 8885 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your Treasury Form 8885. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is Treasury Form 8885?

Treasury Form 8885 is a tax form used to claim the Health Coverage Tax Credit (HCTC) for eligible individuals, often related to certain health insurance premiums.

Who is required to file Treasury Form 8885?

Individuals who qualify for the Health Coverage Tax Credit, such as certain displaced workers and retirees receiving pension payments from the Pension Benefit Guaranty Corporation (PBGC), are required to file Treasury Form 8885.

How to fill out Treasury Form 8885?

To fill out Treasury Form 8885, eligible individuals must provide personal information, information about the health insurance plan, and details regarding qualified health coverage expenses. Instructions provided with the form should be closely followed.

What is the purpose of Treasury Form 8885?

The purpose of Treasury Form 8885 is to enable eligible individuals to claim the Health Coverage Tax Credit, which helps alleviate the cost of health insurance premiums.

What information must be reported on Treasury Form 8885?

Treasury Form 8885 requires reporting information such as personal identification details, health insurance provider information, the amount of premiums paid, and any other relevant tax preferences related to the Health Coverage Tax Credit.

Fill out your Treasury Form 8885 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Treasury Form 8885 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.