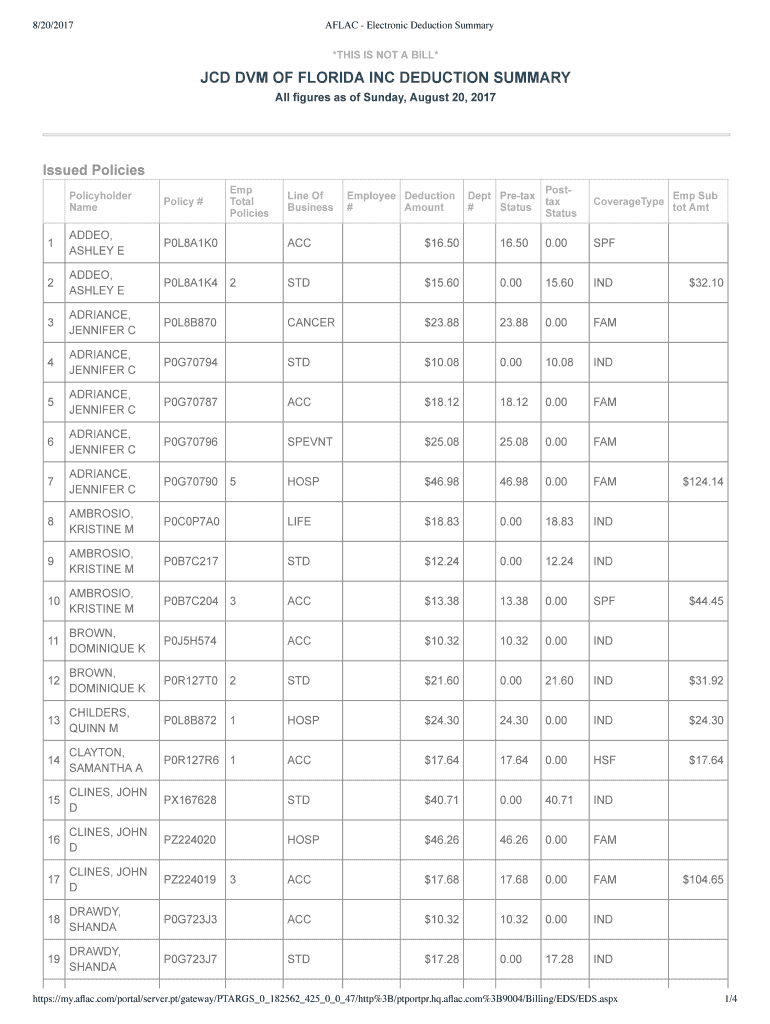

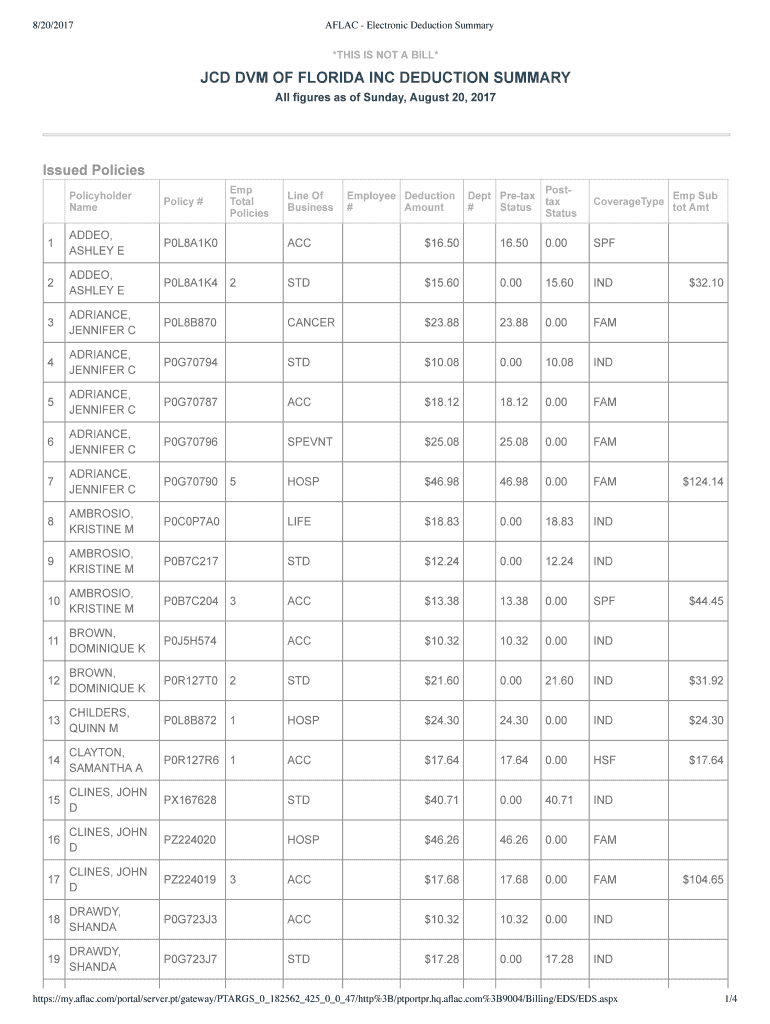

Get the free AFLAC - Electronic Deduction Summary

Show details

64 HSF CLINES JOHN D PX167628 40. 71 PZ224020 46. 26 PZ224019 17. 68 104. 65 DRAWDY SHANDA P0G723J3 17. 51 SISCO 43. 86 TRENT DAWN M 22. 92 P0E3A5X7 29. 16 35. 94 82. 38 VINER ANGELENA M 19. 25 32. 51 1 274. 30 34 LEE CHERYL R P0L8E4G8 15. 36 13. 26 28. 62 LUCAS LAUREN 11. 22 18. 36 78. 60 MANSFIELD MELISSA S 12. 12 SPEVNT 25. 08 HOSP 46. 98 124. 14 AMBROSIO KRISTINE M P0C0P7A0 LIFE 18. 83 P0B7C217 12. 24 P0B7C204 3 13. 58 P0R127S3 23. 04 21. 00 12. 90 90. 12 GILBERT JEFFREY D GREER...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aflac - electronic deduction

Edit your aflac - electronic deduction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aflac - electronic deduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit aflac - electronic deduction online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit aflac - electronic deduction. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aflac - electronic deduction

How to fill out AFLAC - Electronic Deduction:

01

Start by obtaining the necessary forms from AFLAC or your employer. These forms will typically include an enrollment form and an authorization form for electronic deduction.

02

Fill out the enrollment form with your personal information, including your full name, address, social security number, and contact information. This form is required to sign up for AFLAC benefits and the electronic deduction.

03

Next, complete the authorization form for electronic deduction. This form will require you to provide your bank account information, including the bank name, account number, and routing number. Make sure to double-check the accuracy of this information to avoid any issues with payment.

04

Review the completed forms for any mistakes or missing information. It is crucial to ensure that all fields are properly filled out to avoid delays in processing.

05

Once you have reviewed the forms and are confident that they are accurate, sign and date them as required. Your signature indicates your agreement to allow AFLAC to deduct the premiums electronically from your bank account.

06

Submit the completed forms to your employer or follow the instructions provided by AFLAC for submission. Keep a copy of the forms for your records.

07

After submitting the forms, allow some time for processing. AFLAC will typically send a confirmation or notification to you and your employer once the electronic deduction is set up and active.

Who needs AFLAC - Electronic Deduction:

01

Employees who are enrolled in AFLAC benefits and wish to pay their premiums conveniently through automatic deductions from their bank account can benefit from AFLAC - Electronic Deduction.

02

This option is particularly useful for individuals who prefer a hassle-free payment method and want to ensure that their premiums are paid on time.

03

AFLAC - Electronic Deduction can be beneficial for both full-time and part-time employees who have opted for AFLAC coverage and want to simplify the premium payment process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my aflac - electronic deduction directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your aflac - electronic deduction and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send aflac - electronic deduction for eSignature?

Once your aflac - electronic deduction is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I execute aflac - electronic deduction online?

Filling out and eSigning aflac - electronic deduction is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

What is aflac - electronic deduction?

Aflac electronic deduction is a system where Aflac insurance premiums are deducted electronically from an employee's paycheck.

Who is required to file aflac - electronic deduction?

Employers who offer Aflac insurance to their employees and deduct the premiums electronically are required to file Aflac electronic deduction.

How to fill out aflac - electronic deduction?

Employers need to provide the necessary employee information and premium amounts to the payroll system for automated deduction.

What is the purpose of aflac - electronic deduction?

The purpose of Aflac electronic deduction is to make the process of premium payment for Aflac insurance more convenient and efficient for both employers and employees.

What information must be reported on aflac - electronic deduction?

The information to be reported on Aflac electronic deduction includes employee names, premium amounts, deduction dates, and any necessary policy information.

Fill out your aflac - electronic deduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aflac - Electronic Deduction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.