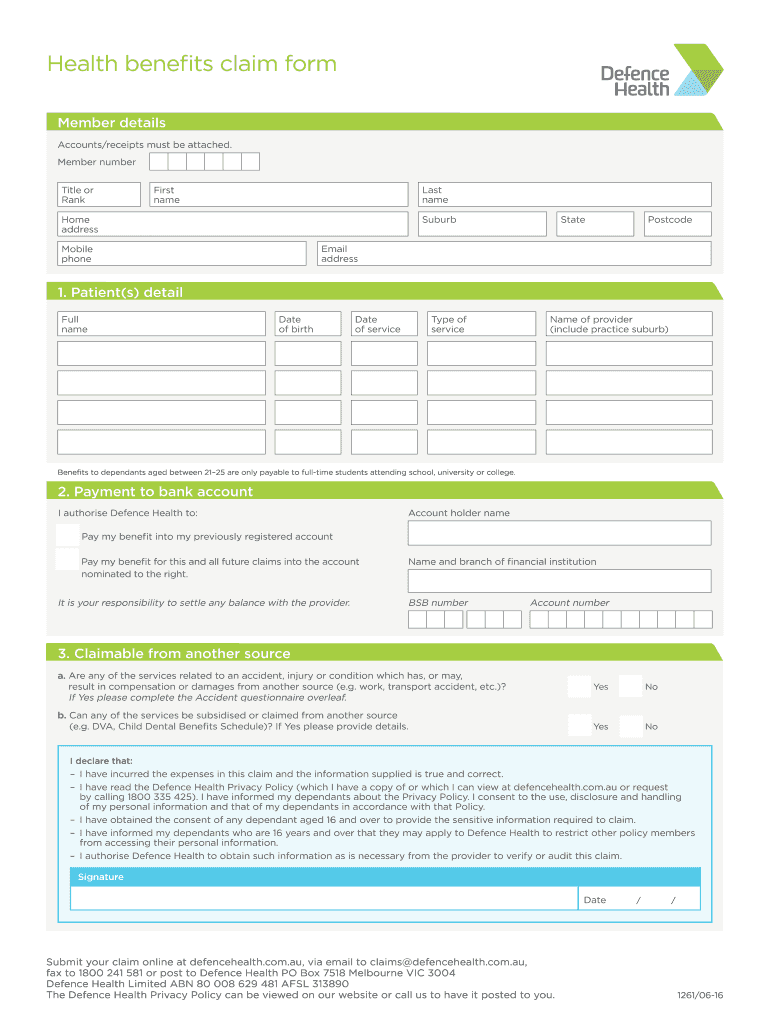

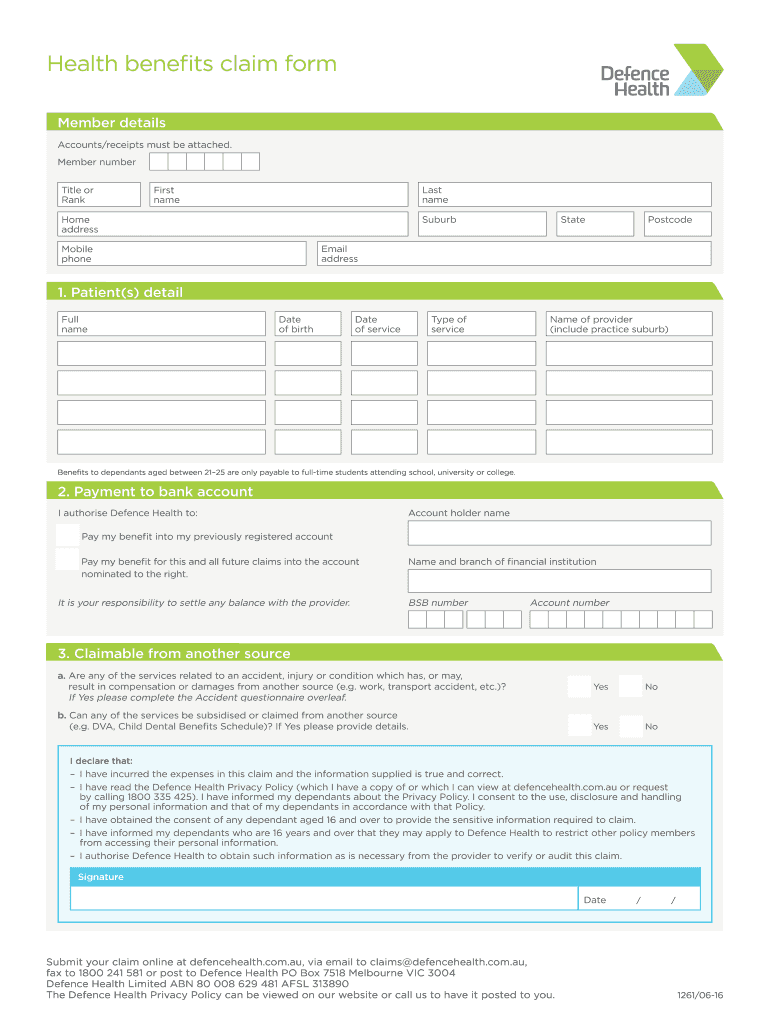

Get the free Accounts/receipts must be attached

Show details

Com.au or request by calling 1800 335 425. I have informed my dependants about the Privacy Policy. I consent to the use disclosure and handling of my personal information and that of my dependants in accordance with that Policy. I have obtained the consent of any dependant aged 16 and over to provide the sensitive information required to claim. I have informed my dependants who are 16 years and over that they may apply to Defence Health to restrict other policy members from accessing their...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accountsreceipts must be attached

Edit your accountsreceipts must be attached form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accountsreceipts must be attached form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing accountsreceipts must be attached online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit accountsreceipts must be attached. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accountsreceipts must be attached

How to Fill Out Account Receipts Must Be Attached:

01

Start by gathering all the necessary information. You will need details such as the date, the customer's name, and contact information, the products or services provided, and the total amount due.

02

Next, create a header for the receipt. Include your company's name, address, and contact information. This will help identify the receipt and make it easier for both parties to keep track of.

03

Begin the body of the receipt. Write down the date of the transaction and the customer's name and contact information. This ensures that the receipt is properly labeled and can be easily identified in the future.

04

List the products or services provided. Be as specific as possible, including any relevant details such as quantities or descriptions. This will help both parties remember the details of the transaction and avoid any confusion.

05

Include the price for each item or service provided. If applicable, calculate any taxes or discounts and include them in the total amount due. Make sure to provide a breakdown so that the customer can easily understand the charges.

06

Calculate and provide the total amount due. Clearly state the amount that the customer needs to pay, using a clear and legible font.

07

Make a note that accounts receipts must be attached. This is important for your records and may be necessary for tax or other purposes. It also ensures that the customer has a copy of the receipt in case they need it in the future.

Who Needs Accounts Receipts Must Be Attached:

01

Small business owners: Keeping accurate accounts receipts with attached documentation is crucial for small business owners to track their financial transactions, monitor their expenses, and prepare accurate financial statements.

02

Individuals filing taxes: Those who are required to file tax returns need to maintain accounts receipts with attached documentation as proof of expenses and deductions claimed. This helps avoid any discrepancies or issues during the tax filing process.

03

Professional service providers: Freelancers, consultants, and other professionals who provide services to clients should keep accounts receipts with attached documentation to track their income and provide proof of payment for their services rendered.

Note: It is important to consult with a legal and/or accounting professional for specific requirements and regulations regarding accounts receipts, as they may vary depending on the jurisdiction and industry.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my accountsreceipts must be attached directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your accountsreceipts must be attached and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Where do I find accountsreceipts must be attached?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific accountsreceipts must be attached and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out accountsreceipts must be attached on an Android device?

Use the pdfFiller Android app to finish your accountsreceipts must be attached and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is accountsreceipts must be attached?

Accounts receipts are documents that provide evidence of financial transactions.

Who is required to file accountsreceipts must be attached?

Any individual or organization that receives income or incurs expenses should file accounts receipts.

How to fill out accountsreceipts must be attached?

Accounts receipts can be filled out by documenting each financial transaction with details such as date, description, amount, and classification.

What is the purpose of accountsreceipts must be attached?

The purpose of accounts receipts is to maintain accurate records of financial transactions for reporting, analysis, and compliance purposes.

What information must be reported on accountsreceipts must be attached?

Information such as date, description, amount, payer/payee details, and any relevant account codes should be reported on accounts receipts.

Fill out your accountsreceipts must be attached online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accountsreceipts Must Be Attached is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.