AL DoR 40 Booklet 2016 free printable template

Show details

Revenue. alabama.gov then click on Where s My Refund. How To Use This Instruction Booklet The instructions for Form 40 are divided into five main sections. Line I. Reserved for future use. schedule of the Alabama Form 40 or Alabama Form 40NR filed by the individual depending upon the nature of the portfolio income. Schedules with instructions Form 40NR Schedules A B D E W-2 FORMS Form 40 Individual Income Tax Return for full year residents of Alabama and also part-year residents of Alabama....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL DoR 40 Booklet

Edit your AL DoR 40 Booklet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL DoR 40 Booklet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AL DoR 40 Booklet online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit AL DoR 40 Booklet. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL DoR 40 Booklet Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL DoR 40 Booklet

How to fill out AL DoR 40 Booklet

01

Gather all necessary financial documents, including income statements, W-2 forms, and other relevant tax information.

02

Obtain the AL DoR 40 Booklet from the Alabama Department of Revenue website or your local tax office.

03

Begin filling out the booklet by entering your personal information in the designated sections, including your name, address, and social security number.

04

Report your income on the appropriate lines, ensuring all sources of income are included.

05

Deduct any eligible expenses, following the instructions provided in the booklet to calculate your taxable income.

06

Check for any applicable tax credits and fill them out in the specified area.

07

Review your calculations for accuracy to ensure all figures are correct.

08

Sign and date the completed booklet, and make a copy for your records.

09

Submit the finished AL DoR 40 Booklet to the Alabama Department of Revenue by the designated deadline.

Who needs AL DoR 40 Booklet?

01

Residents of Alabama who earn income and are required to file a state income tax return.

02

Individuals who are self-employed or have business income.

03

Taxpayers claiming deductions or credits on their Alabama income tax return.

04

Anyone who needs to report various types of income, including wages, interest, dividends, and capital gains.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a copy of my 10/40 form?

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

How to fill out Alabama state tax form?

0:48 4:04 Number line C enter your home address line D enter the city you live in line e enter the state youMoreNumber line C enter your home address line D enter the city you live in line e enter the state you live in line F enter the zip code you live in line G and H. You will skip.

Can you complete R40 online?

You can make a claim for a tax repayment on your PPI interest using form R40 (or form R43 if you are living overseas). You can either do this online, or by downloading and printing off a paper form to send by post. You can access the form R40 on GOV.UK, together with instructions about how to complete the form.

When should I complete my R40?

An R40 is the form that needs to be completed if you wish to claim a repayment of tax deducted from your savings and investments. The information provided will allow HM Revenue & Customs to investigate whether you've paid too much tax and issue you with a refund of any monies you may be due.

Where can I get Alabama state tax forms?

If you are trying to locate, download, print, or fill state of Alabama tax forms, you can do so on the Alabama Department of Revenue website.

What is an HMRC R40 form?

Complete form R40 to claim a refund if you think you've paid too much tax on interest from your savings in an earlier tax year. Use form R43 to claim personal allowances and a tax repayment if you're an individual not resident in the United Kingdom.

How to fill out Alabama state tax withholding form?

0:48 4:04 Number line C enter your home address line D enter the city you live in line e enter the state youMoreNumber line C enter your home address line D enter the city you live in line e enter the state you live in line F enter the zip code you live in line G and H. You will skip.

How much should I withhold for Alabama taxes?

The amount your employer withholds will depend on the information you provide on your W-4 tax form.Income Tax Brackets. Single FilersAlabama Taxable IncomeRate$0 - $5002.00%$500 - $3,0004.00%$3,000+5.00%

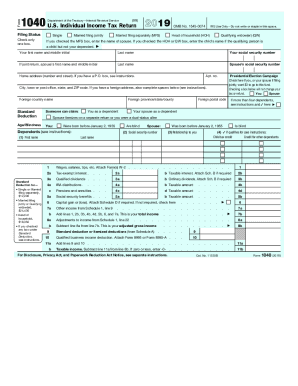

What is a form 40 for taxes?

More In Forms and Instructions Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What is a form 40?

Also called the Registration and Annual Report for Canadian Securities Form, Form 40-F is a filing with the US Securities and Exchange Commission (SEC) used by Canadian companies that want to offer their securities to United States investors.

How do I get my 1040?

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

Where can I get a R40 form from?

You can download form R40 from GOV.UK. If you are unable to print the form off yourself (or with help from friends/a local library, etc.) then you will have to phone HMRC to request that they send you a copy. The phone number to use is: 0300 200 3300.

How do I file my Alabama state taxes?

You can file your Alabama resident and non-resident returns online through My Alabama Taxes at no charge. This free electronic filing option is available to all taxpayers filing an Alabama Individual Income Tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit AL DoR 40 Booklet from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including AL DoR 40 Booklet, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make edits in AL DoR 40 Booklet without leaving Chrome?

AL DoR 40 Booklet can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for the AL DoR 40 Booklet in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your AL DoR 40 Booklet in seconds.

What is AL DoR 40 Booklet?

AL DoR 40 Booklet is a publication provided by the Alabama Department of Revenue that outlines the necessary forms and guidelines for individuals and businesses to report their tax information and comply with tax regulations in the state.

Who is required to file AL DoR 40 Booklet?

Individuals and businesses operating within Alabama who have taxable income or meet certain tax thresholds are required to file the AL DoR 40 Booklet.

How to fill out AL DoR 40 Booklet?

To fill out the AL DoR 40 Booklet, you need to gather your financial records, accurately complete the required forms included in the booklet, and ensure all calculations are correct before submitting it to the Alabama Department of Revenue.

What is the purpose of AL DoR 40 Booklet?

The purpose of AL DoR 40 Booklet is to provide a standardized format for taxpayers to report their income, deductions, and credits, ensuring compliance with Alabama tax laws and facilitating the assessment of state taxes.

What information must be reported on AL DoR 40 Booklet?

The AL DoR 40 Booklet requires reporting of personal and business income, deductions, credits, and other relevant financial information that determines the tax liability for individuals and businesses in Alabama.

Fill out your AL DoR 40 Booklet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL DoR 40 Booklet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.