AL DoR 40 Booklet 2021 free printable template

Show details

WWW.revenue. Alabama.govFormAlabamaBooklet202140 Long Return Residents and Part Year Residents Forms and Instructions.myalabamataxes. Alabama.index

Filing Status 6FirstTime and Second Chance Home

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign alabama dept of revenue form 40

Edit your alabama form 40 booklet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alabama booklet return part year instructions fill form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit alabama tax forms and instructions online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit alabama form 40 instructions pdf. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL DoR 40 Booklet Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out alabama form 40 booklet long return part year fill

How to fill out AL DoR 40 Booklet

01

Gather your personal information including name, address, and Social Security Number.

02

Obtain your income documents such as W-2s, 1099s, and any other relevant income statements.

03

Complete the identification section at the top of the AL DoR 40 Booklet.

04

Follow the instructions for reporting your income, ensuring all sources are included.

05

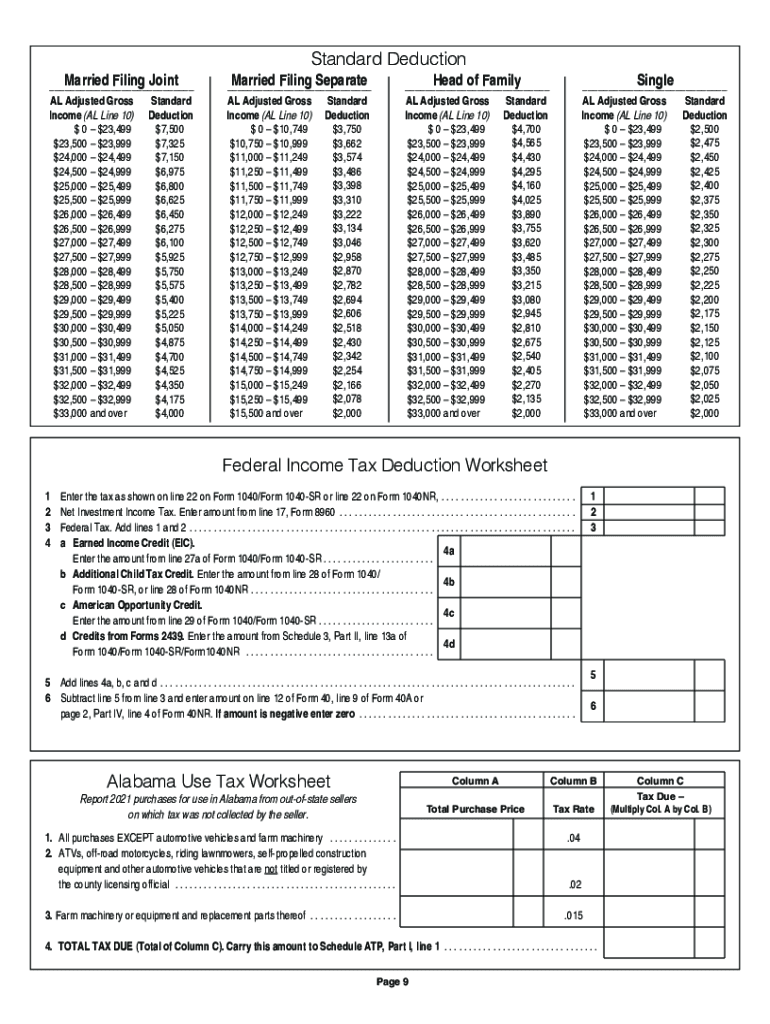

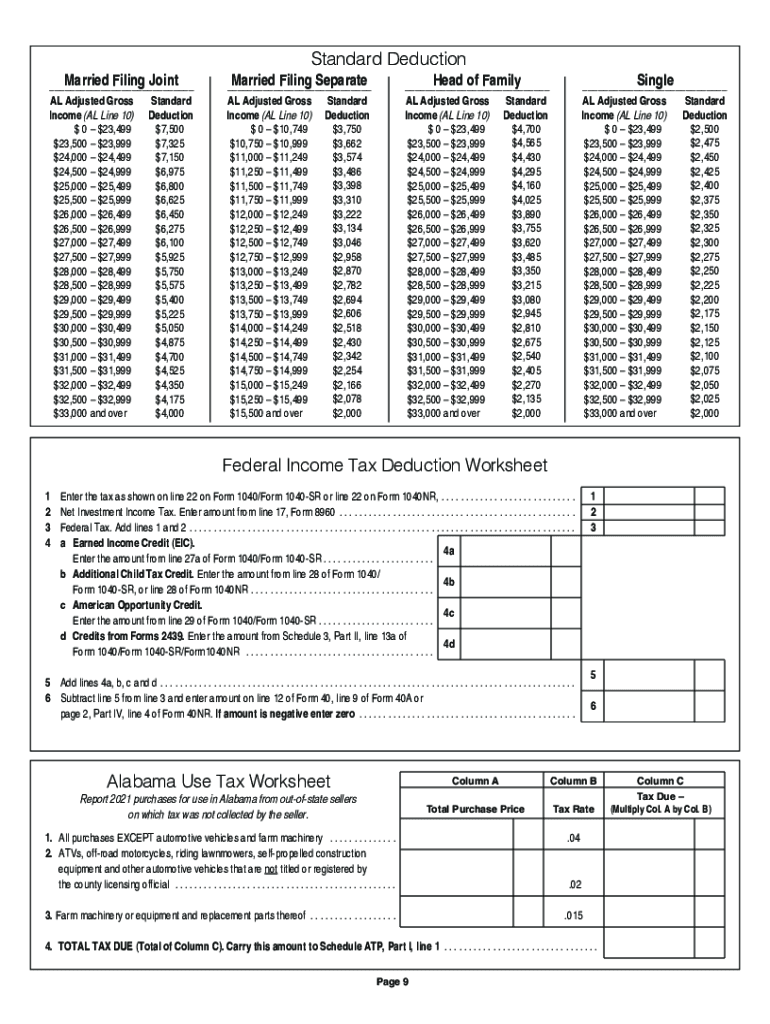

Deductions and credits sections should be filled out next, based on your eligibility.

06

Review the tax tables to determine your tax liability.

07

Complete the signature section and include the date.

08

Submit your completed AL DoR 40 Booklet by the tax deadline.

Who needs AL DoR 40 Booklet?

01

Residents of Alabama who have earned income.

02

Individuals needing to file a tax return for state tax purposes.

03

Anyone who is claiming deductions or credits on their state taxes.

04

Self-employed individuals who need to report their income and expenses.

Fill

alabama form 40 instruction booklet

: Try Risk Free

People Also Ask about alabama form 40 long return part year instructions template

How do I get a copy of my 10/40 form?

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

How to fill out Alabama state tax form?

0:48 4:04 Number line C enter your home address line D enter the city you live in line e enter the state youMoreNumber line C enter your home address line D enter the city you live in line e enter the state you live in line F enter the zip code you live in line G and H. You will skip.

Can you complete R40 online?

You can make a claim for a tax repayment on your PPI interest using form R40 (or form R43 if you are living overseas). You can either do this online, or by downloading and printing off a paper form to send by post. You can access the form R40 on GOV.UK, together with instructions about how to complete the form.

When should I complete my R40?

An R40 is the form that needs to be completed if you wish to claim a repayment of tax deducted from your savings and investments. The information provided will allow HM Revenue & Customs to investigate whether you've paid too much tax and issue you with a refund of any monies you may be due.

Where can I get Alabama state tax forms?

If you are trying to locate, download, print, or fill state of Alabama tax forms, you can do so on the Alabama Department of Revenue website.

What is an HMRC R40 form?

Complete form R40 to claim a refund if you think you've paid too much tax on interest from your savings in an earlier tax year. Use form R43 to claim personal allowances and a tax repayment if you're an individual not resident in the United Kingdom.

How to fill out Alabama state tax withholding form?

0:48 4:04 Number line C enter your home address line D enter the city you live in line e enter the state youMoreNumber line C enter your home address line D enter the city you live in line e enter the state you live in line F enter the zip code you live in line G and H. You will skip.

How much should I withhold for Alabama taxes?

The amount your employer withholds will depend on the information you provide on your W-4 tax form.Income Tax Brackets. Single FilersAlabama Taxable IncomeRate$0 - $5002.00%$500 - $3,0004.00%$3,000+5.00%

What is a form 40 for taxes?

More In Forms and Instructions Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What is a form 40?

Also called the Registration and Annual Report for Canadian Securities Form, Form 40-F is a filing with the US Securities and Exchange Commission (SEC) used by Canadian companies that want to offer their securities to United States investors.

How do I get my 1040?

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

Where can I get a R40 form from?

You can download form R40 from GOV.UK. If you are unable to print the form off yourself (or with help from friends/a local library, etc.) then you will have to phone HMRC to request that they send you a copy. The phone number to use is: 0300 200 3300.

How do I file my Alabama state taxes?

You can file your Alabama resident and non-resident returns online through My Alabama Taxes at no charge. This free electronic filing option is available to all taxpayers filing an Alabama Individual Income Tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify alabama form part year instructions printable without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your alabama form 40 schedule e into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for signing my alabama form 40 long part year print in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your alabama form 40 booklet directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out the alabama booklet form form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign alabama form 40 residents part year instructions printable and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is AL DoR 40 Booklet?

The AL DoR 40 Booklet is a tax form used in Alabama for reporting individual income taxes. It includes instructions and necessary documents for taxpayers to fulfill their state tax obligations.

Who is required to file AL DoR 40 Booklet?

Residents of Alabama who have a tax liability or meet the income threshold requirements are required to file the AL DoR 40 Booklet.

How to fill out AL DoR 40 Booklet?

To fill out the AL DoR 40 Booklet, taxpayers need to provide personal information, report their income, claim deductions and credits, and calculate their tax liability according to the instructions provided in the booklet.

What is the purpose of AL DoR 40 Booklet?

The purpose of the AL DoR 40 Booklet is to guide taxpayers in preparing and submitting their state income tax returns to ensure compliance with Alabama tax laws.

What information must be reported on AL DoR 40 Booklet?

Taxpayers must report personal identification details, income from various sources, deductions and exemptions claimed, tax credits, and the total amount of tax due or refund expected on the AL DoR 40 Booklet.

Fill out your AL DoR 40 Booklet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Alabama Form 40 Long Residents Part Year Instructions Template is not the form you're looking for?Search for another form here.

Keywords relevant to alabama form 40 booklet return part year instructions create

Related to alabama form 40 booklet residents part year instructions

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.