HI PTS Enrollment Form 2017-2025 free printable template

Show details

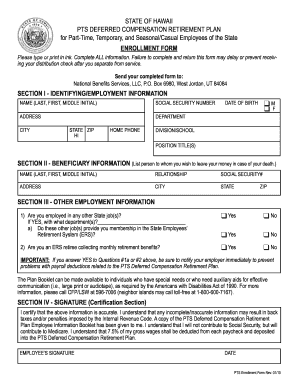

A copy of the PTS Deferred Compensation Retirement Plan Employee Information Booklet has been given to me. 5 of my gross wages shall be deducted from each paycheck and deposited into the PTS Deferred Compensation Retirement Plan. EMPLOYEE S SIGNATURE DATE. STATE OF HAWAII PTS DEFERRED COMPENSATION RETIREMENT PLAN for Part-Time Temporary and Seasonal/Casual Employees of the State Enrollment Form Please type or print in ink. RELATIONSHIP STATE ZIP SECTION III - OTHER EMPLOYMENT INFORMATION 1...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI PTS Enrollment Form

Edit your HI PTS Enrollment Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI PTS Enrollment Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit HI PTS Enrollment Form online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit HI PTS Enrollment Form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI PTS Enrollment Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI PTS Enrollment Form

How to fill out HI PTS Enrollment Form

01

Obtain the HI PTS Enrollment Form from the official website or the relevant administrative office.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Provide any required identification details, such as Social Security Number or identification number.

04

Complete any sections related to your eligibility or the specific programs you are enrolling for.

05

Review the form to ensure all sections are filled out correctly and completely.

06

Sign and date the form where indicated.

07

Submit the completed form via the specified submission method, whether online, by mail, or in person.

Who needs HI PTS Enrollment Form?

01

Individuals seeking to enroll in the HI PTS program need to fill out the HI PTS Enrollment Form.

02

Healthcare professionals who need to report or track their services may be required to complete this form.

03

Organizations that are participating in the HI PTS initiative may also need to fill out the form for their members.

Fill

form

: Try Risk Free

People Also Ask about

How does a deferred compensation plan work?

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

What is the difference between a 401k and a deferred compensation plan?

A 401k plan has certain limitations on the amount that an individual can contribute each year. A deferred compensation plan, on the other hand, has no maximum contribution limit in any given year.

What is a PTS retirement plan?

The PTS Plan is a deferred compensation plan established under Section 457 of the Internal Revenue Code. Contributions to the plan are made automatically each pay period to your employer- sponsored retirement account. Federal and New York State income taxes are deferred until the assets are withdrawn from your account.

What is NYC deferred compensation plan?

The New York City Deferred Compensation Plan (DCP) allows eligible New York City employees a way to save for retirement through convenient payroll deductions. DCP is comprised of two programs: a 457 Plan and a 401(k) Plan, both of which offer pre-tax and Roth (after-tax) options.

What is PTS deferred compensation?

Under this Plan, PTS employees will be automatically enrolled and 7.5% of their gross pay each pay period will be deducted, in lieu of Social Security taxes, and placed in an interest-bearing PTS account.

What is the difference between NYC Deferred Comp 457 and 401k?

In the 457 Plan, you may choose to make pre-tax contributions and/or Roth (after-tax) contributions. However, the combined deferral cannot exceed $22,500. In the 401(k) Plan, you may choose to make pre-tax contributions and/ or Roth (after-tax) contributions. However, the combined deferral cannot exceed $22,500.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get HI PTS Enrollment Form?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific HI PTS Enrollment Form and other forms. Find the template you want and tweak it with powerful editing tools.

How can I edit HI PTS Enrollment Form on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing HI PTS Enrollment Form, you can start right away.

How do I edit HI PTS Enrollment Form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign HI PTS Enrollment Form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is HI PTS Enrollment Form?

The HI PTS Enrollment Form is a document used to enroll individuals in the Health Insurance Premium Tax Subsidy program, allowing eligible participants to receive financial assistance with their health insurance premiums.

Who is required to file HI PTS Enrollment Form?

Individuals who wish to receive health insurance premium tax subsidies and meet the eligibility requirements set forth by the program must file the HI PTS Enrollment Form.

How to fill out HI PTS Enrollment Form?

To fill out the HI PTS Enrollment Form, applicants need to provide personal information such as their name, address, income details, and information about their health insurance coverage. The form typically includes instructions for completing each section.

What is the purpose of HI PTS Enrollment Form?

The purpose of the HI PTS Enrollment Form is to collect necessary information to determine eligibility for health insurance premium tax subsidies, ensuring that individuals receive financial support for their health insurance costs.

What information must be reported on HI PTS Enrollment Form?

The HI PTS Enrollment Form must report personal details including the applicant's name, social security number, household size, income, and current health insurance plan information. Accurate reporting is crucial for determining eligibility.

Fill out your HI PTS Enrollment Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI PTS Enrollment Form is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.