Get the free Pay Statement

Show details

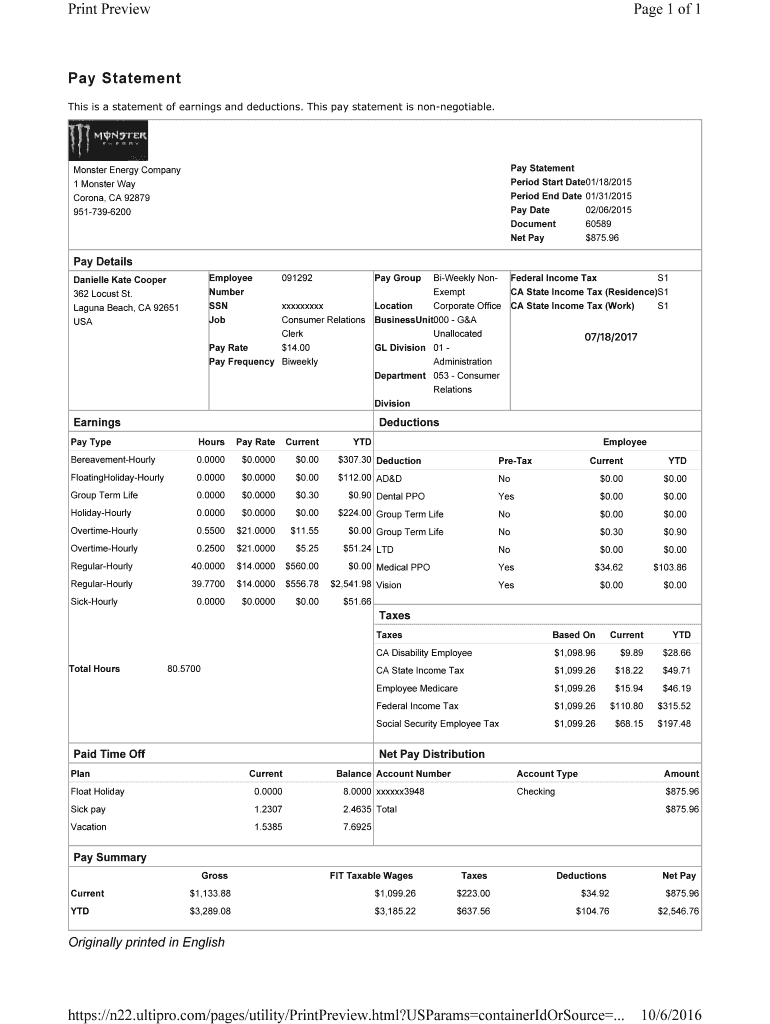

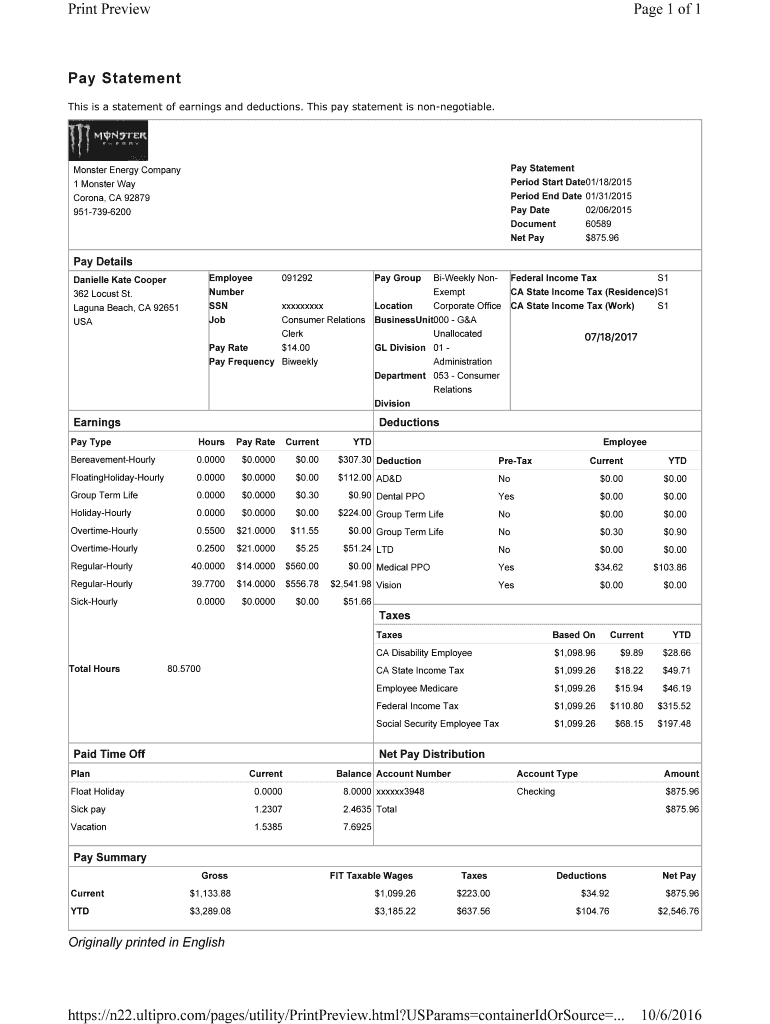

5500 21. 0000 11. 55 Regular-Hourly 560. 00 39. 7700 556. 78 Sick-Hourly Federal Income Tax S1 CA State Income Tax Residence S1 YTD Pre-Tax No Yes 224. Period Start Date01/18/2015 Period End Date 01/31/2015 Pay Date 02/06/2015 Document 60589 Net Pay 875. 0000 307. 30 Deduction FloatingHoliday-Hourly 112. 00 AD D Group Term Life Holiday-Hourly Overtime-Hourly 0. 00 GL Division 01 Pay Frequency Biweekly Administration Department 053 - Consumer Relations Division Employee Number SSN Job Danielle...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pay statement

Edit your pay statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pay statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pay statement online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pay statement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pay statement

How to fill out pay statement:

01

Gather necessary information: Before filling out a pay statement, make sure you have all the necessary information at hand. This includes your employer's name and contact information, your employee identification number, and the period for which the pay statement is being created (e.g., monthly, biweekly).

02

Understand the components: Familiarize yourself with the different sections of a pay statement. These typically include your gross earnings, deductions (such as taxes, insurance, and retirement contributions), net pay (the amount you take home after deductions), and year-to-date totals.

03

Calculate gross earnings: Calculate your gross earnings by multiplying your hourly rate by the number of hours worked during the pay period. If you receive a fixed salary, this step may not be necessary.

04

Deductions: Deduct any applicable taxes, insurance premiums, retirement contributions, and other authorized deductions. Consult your employer's policies or seek assistance if you have any questions regarding specific deductions.

05

Determine net pay: Subtract the total deductions from your gross earnings to determine your net pay. This is the amount that will be deposited into your bank account or provided to you in the form of a physical paycheck.

Who needs pay statement:

01

Employees: Pay statements are essential for employees as they provide a detailed breakdown of their earnings, deductions, and net pay. It allows them to verify the accuracy of their wages, understand any deductions made, and ensure compliance with employment laws.

02

Employers: Employers need to provide pay statements to their employees as a legal requirement in most jurisdictions. It helps employers maintain transparency and demonstrate compliance with wage regulations. Additionally, pay statements serve as a record-keeping tool for employers to track payments made to their employees.

03

Financial institutions: Pay statements may be required by financial institutions when applying for loans, mortgages, or other financial services. These statements provide evidence of regular income and help lenders assess an individual's ability to repay the loan.

In conclusion, knowing how to fill out a pay statement correctly is important for both employees and employers. Pay statements serve as a crucial financial document that ensures transparency, provides proof of income, and helps maintain accurate payroll records.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my pay statement in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your pay statement and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I complete pay statement on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your pay statement from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I fill out pay statement on an Android device?

Use the pdfFiller mobile app to complete your pay statement on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is pay statement?

A pay statement is a document provided by an employer to an employee that outlines the details of the employee's pay for a specific period of time.

Who is required to file pay statement?

Employers are required to provide pay statements to their employees.

How to fill out pay statement?

Pay statements can be filled out manually or generated through payroll software, and should include details such as hours worked, wages earned, deductions, and taxes withheld.

What is the purpose of pay statement?

The purpose of a pay statement is to provide employees with a record of their earnings and deductions for each pay period.

What information must be reported on pay statement?

Pay statements must include details such as gross wages, net pay, deductions for taxes and benefits, and any overtime or bonus pay.

Fill out your pay statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pay Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.