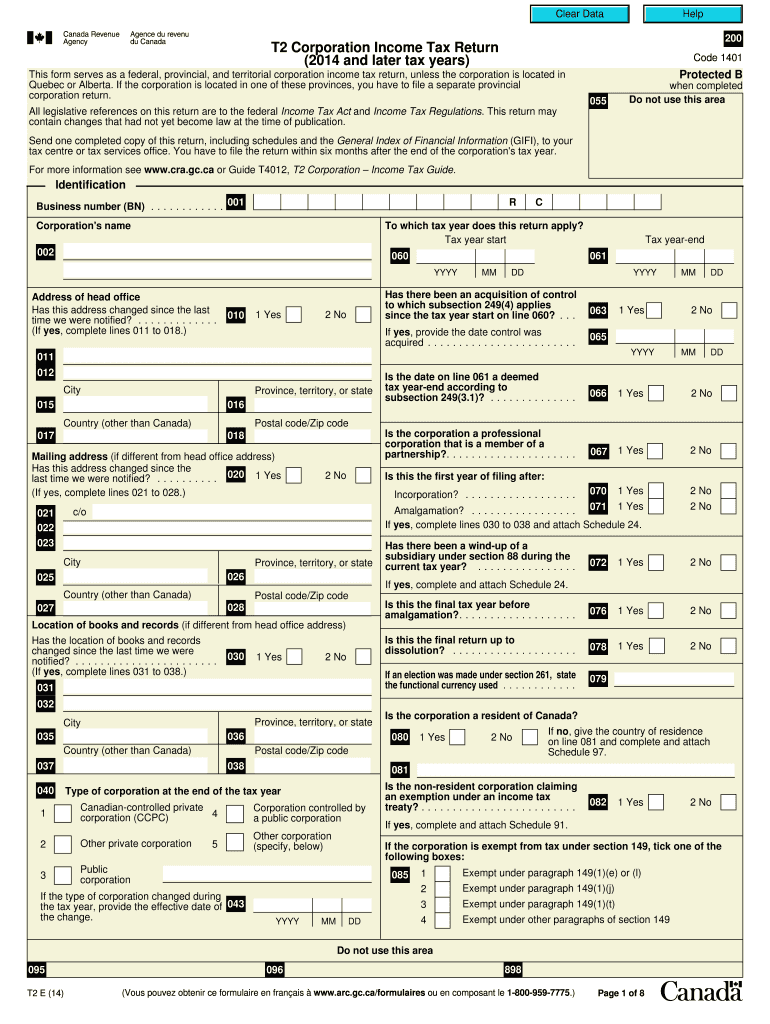

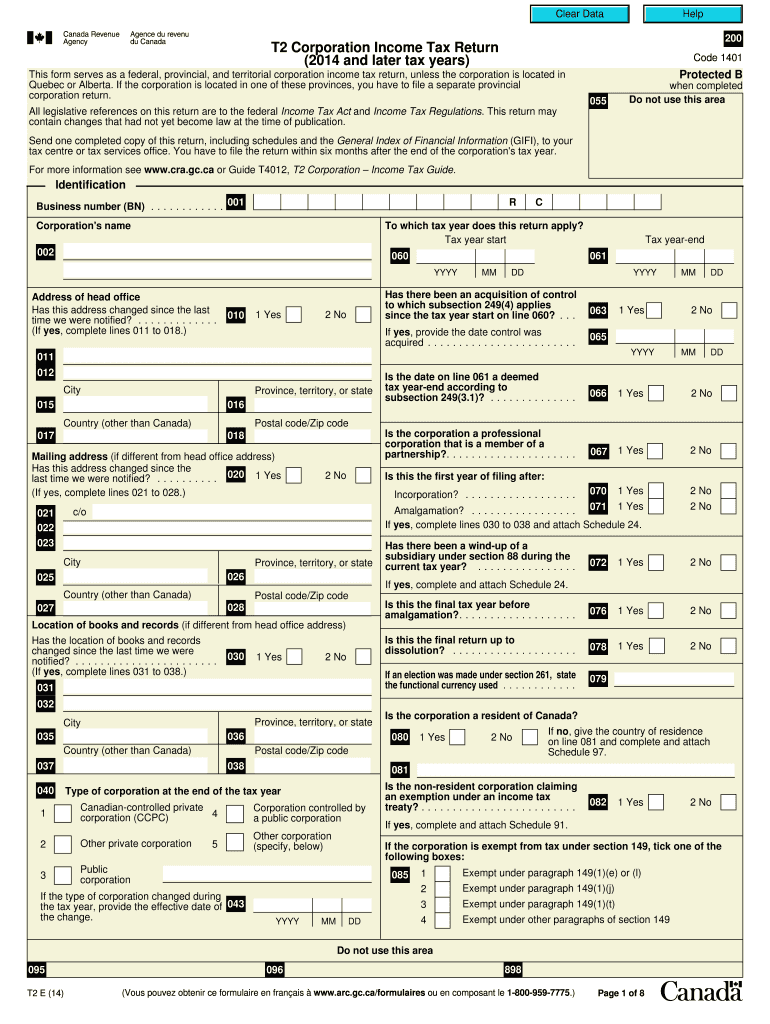

Get the free T2 Corporation Income Tax Return

Show details

Indiquez votre langue de correspondance en inscrivant 1 pour anglais ou 2 pour fran ais. Privacy Act personal information bank number CRA PPU 047 Page 8. 250 T1131 T1177 Page 2. 271 T1134 employees for SR ED. 264 T1145 T1135 T1141 T1142 T1146 T1174 T2002 general rate income pool GRIP change in the tax year. 205 T5004 T5013 T106 line 320 of the T2 return b a partnership c a foreign business or d a personal services business or ii does the corporation have aggregate investment income at line...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign t2 corporation income tax

Edit your t2 corporation income tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t2 corporation income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing t2 corporation income tax online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit t2 corporation income tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out t2 corporation income tax

How to fill out T2 corporation income tax?

01

Determine your tax year: Before filling out the T2 corporation income tax form, you need to determine the tax year for which you are filing. The tax year generally follows the fiscal year end of your corporation.

02

Gather relevant financial information: Collect all the essential financial documents, such as income statements, balance sheets, and supporting documents for deductions and credits. Ensure that your financial records are accurate and up to date.

03

Complete the identification section: Fill out the identification section of the T2 form, which includes providing your corporation's name, address, fiscal period, business number, and contact information.

04

Calculate and report income: Determine your corporation's income for the tax year and report it accurately in the appropriate sections of the T2 form. This includes reporting business income, dividends received, capital gains, and any other relevant sources of income.

05

Claim eligible deductions and credits: Identify and claim any eligible deductions or credits to reduce your corporation's taxable income. These may include expenses related to your business operations, such as salaries, rent, advertising, and interest charges. Ensure that you have proper supporting documentation for each deduction or credit claimed.

06

Report and remit taxes owed: Calculate the taxes owed by your corporation based on the taxable income reported and the applicable tax rates. Ensure you have accounted for federal and provincial/territorial taxes. Include any applicable tax installment payments or any balance due.

07

File the T2 form: Once you have completed all the necessary sections and calculations, review the form for accuracy and completeness. Sign the form and submit it to the Canada Revenue Agency (CRA) by the due date. Electronic filing is generally the preferred method.

Who needs T2 corporation income tax?

01

Canadian corporations: T2 corporation income tax is required for all Canadian corporations, including federal and provincial/territorial corporations, regardless of their size or profitability. This includes both active and inactive corporations.

02

Corporations with taxable income: Corporations that have taxable income during the tax year need to file a T2 return. Even if a corporation has no taxable income, it may still be required to file a return if it has a balance in its refundable dividend tax on hand account, received certain income, or wishes to claim a refund.

03

Foreign corporations doing business in Canada: Foreign corporations engaged in business activities in Canada are also required to file a T2 corporation income tax return if they have taxable income or have disposed of taxable Canadian property during the year.

Note: It is essential to consult with a tax professional or visit the Canada Revenue Agency's website for detailed information and specific requirements based on your corporation's circumstances and applicable tax laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete t2 corporation income tax on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your t2 corporation income tax, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I edit t2 corporation income tax on an Android device?

You can make any changes to PDF files, like t2 corporation income tax, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I complete t2 corporation income tax on an Android device?

Use the pdfFiller Android app to finish your t2 corporation income tax and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is t2 corporation income tax?

T2 corporation income tax is a tax on the income of corporations in Canada.

Who is required to file t2 corporation income tax?

All corporations in Canada, except for those that are exempt, are required to file T2 corporation income tax.

How to fill out t2 corporation income tax?

T2 corporation income tax can be filled out using the CRA's online services or by submitting a paper form.

What is the purpose of t2 corporation income tax?

The purpose of T2 corporation income tax is to collect revenue from corporations based on their income.

What information must be reported on t2 corporation income tax?

Information such as income, expenses, taxes owed, and deductions must be reported on T2 corporation income tax.

Fill out your t2 corporation income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

t2 Corporation Income Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.