Get the free DALLAS COUNTY TAX OFFICE

Show details

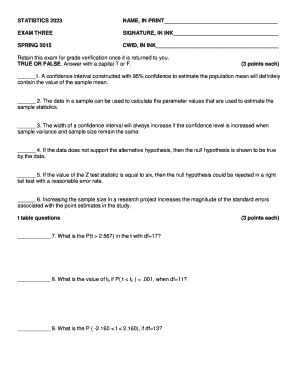

Dallascad.org www. collincad.org www. dentoncad.com www. elliscad.org www. kaufman-cad.org www. rockwallcad.com www. Dallascounty. org/tax 214-653-7811 email propertytax dallascounty. org 2016 TAX STATEMENT 445037000A0010000 Account 445037000A0010000 BOSWORTH RICHARD A 740 I30 EAST SULPHUR SPRINGS TX 75482-6291 Property Description 7904 CHIESA RD CW Land Value Improvement Value Agriculture Value Market Value OAKS AT LIBERTY GROVE BLK A LT 1 ACS 9. DALLAS COUNTY TAX OFFICE JOHN R. AMES CTA TAX...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dallas county tax office

Edit your dallas county tax office form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dallas county tax office form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dallas county tax office online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit dallas county tax office. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dallas county tax office

How to fill out Dallas County tax office:

01

Gather all necessary documents: Before you begin filling out any tax forms, make sure you have all the relevant documents handy. This may include your W-2 forms, 1099 forms, receipts, and other financial documents.

02

Determine your tax filing status: The next step is to determine your tax filing status. This could be single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child. Your filing status will determine the tax brackets and deductions that apply to you.

03

Complete the necessary forms: Depending on your specific situation, you may need to fill out different forms. The most common form is the 1040 individual income tax return. Make sure to accurately report your income, deductions, and credits.

04

Double-check for accuracy: It is crucial to review your completed forms for accuracy before submitting them. Mistakes or omissions can lead to delays or potential problems with your tax return. Take the time to carefully review all the information you have provided.

05

Sign and submit: Once you are satisfied with the accuracy of your tax forms, sign and date them. You can then submit your forms either electronically or by mail to the Dallas County tax office. Be aware of any deadlines and ensure that you comply with them.

Who needs Dallas County tax office:

01

Residents of Dallas County: If you reside in Dallas County, you are required to pay taxes to the county. Whether you own property, have a business, or generate income within the county, you will need to utilize the services of the Dallas County tax office.

02

Property owners: If you own real estate property in Dallas County, you will need to pay property taxes. The Dallas County tax office is responsible for assessing and collecting property taxes from residents and businesses.

03

Business owners: If you operate a business in Dallas County, you will have tax obligations related to your business activities. This includes sales tax, employment taxes, and other business-related taxes. The Dallas County tax office can assist you with understanding and fulfilling these tax obligations.

In summary, filling out the Dallas County tax office requires gathering necessary documents, determining your filing status, completing the appropriate forms accurately, and submitting them to the tax office. Residents of Dallas County, property owners, and business owners are among those who need the services of the Dallas County tax office.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit dallas county tax office from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including dallas county tax office. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Where do I find dallas county tax office?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the dallas county tax office. Open it immediately and start altering it with sophisticated capabilities.

How do I edit dallas county tax office on an Android device?

The pdfFiller app for Android allows you to edit PDF files like dallas county tax office. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is dallas county tax office?

The Dallas County Tax Office is responsible for assessing and collecting property taxes in Dallas County.

Who is required to file dallas county tax office?

Property owners in Dallas County are required to file and pay property taxes.

How to fill out dallas county tax office?

To fill out the Dallas County Tax Office forms, property owners must provide information about their property and calculate the appropriate tax amount.

What is the purpose of dallas county tax office?

The purpose of the Dallas County Tax Office is to fund local government services and infrastructure through property tax revenue.

What information must be reported on dallas county tax office?

Property owners must report details about their property, such as its value and location, on the Dallas County Tax Office forms.

Fill out your dallas county tax office online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dallas County Tax Office is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.