Get the free STATEMENT OF RETAINED EARNINGS

Show details

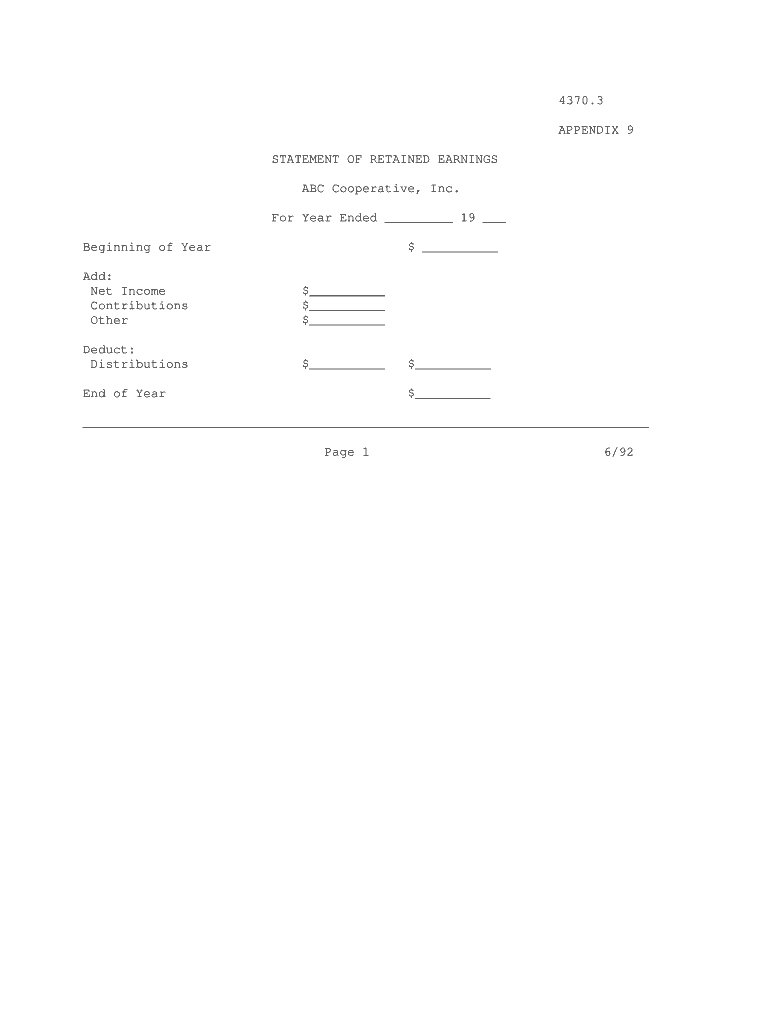

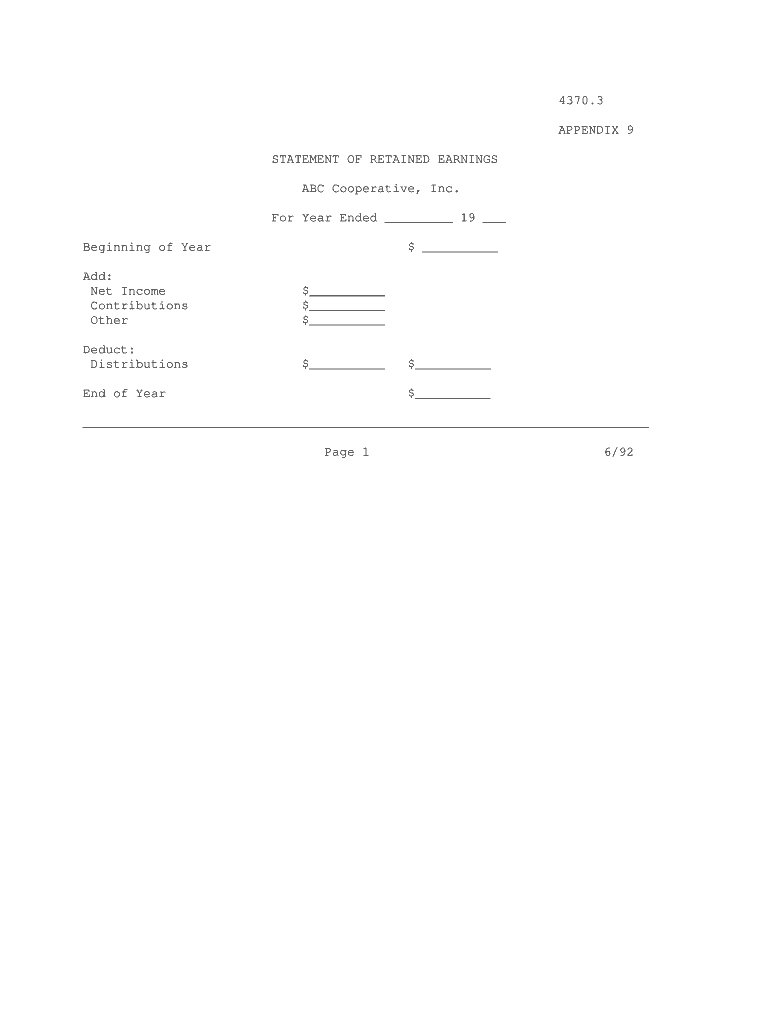

4370.3 APPENDIX 9 STATEMENT OF RETAINED EARNINGS ABC Cooperative, Inc. For Year Ended 19 Beginning of Year Add: Net Income Contributions Other $ $ Deduct: Distributions End of Year $ Page 16/92

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign statement of retained earnings

Edit your statement of retained earnings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your statement of retained earnings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing statement of retained earnings online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit statement of retained earnings. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out statement of retained earnings

How to fill out statement of retained earnings:

01

Begin by opening a blank spreadsheet or document in your preferred software program.

02

Create a heading for the statement, naming it "Statement of Retained Earnings."

03

Include the name of the company or organization for which the statement is being prepared.

04

Specify the time period covered by the statement (e.g., for the fiscal year ending December 31, 2021).

05

Identify the beginning balance of retained earnings for the period, which can be obtained from the previous year's financial statements or records.

06

Add the net income or loss for the period. This information can be found in the income statement.

07

Subtract any dividends or distributions that were paid to shareholders during the period.

08

Adjust the retained earnings balance for any other changes, such as prior period adjustments or accounting errors.

09

Calculate the sum of the net income or loss and any adjustments made to the beginning balance.

10

Include a line that shows the final balance of retained earnings for the period.

Who needs a statement of retained earnings:

01

Businesses and corporations: Companies of all sizes and structures, whether publicly traded or privately owned, need to prepare a statement of retained earnings. This financial statement helps track the accumulation and allocation of earnings over time.

02

Shareholders and investors: Individuals who have invested in a company or own shares in it have a vested interest in the financial health and profitability of the business. The statement of retained earnings provides important information about the company's ability to generate profit and its plans for distributing earnings.

03

Lenders and creditors: Financial institutions and creditors often require a statement of retained earnings as part of their evaluation process when considering extending credit or loans to a company. It helps them assess the company's financial stability and ability to repay debts.

04

Regulatory authorities: Government agencies and regulatory bodies may require companies to submit a statement of retained earnings as part of their compliance reporting and financial disclosure obligations.

05

Internal stakeholders: Executives, management, and board members of a company utilize the statement of retained earnings to monitor the financial performance of the business, make informed decisions regarding dividend distributions, and analyze trends in earnings growth or decline.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in statement of retained earnings without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your statement of retained earnings, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for signing my statement of retained earnings in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your statement of retained earnings and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I complete statement of retained earnings on an Android device?

Use the pdfFiller Android app to finish your statement of retained earnings and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is statement of retained earnings?

The statement of retained earnings is a financial statement that outlines the changes in the retained earnings of a company over a specific period of time.

Who is required to file statement of retained earnings?

All corporations are required to file a statement of retained earnings as part of their financial reporting requirements.

How to fill out statement of retained earnings?

To fill out a statement of retained earnings, you need to calculate the ending balance of retained earnings by adding net income, subtracting dividends, and any adjustments from previous periods.

What is the purpose of statement of retained earnings?

The purpose of the statement of retained earnings is to show how the company's profits are being reinvested back into the business or distributed to shareholders.

What information must be reported on statement of retained earnings?

The statement of retained earnings must include the beginning balance of retained earnings, net income or loss, dividends issued, any adjustments, and the ending balance of retained earnings.

Fill out your statement of retained earnings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Statement Of Retained Earnings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.