Get the free What happens to your super when you die

Show details

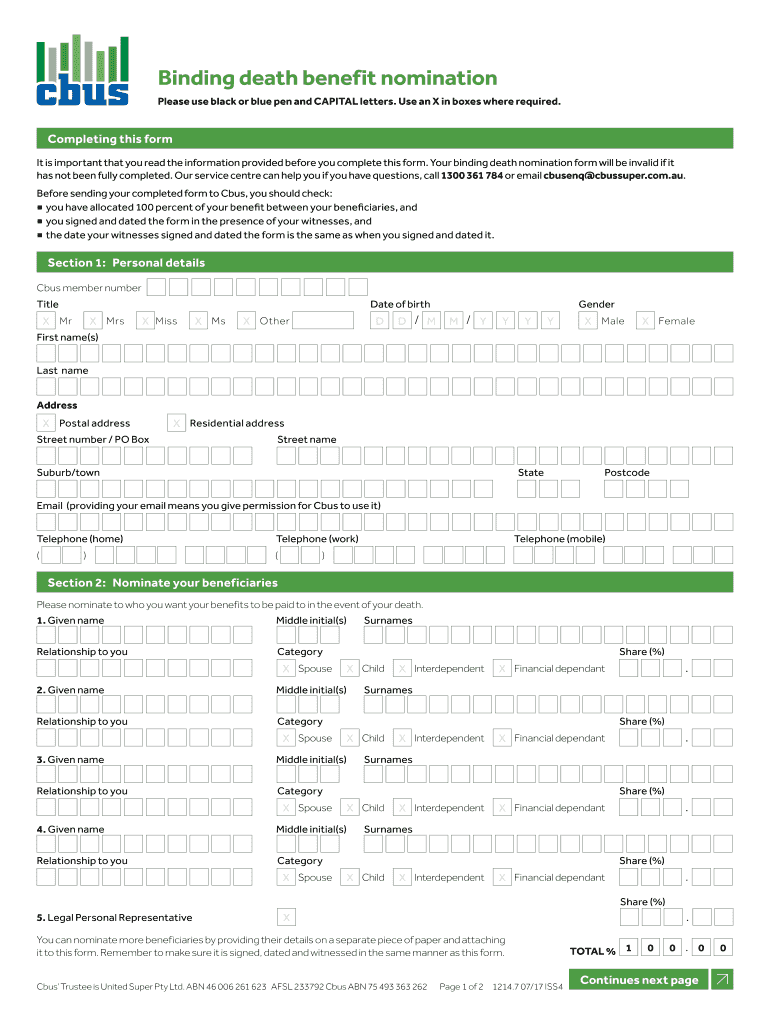

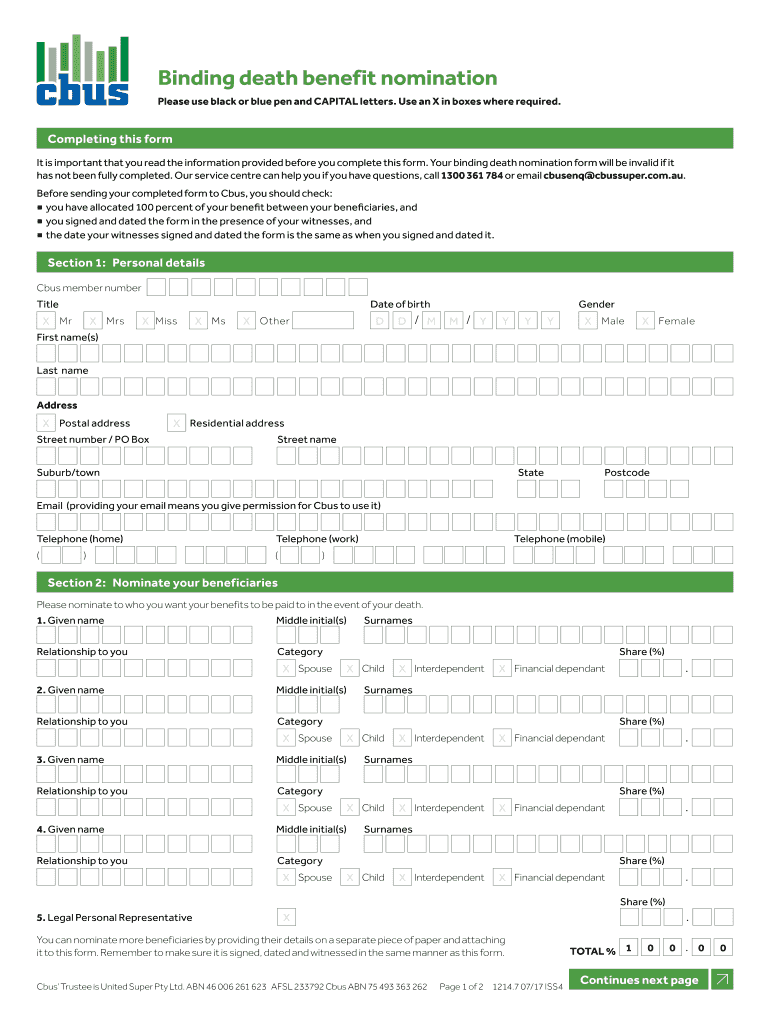

Binding death benefit nomination

What happens to your super when you die? Most people think that super automatically becomes part of their estate when they die, and is combined

with the rest of their

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign what happens to your

Edit your what happens to your form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what happens to your form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing what happens to your online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit what happens to your. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out what happens to your

Point by point, here is how to fill out the form "what happens to your":

01

Start by gathering all the necessary information related to your personal or business affairs. This may include your assets, liabilities, insurance policies, bank accounts, investments, and any legal documents such as wills or trusts.

02

Carefully review the instructions provided with the form to understand the purpose and scope of the document. This will help you provide accurate and relevant information.

03

Begin by filling out the personal details section. This may include your full name, address, contact information, and social security number or tax identification number.

04

Move on to the asset section, where you will list and describe all your assets, such as real estate properties, vehicles, bank accounts, investment portfolios, and valuable possessions. Include as much detail as possible, including account numbers, titles, and approximate values.

05

In the liability section, disclose any debts, loans, mortgages, or other financial obligations you have. Provide the names of the creditors, outstanding balances, and payment terms.

06

If applicable, use the insurance section to provide information about your life insurance policies, health insurance, disability insurance, and any other insurance coverage you may have. Include policy numbers, coverage details, and contact information for the insurance providers.

07

Create a section on beneficiaries or heirs, where you can specify who will inherit or receive your assets or benefits upon your passing. Include their names, relationships, and contact information.

08

Consider consulting with a legal professional or estate planner to ensure you are correctly filling out the form and making informed decisions regarding your assets and beneficiaries.

Who needs what happens to your:

01

Individuals who want to plan ahead and ensure their assets and affairs are handled according to their wishes in case of incapacity or death.

02

Business owners who want to establish a plan for the continuity or transfer of their business in the event of their absence or death.

03

Individuals with dependents who want to provide for their loved ones and ensure their financial well-being after their passing.

04

Those who want to avoid potential conflicts or disputes among family members or beneficiaries by clearly outlining their wishes in a legal document.

05

Anyone who wants to have control over their estate and minimize the potential impact of taxes and legal complexities on their loved ones.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my what happens to your directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your what happens to your and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I execute what happens to your online?

pdfFiller has made it easy to fill out and sign what happens to your. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I sign the what happens to your electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your what happens to your in minutes.

What is what happens to your?

What happens to your refers to the process of reporting your financial and personal information to the relevant authorities.

Who is required to file what happens to your?

Individuals who meet the filing requirements set by the authorities are required to file what happens to your.

How to fill out what happens to your?

You can fill out what happens to your by providing accurate and complete information on the required forms.

What is the purpose of what happens to your?

The purpose of what happens to your is to ensure transparency and compliance with regulations regarding financial and personal information.

What information must be reported on what happens to your?

You must report details such as income, assets, liabilities, and personal information on what happens to your.

Fill out your what happens to your online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Happens To Your is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.