Get the free Community Disaster Loans Program Specific Recovery Act Plan

Show details

A report outlining the Community Disaster Loan Program, defined by the provisions following the American Recovery and Reinvestment Act, which provides funding to local governments significantly affected

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign community disaster loans program

Edit your community disaster loans program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your community disaster loans program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing community disaster loans program online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit community disaster loans program. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out community disaster loans program

How to fill out Community Disaster Loans Program Specific Recovery Act Plan

01

Gather all necessary documentation related to disaster-related losses.

02

Identify the type of disaster and the specific damages incurred.

03

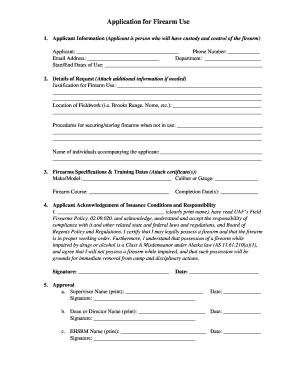

Complete the application form for the Community Disaster Loans Program.

04

Provide a detailed account of the financial impact the disaster has had on the community.

05

Specify the amount requested and how the funds will be used.

06

Review and ensure all information is accurate and complete.

07

Submit the completed plan to the appropriate authority for review.

Who needs Community Disaster Loans Program Specific Recovery Act Plan?

01

Local governments affected by a disaster.

02

Communities seeking financial assistance for recovery efforts.

03

Municipalities that require funding to maintain essential services post-disaster.

Fill

form

: Try Risk Free

People Also Ask about

Why would I get denied for an SBA disaster loan?

If your credit history is unimpressive, you will not receive a favorable credit rating. It's important to note that you need a credit score of at least 620 when applying for an SBA disaster loan. However, a higher credit score improves your chances of swift approval.

Do you have to pay back disaster loan assistance?

Economic Injury Disaster Advance Grants Do You Need To Repay It?: No! This loan advance does not need to be repaid.

Do you have to pay taxes on disaster relief money?

Disaster assistance grants are not subject to income tax, self-employment tax, or employment taxes such as Social Security, Medicare and federal unemployment taxes. No withholding is required.

How does disaster assistance work?

Individual assistance declarations provide assistance to individuals and households. Public assistance declarations provide assistance to state, tribal and local governments and certain private nonprofit organizations for emergency work and the repair or replacement of disaster-damaged facilities.

Do you have to pay back disaster assistance?

In most cases, FEMA grants do not have to be paid back. If you have insurance that covers your temporary housing costs, but you ask FEMA to advance you some money to help you pay for those costs while your insurance is delayed, you will need to pay that money back to FEMA after you receive your insurance settlement.

What is a disaster recovery loan?

Program Description. The U.S. Small Business Administration (SBA) offers financial help to homeowners and renters in declared disaster areas. You don't need to own a business to get our help. We provide long-term, low-interest loans for losses that insurance and other sources don't fully cover.

Does everyone get approved for an SBA disaster loan?

To qualify for an SBA disaster loan you must operate a business located within a declared disaster zone. This might include a city, county, state, or country depending on the nature of the disaster.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Community Disaster Loans Program Specific Recovery Act Plan?

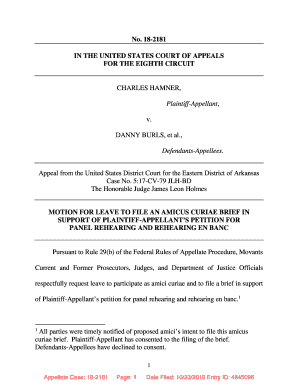

The Community Disaster Loans Program Specific Recovery Act Plan is a framework set by the Federal Emergency Management Agency (FEMA) to provide financial assistance to local governments affected by disasters. It allows these entities to apply for loans to cover short-term operational costs while they recover.

Who is required to file Community Disaster Loans Program Specific Recovery Act Plan?

Entities such as local governments, municipalities, or tribes that have received federal disaster declarations and are seeking financial assistance through the Community Disaster Loans Program are required to file the plan.

How to fill out Community Disaster Loans Program Specific Recovery Act Plan?

To fill out the plan, applicants must gather necessary financial information, demonstrate the impact of the disaster on their operations, provide a recovery timeline, and outline how funds will be managed and utilized. Specific forms and guidelines can be obtained from FEMA's official website.

What is the purpose of Community Disaster Loans Program Specific Recovery Act Plan?

The purpose of the plan is to ensure local governments can adequately recover from disasters by providing them the financial resources necessary to meet their operational needs and to help stabilize their financial standing.

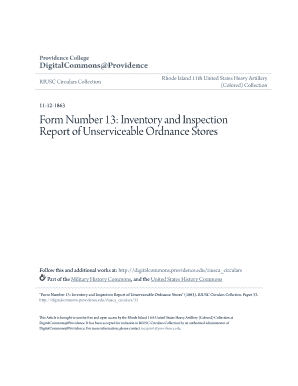

What information must be reported on Community Disaster Loans Program Specific Recovery Act Plan?

The reported information must include detailed financial statements, a breakdown of disaster-related expenses, a description of the operational impact, projected revenue losses, and a plan for recovery and financial management.

Fill out your community disaster loans program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Community Disaster Loans Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.