TX 74-176 2017 free printable template

Show details

74176

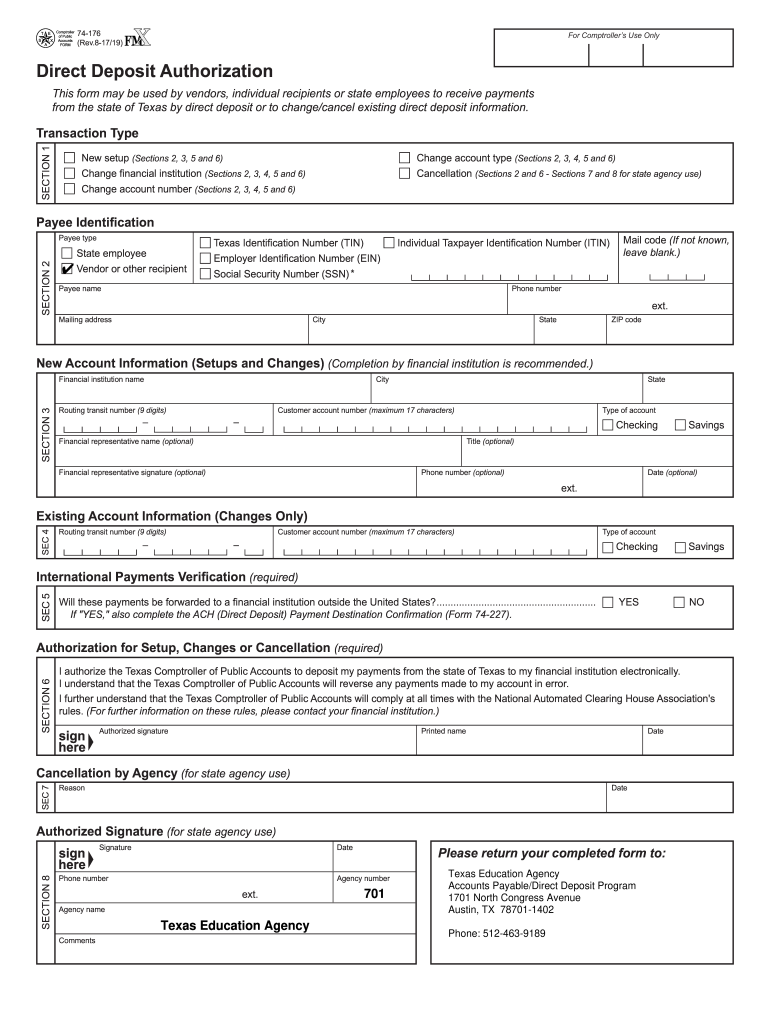

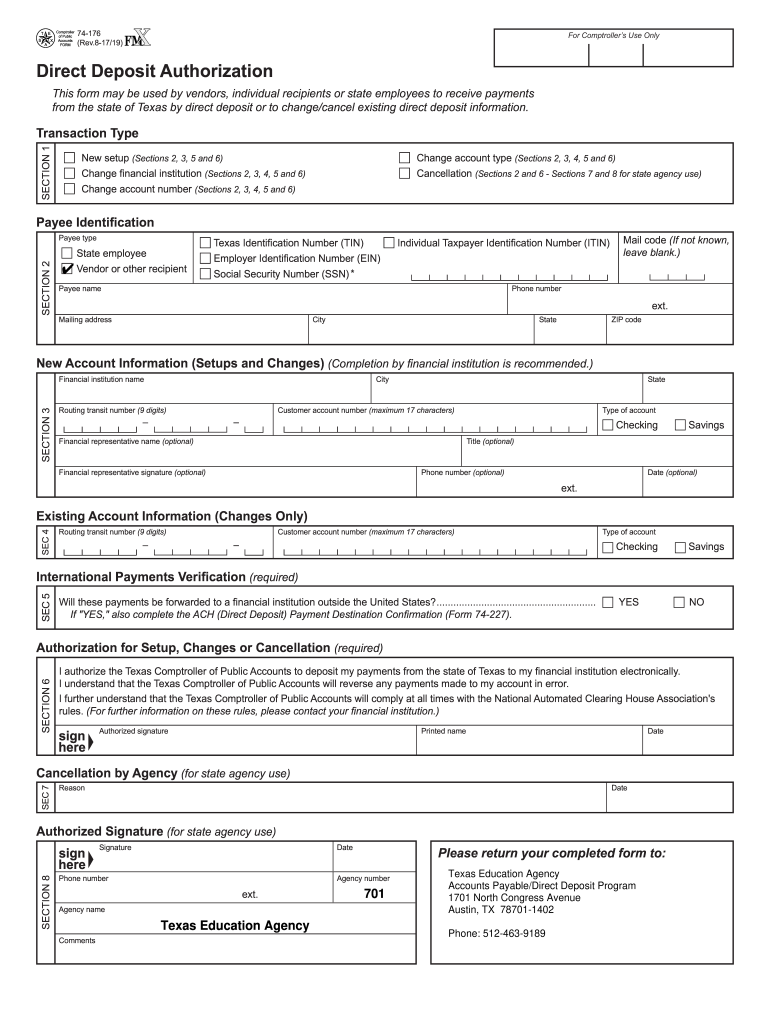

(Rev.817/19)For Comptrollers Use OnlyPRINT FORMCLEAR FIELDSDirect Deposit Authorization

This form may be used by vendors, individual recipients or state employees to receive payments

from the

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX 74-176

Edit your TX 74-176 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX 74-176 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX 74-176 online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit TX 74-176. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX 74-176 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX 74-176

How to fill out TX 74-176

01

Start by obtaining the TX 74-176 form from the official Texas state website or your local county office.

02

Fill in the personal information section at the top of the form, including your name, address, and contact details.

03

Provide any relevant identification numbers, such as your Social Security Number or Tax Identification Number, if applicable.

04

Complete the details regarding the purpose of the claim or application as directed on the form.

05

Ensure that you fill out any additional sections that pertain to your specific situation accurately.

06

Review the completed form for accuracy, ensuring all required sections are filled out and there are no mistakes.

07

Sign and date the form at the designated area to certify that the information provided is true and correct.

08

Submit the form by mail or in person as instructed on the form, keeping a copy for your records.

Who needs TX 74-176?

01

Individuals or businesses in Texas who need to submit claims or applications related to specific state programs or services will require the TX 74-176 form.

02

Those who are involved in legal matters such as property disputes, estate settlements, or other legal claims may also need this form.

Fill

form

: Try Risk Free

People Also Ask about

Are direct deposit authorization forms required?

Yes. Collecting and using personal bank information in any way without the individual's written consent is illegal. If you want to use direct deposit, you will need your employees to sign an authorization form.

Can you request a direct deposit form online?

Ask for a written or online direct deposit form. If that isn't available, ask your bank or credit union for one. We've included a list of forms from top banks, including the Capital One and Bank of America direct deposit forms.

How do I fill out a direct deposit enrollment?

Here's everything you need to know about how to set up direct deposit at your financial institution. Get a direct deposit form from your employer. Ask for a written or online direct deposit form. Fill in account information. Confirm the deposit amount. Attach a voided check or deposit slip, if required. Submit the form.

How do I fill out a direct deposit enrollment form?

1:21 5:44 How to Fill Out the Direct Deposit Enrollment Form - YouTube YouTube Start of suggested clip End of suggested clip You must fill in every blank on the page the one exception is the email. Address if any otherMoreYou must fill in every blank on the page the one exception is the email. Address if any other information is missing the form will be returned to you you will then need to fill in the missing.

What is a direct deposit authorization form?

A direct deposit authorization form is a form that employees fill out to authorize their employer to deposit money straight into their bank account.

Can I get a direct deposit form online?

Ask for a written or online direct deposit form. If that isn't available, ask your bank or credit union for one. We've included a list of forms from top banks, including the Capital One and Bank of America direct deposit forms.

What documents are required for direct deposit?

Just have your bank account information (routing and bank account numbers) handy. The second step in direct deposit enrollment is to ask your employer for direct deposit forms. These are generally very basic. It helps to have your Social Security number handy, and a blank check or account and routing numbers.

How do I download direct deposit?

Where can I get a direct deposit payroll form? From your Accounts page, select your chequing account. Select Direct Deposits & Payments. Go to Direct Deposit / Payroll Form and select View/Print.

How do I get direct deposit letter from my bank?

How To Request/Obtain A Bank Letter In-person: The quickest way to obtain a bank letter is to request one in-person. By phone: Another convenient way to obtain a bank letter is to call your bank's support line. By email: Depending on your bank, you may be able to request a bank letter via email.

What do you need to give employers for direct deposit?

Each employee needs to provide the following information: bank name, account type, account number and routing number. Some states also require employees to sign a consent form before their employer can switch them to direct deposit.

How do I authorize a direct deposit?

How to set up direct deposit for your paycheck Ask for a copy of your employer's direct deposit signup form, or download the U.S. Bank Direct Deposit Authorization Form (PDF). Provide your U.S. Bank deposit account type (checking or savings), account number and routing number, and other required information.

Can I get an online voided check?

If you need a voided check and don't have a checkbook, look at your bank's online system. You can send yourself a check and then mark it as void. Another option is to print a check. Using check printing software, print out the check and then void it.

How do I get a direct deposit letter from my bank?

How To Request/Obtain A Bank Letter In-person: The quickest way to obtain a bank letter is to request one in-person. By phone: Another convenient way to obtain a bank letter is to call your bank's support line. By email: Depending on your bank, you may be able to request a bank letter via email.

Do I need a direct deposit authorization form?

It's critical to get proper authorization to use an employee's bank details for payroll before sending money. Otherwise, your business could find itself in legal trouble. A direct deposit authorization form also covers all the bank account details that you need to know where to send a payment.

What is a direct deposit form and how do I get one?

What is a Direct Deposit Authorization Form? Direct deposit authorization forms authorize employers to send money directly into an individual's bank account. In times past, employers would print out and distribute physical checks on pay day for each employee to deposit into their bank accounts themselves.

What info does an employer need for direct deposit?

It's also known as an automated clearinghouse (ACH) transaction. This process requires the employee's bank account number, routing number, type of account, bank name and address, and the names of the account holders. Direct deposit isn't just for paying wages.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute TX 74-176 online?

pdfFiller has made it simple to fill out and eSign TX 74-176. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit TX 74-176 straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing TX 74-176.

How can I fill out TX 74-176 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your TX 74-176 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is TX 74-176?

TX 74-176 is a form used in Texas for reporting certain financial information related to franchise tax.

Who is required to file TX 74-176?

Entities doing business in Texas, including corporations and limited liability companies, that meet specific thresholds are required to file TX 74-176.

How to fill out TX 74-176?

TX 74-176 can be filled out by providing information regarding the entity's revenue, deductions, and other required financial details as outlined in the instructions provided with the form.

What is the purpose of TX 74-176?

The purpose of TX 74-176 is to report an entity's financial information to determine its franchise tax obligations in Texas.

What information must be reported on TX 74-176?

The information that must be reported on TX 74-176 includes total revenue, deductions, the amount of franchise tax owed, and other pertinent business information.

Fill out your TX 74-176 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX 74-176 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.