CA CDTFA-416 (Formerly BOE-416) 2017 free printable template

Show details

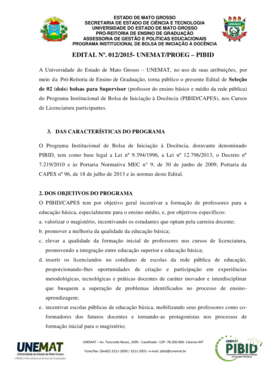

CDTFA416 REV. 9 (717)STATE OF CALIFORNIAPETITION FOR REDETERMINATIONCALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATIONBUSINESS NAMEACCOUNT NUMBER/FEE PAYER NAMELY OF TAX OR REPETITION FOR REDETERMINATION

Administrative

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CDTFA-416 Formerly BOE-416

Edit your CA CDTFA-416 Formerly BOE-416 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CDTFA-416 Formerly BOE-416 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA CDTFA-416 Formerly BOE-416 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA CDTFA-416 Formerly BOE-416. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CDTFA-416 (Formerly BOE-416) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA CDTFA-416 Formerly BOE-416

How to fill out CA CDTFA-416 (Formerly BOE-416)

01

Download the CA CDTFA-416 form from the California Department of Tax and Fee Administration (CDTFA) website.

02

Fill out the business information section, including your business name, address, and contact information.

03

Indicate the type of tax you are reporting for by selecting the appropriate boxes.

04

Provide the period you are reporting for, typically the start and end dates.

05

Complete the revenue section by entering the total gross receipts for the period.

06

If applicable, detail any deductions or exemptions in the relevant sections.

07

Sign and date the form, certifying that the information provided is accurate.

08

Submit the completed form either electronically through the CDTFA website or by mailing it to the appropriate CDTFA office.

Who needs CA CDTFA-416 (Formerly BOE-416)?

01

Businesses operating in California that are required to report sales and use taxes.

02

Taxpayers seeking to claim refunds for overpaid taxes or specific exemptions.

03

Entities involved in regulated activities that require reporting to the CDTFA.

Fill

form

: Try Risk Free

People Also Ask about

What is the form for California state income tax?

Form 540 is used by California residents to file their state income tax every April. This form should be completed after filing your federal taxes, such as Form 1040, Form 1040A, or Form 1040EZ, because information from your federal taxes will be used to help fill out Form 540.

Is CDTFA the same as BOE?

Note: All other tax programs previously administered by the BOE (Sales and Use Tax or Business Taxes) are now administered by the California Department of Tax and Fee Administration (CDTFA).

What is the purpose of Schedule CA 540?

Purpose. Use Schedule CA (540), California Adjustments – Residents, to make adjustments to your federal adjusted gross income and to your federal itemized deductions using California law.

Do I need to file Schedule CA 540?

If there are no differences between your federal and California income or deductions, do not file a Schedule CA (540), California Adjustments - Residents. If there are differences between your federal and California income or deductions, complete Schedule CA (540).

What is form 100 B for?

The form BOE-100-B Statement of Change in Control and Ownership of Legal Entities is filed with the BOE and reviewed by the BOE. Once the BOE determines that either there is a change in control or a change in ownership has occurred, then that interest is subject to reassessment.

Who must file form 540?

If you have a tax liability for 2022 or owe any of the following taxes for 2022, you must file Form 540. Tax on a lump-sum distribution. Tax on a qualified retirement plan including an Individual Retirement Arrangement (IRA) or an Archer Medical Savings Account (MSA).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CA CDTFA-416 Formerly BOE-416 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your CA CDTFA-416 Formerly BOE-416 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I execute CA CDTFA-416 Formerly BOE-416 online?

Completing and signing CA CDTFA-416 Formerly BOE-416 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I fill out CA CDTFA-416 Formerly BOE-416 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your CA CDTFA-416 Formerly BOE-416, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is CA CDTFA-416 (Formerly BOE-416)?

CA CDTFA-416, formerly known as BOE-416, is a form used in California for reporting transactions involving the sale of a business or property.

Who is required to file CA CDTFA-416 (Formerly BOE-416)?

Any business or individual who sells or transfers ownership of a business or tangible personal property in California is required to file CA CDTFA-416.

How to fill out CA CDTFA-416 (Formerly BOE-416)?

To fill out CA CDTFA-416, you need to provide details about the seller, buyer, transaction, and property involved. Ensure all required information is accurate and complete.

What is the purpose of CA CDTFA-416 (Formerly BOE-416)?

The purpose of CA CDTFA-416 is to report sales transactions that may be subject to use tax and to facilitate the proper assessment of taxes associated with the transfer.

What information must be reported on CA CDTFA-416 (Formerly BOE-416)?

Information that must be reported includes the names and addresses of the buyer and seller, a description of the property or business sold, the sale price, and the date of the transaction.

Fill out your CA CDTFA-416 Formerly BOE-416 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CDTFA-416 Formerly BOE-416 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.