Get the free Insurance Bond

Show details

Trusts For a registered managed investment scheme regulated trust eg self-managed super fund or government superannuation fund please provide one of the following Evidence of a search of the ASIC ATO or relevant regulator s website. Issue date 1 January 2017 Issued by AMP Life Limited ABN 84 079 300 379 AFSL No. 233671 1 of 4 Portfolios Verifying a customer s identity If you have invested in more than one portfolio the following minimums apply to each individual portfolio. A copy or...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance bond

Edit your insurance bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit insurance bond online

Follow the steps below to benefit from a competent PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit insurance bond. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance bond

How to fill out insurance bond?

01

Gather necessary information: Before filling out an insurance bond, make sure you have all the required information at hand. This may include personal details, such as your name, address, and contact information, as well as any specific details related to the insurance policy or bond you are applying for.

02

Read and understand the form: Carefully go through the insurance bond form to understand its sections and requirements. This will help you to correctly fill out the necessary information in the appropriate sections.

03

Provide accurate information: It is essential to provide accurate and truthful information while completing the insurance bond. Double-check the spelling of your name, address, and other personal details to avoid any errors that could potentially invalidate the bond.

04

Fill in the policy details: If you already have an existing insurance policy, provide the necessary details related to it in the appropriate section. Include the policy number, type of insurance, and any other relevant information requested.

05

Declare any necessary information: Some insurance bond forms may require you to declare certain information, such as previous claims or criminal history. If applicable, be honest and provide the required details as accurately as possible.

06

Review and sign the form: Before submitting the insurance bond form, review all the information you have entered to ensure its accuracy and completeness. Make sure you have signed the form using your legal signature where required.

Who needs insurance bond?

01

Contractors and Construction Professionals: Many contractors and construction professionals require an insurance bond as part of their licensing or contractual requirements. This bond serves as a guarantee to clients that the contractor will complete the work as agreed and follow all applicable laws and regulations.

02

Business Owners: Some industries, such as finance, transportation, and healthcare, may require business owners to obtain an insurance bond. This bond helps protect clients or customers in case of any financial loss or damages caused by the business's actions or negligence.

03

Court Defendants: In certain legal proceedings, defendants may need to secure an insurance bond to ensure they will fulfill their legal obligations or compensate the affected parties if they lose the case. This bond provides financial security to the court and any potential claimants.

04

License and Permit Applicants: Various professionals and individuals seeking specific licenses or permits, such as liquor licenses or contractor licenses, may be required to obtain an insurance bond. This ensures compliance with regulations and protects consumers or the general public from any potential harm.

05

Government Contractors: When bidding for government contracts, contractors may need to provide an insurance bond to guarantee their performance and fulfill the agreed-upon obligations. This bond protects the government entity from financial loss if the contractor fails to meet their contractual requirements.

06

Vehicle Owners: Some states or regions may require vehicle owners to obtain an insurance bond to ensure financial responsibility in case of accidents or damages. This bond serves as a guarantee that the owner can cover any potential costs resulting from their vehicle's operation.

Overall, insurance bonds are necessary for individuals or businesses operating in various industries and situations. The specific requirements and conditions may vary depending on the jurisdiction and the purpose of the bond. It is always advisable to consult with an insurance professional or relevant authorities to determine whether an insurance bond is needed in your specific case.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my insurance bond directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your insurance bond and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Where do I find insurance bond?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific insurance bond and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for signing my insurance bond in Gmail?

Create your eSignature using pdfFiller and then eSign your insurance bond immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

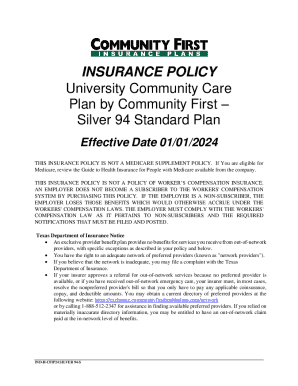

What is insurance bond?

An insurance bond is a type of investment product offered by insurance companies that guarantees both the principal investment and any accrued interest.

Who is required to file insurance bond?

Insurance companies are usually required to file insurance bonds as a form of financial guarantee.

How to fill out insurance bond?

To fill out an insurance bond, the company must provide detailed information about the coverage, premiums, and beneficiaries.

What is the purpose of insurance bond?

The purpose of an insurance bond is to ensure that the beneficiaries receive the financial protection promised by the insurance company.

What information must be reported on insurance bond?

The insurance bond must include information about the policyholder, beneficiary, coverage details, and any other relevant terms and conditions.

Fill out your insurance bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.