Get the free Late Filing Penalties

Show details

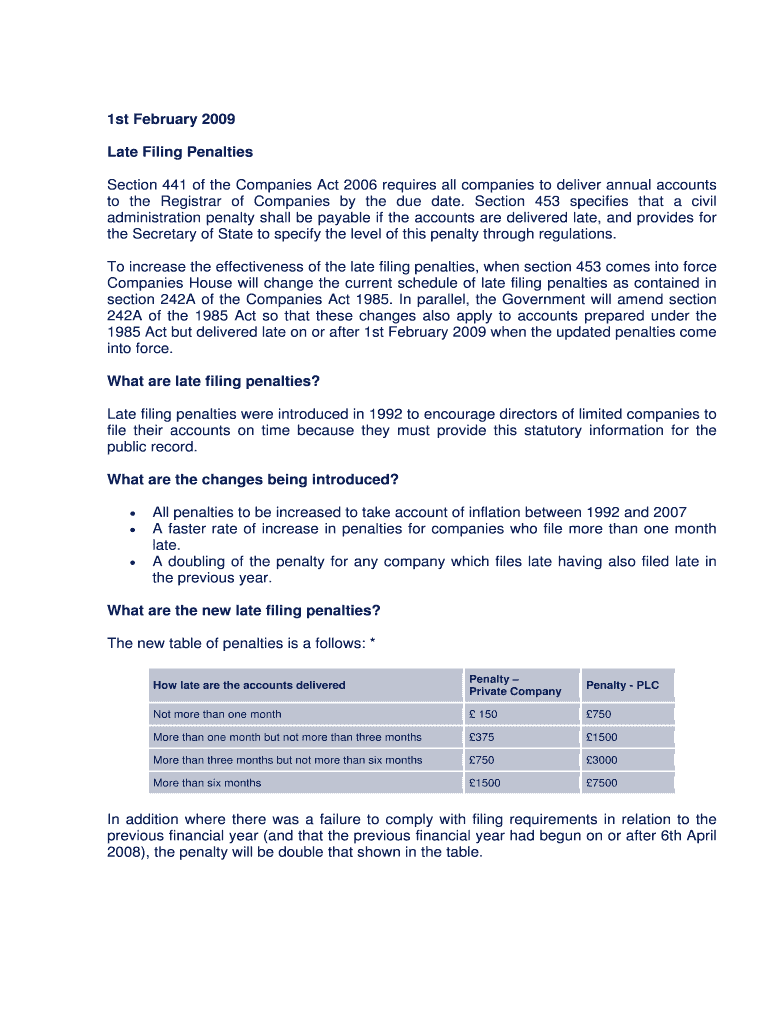

Companieshouse. gov.uk/companiesAct/publications. shtml Copies of the regulations are available on the OPSI website at http //www. In parallel the Government will amend section 242A of the 1985 Act so that these changes also apply to accounts prepared under the 1985 Act but delivered late on or after 1st February 2009 when the updated penalties come into force. Opsi. gov.uk/si/si2008/uksi20080497en1 14 day concession Section 706 of the Companies Act 1985 required companies to deliver...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign late filing penalties

Edit your late filing penalties form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your late filing penalties form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing late filing penalties online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit late filing penalties. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out late filing penalties

How to fill out late filing penalties:

01

Gather all necessary documents: Start by collecting all the required paperwork, such as tax forms, financial statements, and any supporting documentation related to the late filing.

02

Determine the reason for the late filing: Identify the circumstances that led to the delayed submission. This could include personal reasons, technical issues, or unforeseen circumstances that prevented timely filing.

03

Review the penalty structure: Familiarize yourself with the late filing penalty structure established by the relevant authorities, such as the IRS or local tax agencies. Understand the specific fees and consequences associated with late filing.

04

Determine eligibility for penalty waivers: Some jurisdictions offer penalty waivers or abatements under certain circumstances, such as a first-time offense or reasonable cause. Assess whether you meet the criteria for such waivers.

05

Prepare a written explanation: If eligible for a penalty waiver, compose a concise and honest written explanation of the reasons behind the late filing. Clearly state the circumstances and any supporting evidence to support your claim.

06

Complete the necessary forms: Fill out the appropriate forms designated for addressing late filing penalties. Follow the provided instructions diligently to ensure accuracy and completeness.

07

Submit the required documents and application: Compile all the relevant paperwork, including the written explanation and completed forms. Submit these materials to the appropriate authority, whether it's an online portal, local tax office, or designated mailing address.

08

Keep copies for reference: Make copies of all the documents you submit for future reference. This will help in case of any inquiries, audits, or further actions related to the late filing penalties.

Who needs late filing penalties?

01

Individuals who have missed their tax filing deadline: Late filing penalties primarily apply to individuals who fail to submit their tax returns on time. These penalties can also extend to self-employed individuals, small business owners, or any other entity responsible for filing tax forms.

02

Organizations not complying with regulatory filing deadlines: Late filing penalties can also be imposed on businesses or other organizations that fail to meet the required filing deadlines set by regulatory bodies. This could include submitting financial statements, annual reports, or any other necessary filings.

03

Anyone subject to specific jurisdiction's regulations: The need for late filing penalties can vary depending on the jurisdiction and the specific regulations in place. Individuals or entities operating within a certain legal framework must comply with the applicable rules regarding timely filing. Failure to do so may result in late filing penalties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit late filing penalties from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your late filing penalties into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I get late filing penalties?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the late filing penalties in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit late filing penalties in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your late filing penalties, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is late filing penalties?

Late filing penalties are fees imposed on individuals or entities who fail to submit their required documents or forms by the prescribed deadline.

Who is required to file late filing penalties?

Any individual or entity who fails to submit their required documents or forms by the prescribed deadline is required to file late filing penalties.

How to fill out late filing penalties?

Late filing penalties can be filled out by providing the necessary information requested on the penalty form and submitting it to the appropriate authority.

What is the purpose of late filing penalties?

The purpose of late filing penalties is to encourage individuals or entities to submit their required documents or forms on time and to deter late submissions.

What information must be reported on late filing penalties?

Late filing penalties typically require the individual or entity to report details such as the reason for the late filing, the date of the original deadline, and any other relevant information.

Fill out your late filing penalties online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Late Filing Penalties is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.