IN 51654 2013 free printable template

Show details

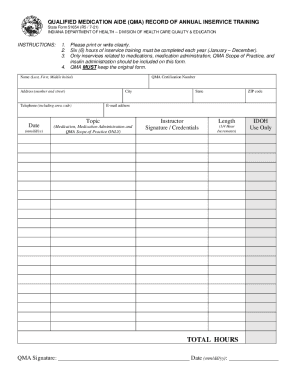

Removal from the registry will require completion of a QMA course and passing the QMA competency test for reinstatement. Renew online with credit card at www. in.gov/pla/license. htm. Failure to submit certification in a timely manner may result in additional fees or removal from the QMA registry. REINSTATEMENT If the recertification fees and/or in-service education form documenting six 6 hours of in-service hours/dates noted above is received by the ISDH ninety-one 91 or more days after...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN 51654

Edit your IN 51654 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN 51654 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IN 51654 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IN 51654. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN 51654 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN 51654

How to fill out IN 51654

01

Obtain the IN 51654 form from the official website or relevant office.

02

Read the instructions carefully before starting to fill out the form.

03

Enter your personal information in the designated fields, including your name, address, and contact details.

04

Provide any necessary identification numbers, such as Social Security Number or taxpayer identification number.

05

Complete any specific sections relevant to your application or request.

06

Review the form for accuracy and ensure all required fields are filled out.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate office or department as instructed.

Who needs IN 51654?

01

Individuals applying for benefits related to tax credits or deductions.

02

Anyone required to provide financial information for government assistance programs.

03

Taxpayers needing to report certain financial details to the IRS or other tax authorities.

Instructions and Help about IN 51654

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to become a QMA in Indiana?

An individual must: Have proof of a high school diploma or equivalent. Be in good standing as a Certified Nurse Aide (CNA) on the Indiana Aide Registry. Worked a minimum of 1,000 hours as a CNA within the last 24 months. Complete the 100 hour QMA Training Program.

How long is the QMA course at Ivy Tech?

100-Hour Training Course Candidates The supervised practicum must be completed within 3 months of completion of classroom instruction. The practicum must be listed in periods of time no longer than 4 hours and must denote a wide variety of procedures performed.

What is the difference between QMA and CNA?

A Qualified Medication Aide (QMA) is a CNA who has satisfactorily completed the state approved Qualified Medication Aide Course; demonstrated competency while dispensing and passing medications and or applying/administering treatments under the direct supervision of a registered nurse or a licensed practical nurse;

How much does a QMA earn in Indiana?

The average salary for a qualified medication aide in Indiana is $35,500 per year. Qualified medication aide salaries in Indiana can vary between $18,500 to $72,000 and depend on various factors, including skills, experience, employer, bonuses, tips, and more.

How do I get a QMA license in Indiana?

How Do I Become a QMA Be at least 18 years of age. Have proof of a high school diploma or equivalent. Be in good standing as a Certified Nurse Aide (CNA) on the Indiana Aide Registry. Worked a minimum of 1,000 hours as a CNA within the last 24 months. Complete the 100 hour QMA Training Program.

What can a QMA do in Indiana?

What can a QMA do? A QMA must function within the scope of their license as defined by Indiana Code. In addition to their responsibilities as a CNA, a QMA can do many tasks such as passing oral medications, eye drops, ear drops, and testing for blood sugar via a fingerstick, and more.

How much do QMA make in Indiana an hour?

How much does a QMA make in Indiana? As of Feb 22, 2023, the average annual pay for a QMA in Indiana is $37,375 a year. Just in case you need a simple salary calculator, that works out to be approximately $17.97 an hour. This is the equivalent of $718/week or $3,114/month.

How much does a nurse aide earn in Indiana?

How much does a Certified Nursing Assistant make in Indiana? The average Certified Nursing Assistant salary in Indiana is $33,816 as of January 26, 2023, but the range typically falls between $30,818 and $37,339.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute IN 51654 online?

pdfFiller has made it simple to fill out and eSign IN 51654. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my IN 51654 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your IN 51654 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit IN 51654 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing IN 51654 right away.

What is IN 51654?

IN 51654 is a form used for reporting certain financial information to the relevant tax authorities.

Who is required to file IN 51654?

Individuals or entities that meet specific financial criteria or engage in particular types of transactions may be required to file IN 51654.

How to fill out IN 51654?

To fill out IN 51654, gather necessary financial documents, provide accurate information in the designated fields, and ensure compliance with any relevant instructions provided by the tax authority.

What is the purpose of IN 51654?

The purpose of IN 51654 is to ensure proper reporting of financial activities and compliance with tax regulations.

What information must be reported on IN 51654?

The information reported on IN 51654 typically includes income details, deductions, credits, and other financial transactions related to taxable entities.

Fill out your IN 51654 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN 51654 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.