CT PC-400 2001 free printable template

Show details

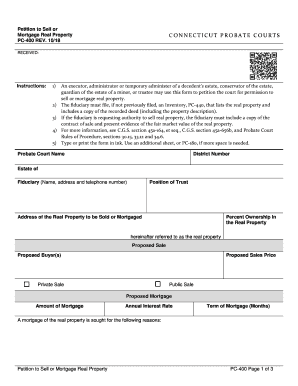

APPLICATION TO SELL OR MORTGAGE REAL PROPERTY PC-400 BBS REV. 2/01 STATE OF CONNECTICUT COURT OF PROBATE RECORDED Type or print in black ink.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pc 400 probate 2001

Edit your pc 400 probate 2001 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pc 400 probate 2001 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pc 400 probate 2001 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pc 400 probate 2001. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT PC-400 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out pc 400 probate 2001

How to fill out CT PC-400

01

Obtain the CT PC-400 form from the appropriate state agency website or office.

02

Fill in your personal information at the top of the form, including name, address, and contact information.

03

Provide information about the tax year for which you are filing.

04

List all relevant income sources in the designated sections.

05

Complete any calculations required on the form to determine your tax liability or refund.

06

Double-check all entered information for accuracy to avoid delays.

07

Sign and date the form where indicated.

08

Submit the form by the deadline, either electronically or via traditional mail.

Who needs CT PC-400?

01

Individuals who need to report income for state tax purposes.

02

Taxpayers filing for a specific tax year in Connecticut.

03

Residents who qualify for tax credits or deductions.

Fill

form

: Try Risk Free

People Also Ask about

How much does an estate have to be worth to go to probate in CT?

How much does an estate have to be worth to go to probate in Connecticut? In the state of Connecticut, the minimum value of the deceased's assets is $40,000.

How long do you have to file probate after death in Connecticut?

Step 1: File the will and Petition/Administration or Probate of Will, PC-200, within 30 days of the decedent's death. A petition for administration or probate of will should be submitted to the Probate Court within 30 days of the decedent's death.

How long does it take to settle probate in Connecticut?

In Connecticut, you can expect it to take a minimum or about six months to probate even a relatively simple estate if that estate is required to go through formal probate. Creditors have three months from the date notice was provided within which to file claims against the estate.

What assets are subject to probate in Connecticut?

List of Probate Assets Real property which is titled only in the name of the person who passed away (the person who passed away is called the decedent). Personal property owned by the decedent. Bank accounts if those accounts are solely in the name of the decedent. Interests in certain types of businesses.

How do you sell a house in probate in CT?

Probate courts require that the property sells for at least 90% of the home's appraised value. After receiving the appraisal, the executor will petition the probate court to begin the sale. Once the court hearing is over, it will grant the executor permission to list the home's sale formally.

What happens when a house goes into probate in CT?

If no will exists, the property is divided ing to Connecticut law. The Probate Courts ensure that any debt owed by the deceased person, funeral expenses and taxes are paid before the remaining assets are distributed. Often a family member or friend is responsible for settling the affairs of the estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pc 400 probate 2001 for eSignature?

Once you are ready to share your pc 400 probate 2001, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit pc 400 probate 2001 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your pc 400 probate 2001 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out pc 400 probate 2001 on an Android device?

Complete your pc 400 probate 2001 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is CT PC-400?

CT PC-400 is a tax form used in Connecticut for reporting the income and expenses of pass-through entities.

Who is required to file CT PC-400?

Pass-through entities such as partnerships, limited liability companies (LLCs), and S corporations operating in Connecticut are required to file CT PC-400.

How to fill out CT PC-400?

To fill out CT PC-400, you need to provide information about the entity, income, expenses, and the distribution of income to partners or shareholders, as well as any applicable deductions.

What is the purpose of CT PC-400?

The purpose of CT PC-400 is to report the income, deductions, and credits of pass-through entities to ensure proper tax assessment and compliance in Connecticut.

What information must be reported on CT PC-400?

CT PC-400 requires reporting of the entity's name, address, federal identification number, types of income, total income, expenses, distributions to partners or shareholders, and any applicable credits.

Fill out your pc 400 probate 2001 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pc 400 Probate 2001 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.