Get the free Fiduciary Liability Insurance Application

Show details

This application is for seeking Fiduciary Liability Insurance, outlining the necessary details, insurance requirements, and loss information related to the applicants' fiduciary roles.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiduciary liability insurance application

Edit your fiduciary liability insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiduciary liability insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fiduciary liability insurance application online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fiduciary liability insurance application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

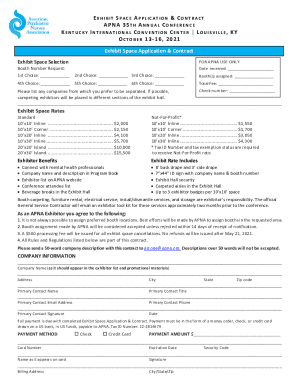

How to fill out fiduciary liability insurance application

How to fill out Fiduciary Liability Insurance Application

01

Obtain the Fiduciary Liability Insurance Application form from your insurance provider.

02

Fill in the basic organizational information, including the name, address, and contact details.

03

Specify the type of business entity (e.g., corporation, partnership, or nonprofit).

04

Provide details about the fiduciary roles within the organization and the number of fiduciaries.

05

Disclose information regarding employee benefits plans managed by the fiduciaries.

06

Outline the financial condition of the organization, including any pending lawsuits or claims.

07

Answer questions related to the organizational policies and procedures for managing fiduciary duties.

08

Review and sign the application to certify the information provided is accurate.

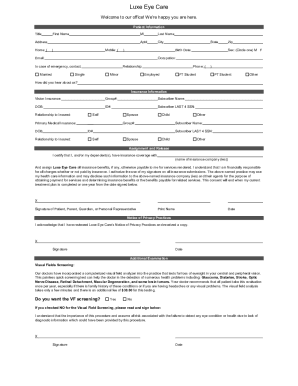

Who needs Fiduciary Liability Insurance Application?

01

Organizations with employee benefit plans, such as retirement plans or health care benefits.

02

Fiduciaries who manage investments or assets on behalf of beneficiaries.

03

Nonprofits that offer employee benefits and have a board of fiduciaries.

04

Corporations with employee stock ownership plans (ESOPs) or other welfare plans.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between fiduciary liability insurance and ERISA bond?

ERISA fidelity bonds protect plan participants from loss due to fraud or dishonesty, while fiduciary liability insurance protects companies from legal liability arising from plan sponsorship.

What is the difference between bonding and liability insurance?

Two popular types of fidelity bonds are business services bonds, which are specifically designed to protect clients when employees enter their home or place of business, and employee dishonesty bonds, which protect companies from financial loss should an employee or group of employees engage in fraudulent activities.

Is fiduciary liability the same as fidelity?

As you may be aware, Employee Retirement Income Security Act (ERISA) fidelity bonds and fiduciary liability insurance are not the same. Both serve to mitigate risk for fiduciaries, and are critical aspects of an employee benefits plan. The difference between the two lies in the risks that they cover.

Where can I get a certificate of liability insurance form?

If you have a general liability insurance policy in place, your insurance company should be able to send you certificates of insurance without an extra charge. A general liability insurance certificate, which is free, is typically provided when you begin coverage.

How much does fiduciary liability insurance cost?

Generally, policies can range from $500 to $2,500 per year, depending on the specific needs of your company. Policies can cover as much as $20 million per year. The scope of fiduciary liability insurance has broadened over the years as claims activity has increased.

What are the two main types of fidelity bonds?

The coverage required by the Employee Retirement Income Security Act (ERISA) is usually called an ERISA fidelity bond, as it is specifically limited to financial losses from employee benefit plans, and not, for example, from a company's general coffers. It is also known as a fiduciary bond.

What is fiduciary liability insurance?

Scope of Coverage: Surety bonds are limited to ensuring performance or compliance with specific obligations (such as completing a construction project or adhering to licensing regulations), whereas liability insurance provides broader protection against a wide range of potential claims, from accidents to professional

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

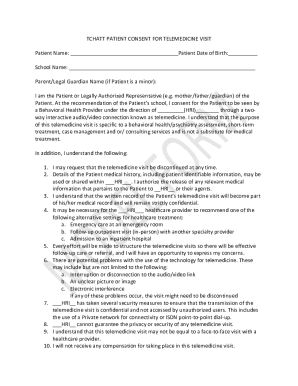

What is Fiduciary Liability Insurance Application?

Fiduciary Liability Insurance Application is a formal document submitted by organizations to secure insurance coverage that protects fiduciaries from claims related to breaches of their fiduciary duties.

Who is required to file Fiduciary Liability Insurance Application?

Any organization that has fiduciaries managing employee benefit plans or investments is generally required to file a Fiduciary Liability Insurance Application to obtain coverage for potential liabilities.

How to fill out Fiduciary Liability Insurance Application?

To fill out the Fiduciary Liability Insurance Application, organizations must provide detailed information about their fiduciary responsibilities, the plans they manage, and any past claims or legal issues.

What is the purpose of Fiduciary Liability Insurance Application?

The purpose of the Fiduciary Liability Insurance Application is to assess the risks associated with fiduciary duties, enabling insurers to determine appropriate coverage terms and premiums.

What information must be reported on Fiduciary Liability Insurance Application?

The information required includes the names of fiduciaries, details about the benefit plans managed, any prior claims or lawsuits, financial information, and the organization's current risk management practices.

Fill out your fiduciary liability insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiduciary Liability Insurance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.