Get the free crediting plan

Show details

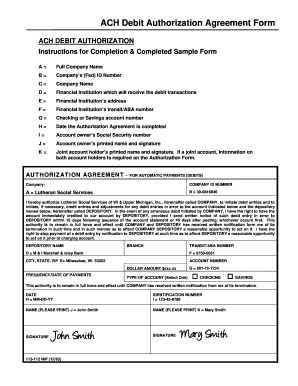

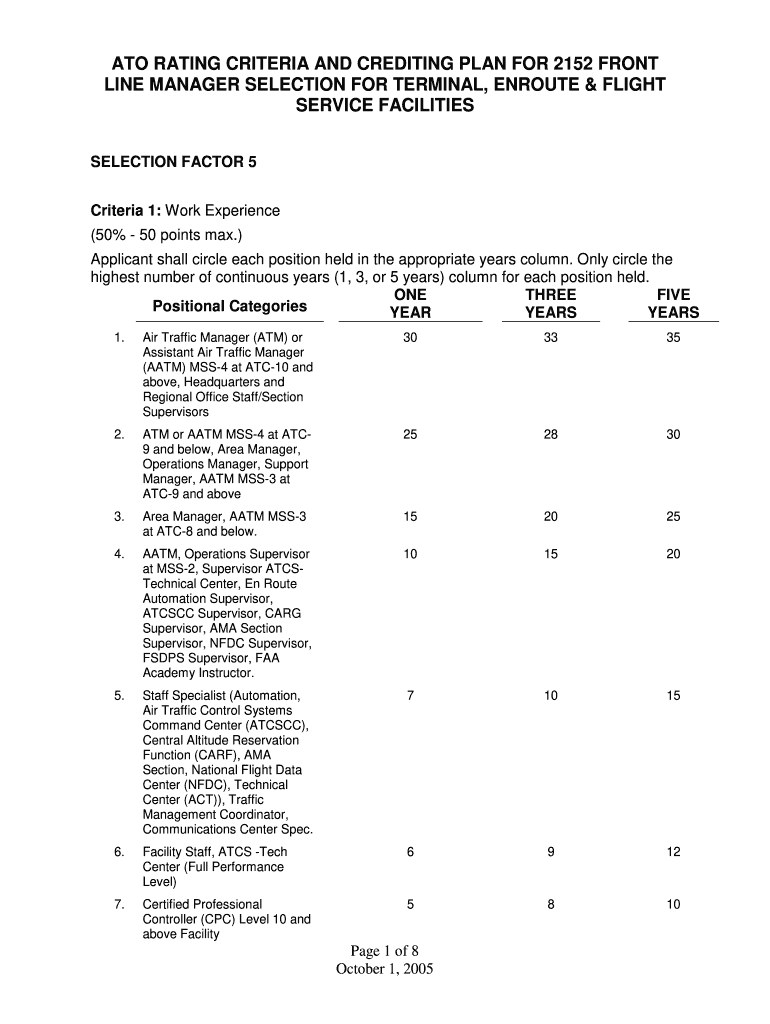

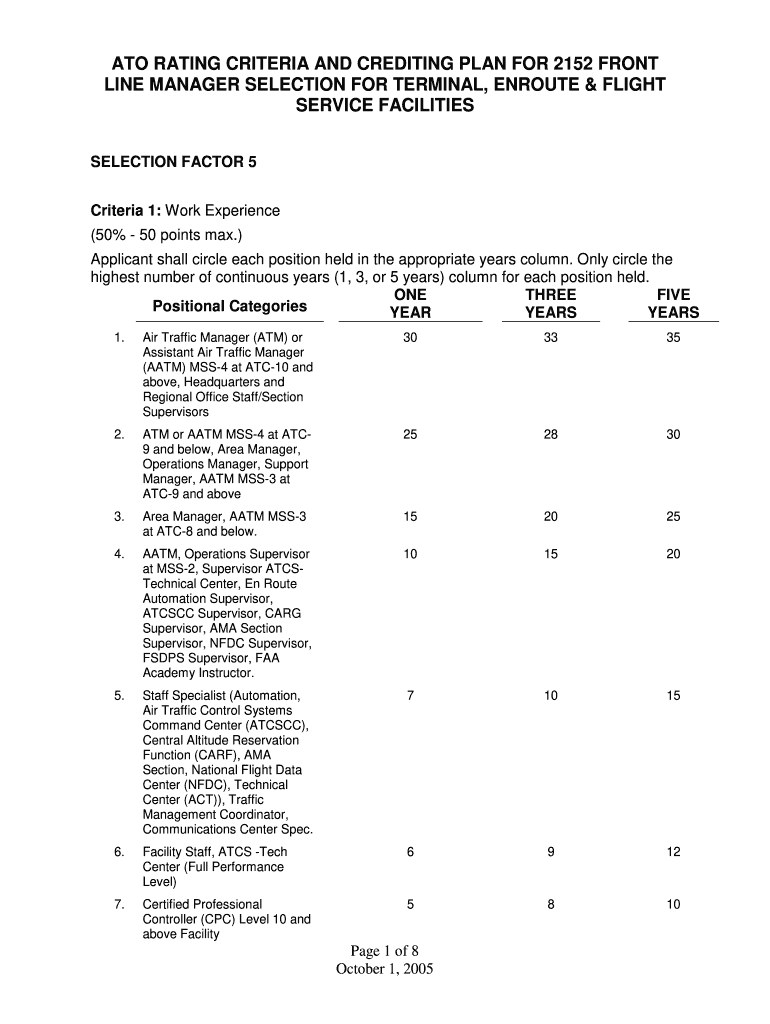

ATO RATING CRITERIA AND CREDITING PLAN FOR 2152 FRONT LINE MANAGER SELECTION FOR TERMINAL, ROUTE & FLIGHT SERVICE FACILITIES SELECTION FACTOR 5 Criteria 1: Work Experience (50% 50 points max.) Applicant

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign crediting plan form

Edit your crediting plan form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your crediting plan form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing crediting plan form online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit crediting plan form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out crediting plan form

Point by point, here's how to fill out a crediting plan:

01

Start by gathering all relevant financial information, such as your income, expenses, debts, and assets. This will give you a complete picture of your financial situation.

02

Determine your financial goals and objectives. What are you hoping to achieve with the credit plan? Whether it's paying off debts, starting a business, or buying a house, having clear objectives will help you make informed decisions.

03

Analyze your current debts and obligations. Take a close look at your outstanding loans, credit card balances, and any other debts you may have. Consider the interest rates, repayment terms, and minimum monthly payments for each.

04

Prioritize your debts. Identify which debts are most pressing and require immediate attention. These could be high-interest loans or overdue bills. By prioritizing your debts, you can allocate your resources effectively.

05

Develop a repayment strategy. Determine how much you can afford to allocate towards debt repayment each month. Consider using strategies like the Debt Snowball or Debt Avalanche method to accelerate your progress. This will help you create a timeline for becoming debt-free.

06

Consider your credit card usage and payment strategy. If you have credit card debt, evaluate your spending habits and make necessary changes. Start paying more than the minimum payment on each card to reduce your overall debt and interest charges.

07

Create a budget. A budget will help you track your income and expenses, ensuring you're able to meet your financial obligations. Allocate funds for savings, debt repayment, and necessary monthly expenses.

08

Evaluate your credit report. Request a copy of your credit report from a reputable credit reporting agency. Review it for any errors or discrepancies, and take steps to correct them if necessary.

09

Seek professional advice if needed. If you're struggling with your finances or are uncertain about how to proceed, consider consulting a financial advisor or credit counselor. They can provide guidance tailored to your specific situation.

Who needs a crediting plan?

A crediting plan is beneficial for anyone who wants to improve their financial situation or manage their debts effectively. It can be useful for individuals or families who are struggling with multiple debts, facing financial challenges, or planning major financial milestones such as buying a home or starting a business. Even individuals with good financial health can benefit from a crediting plan to maintain their financial stability and achieve their goals.

Fill

form

: Try Risk Free

People Also Ask about

What is a job analysis OPM?

A job analysis "identifies the competencies/KSAs directly related to performance on the job. It is a systematic procedure for gathering, documenting, and analyzing information about the content, context, and requirements of the job.

What is an example of a selective placement factor?

If SPF are used, they are considered something critical for successful performance—and not something that a new employee can easily learn. Typical examples include foreign language skills or a specific technical skill. SPF should be reflected in position description and job analysis used for the posting.

What are the FES standards?

Many point factor standards are in Factor Evaluation System (FES) format, which uses factors with established point values. Some FES standards include benchmark position descriptions to illustrate typical combinations of factor levels at different grade levels.

What is the rule of three in OPM?

The rule of three requires qualified candidates to be listed in rank order and managers to se- lect from among the top three available candi- dates. But often a number of candidates have identical ratings, and some method must be used to decide which candidates will be placed on the referral register and in what order.

What is a qualifying ranking factor?

A Quality Ranking Factor (QFR) is job related skills, knowledge, or abilities that are expected to significantly enhance performance—but are not essential.

What are selective placement factors?

Selective Placement Factors are job-related KSAs that are essential for satisfactory performance on the job. Only applicants that meet this requirement as of the closing date of the JOA receive further consideration for the job.

What is a GS 7 equivalent experience?

GS 7 = Bachelor's degree with Superior Academic Achievement (if you maintained a B average, or met other academic credentials in college) OR 1 academic year of graduate education or law school, as specified in qualification standards or individual occupational requirements.

What is a crediting plan?

A crediting plan is a plan developed to rate and rank candidates for a specific position. It is designed to measure the various quality levels at which candidates possess the job-related knowledge, skills, and abilities that are necessary for successful performance in a position.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is crediting plan?

A crediting plan is a document that outlines how an individual or organization plans to give credit to others for their work or contributions.

Who is required to file crediting plan?

Anyone who has agreed to provide credit to others for their work or contributions is required to file a crediting plan.

How to fill out crediting plan?

To fill out a crediting plan, one must include details on the work or contributions for which credit is being given, as well as the method of providing credit.

What is the purpose of crediting plan?

The purpose of a crediting plan is to ensure that individuals or organizations receive proper recognition for their work or contributions.

What information must be reported on crediting plan?

Information such as the name of the individual or organization receiving credit, the work or contributions being credited, and the method of providing credit must be reported on the crediting plan.

How do I modify my crediting plan form in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your crediting plan form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I complete crediting plan form online?

Filling out and eSigning crediting plan form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I edit crediting plan form on an iOS device?

You certainly can. You can quickly edit, distribute, and sign crediting plan form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your crediting plan form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Crediting Plan Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.