ZA SARS IT77TR 2017-2025 free printable template

Show details

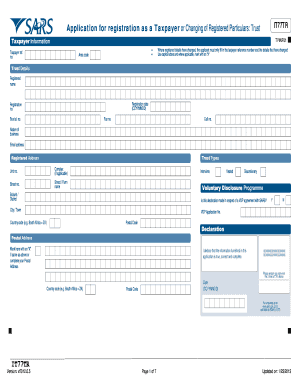

This document serves as an application form for registering a trust as a taxpayer or for changing registered particulars of an existing taxpayer trust in South Africa.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign it77tr form

Edit your sars it77tr form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it77tr online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit it77 form online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sars it77 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ZA SARS IT77TR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out it 77 form

How to fill out ZA SARS IT77TR

01

Obtain the ZA SARS IT77TR form from the SARS website or your local SARS office.

02

Fill in your personal information, including your ID number, name, and contact details.

03

Provide details about your income and any other relevant financial information.

04

Complete the sections regarding your assets and liabilities.

05

Sign and date the form to confirm the information is accurate.

06

Submit the form online via the SARS eFiling system or deliver it to your nearest SARS office.

Who needs ZA SARS IT77TR?

01

Individuals or entities that are registered for tax in South Africa and need to declare their financial position.

02

Taxpayers who are undergoing voluntary disclosure or wish to clarify their tax status.

03

Anyone required by SARS to submit additional information or documentation for tax assessment.

Fill

it77 registration form

: Try Risk Free

People Also Ask about sars disability form 2025

What is an it77 form?

Application for registration as a Taxpayer or Changing of Registered Particulars: Company. IT77C. Taxpayer Information. Company Details.

What documents are needed to register a trust for income tax?

1 Copy of the Letter of Authority (Issued by the Master of the High Court). 2 Copy of the Trust Deed. 3.3 SA Temporary Identity Document. 4 Trust resolution stipulating/ confirming the appointment of the “Representative Taxpayer (e.g. Main trustee)” of the Trust.

What are the requirements for T3 reporting to CRA by trust companies?

A T3 return must be filed when the trusts' total income from all sources is less than $500, however the trust made a distribution of capital to one or more beneficiaries.

How do I register a trust with CRA?

Apply for a trust account number by completing Form T3APP, T3 Application for Trust Account Number. Where you send Form T3APP depends on whether the trust is resident in Canada, or is a non-resident trust or deemed resident trust.

Does a trust need to register for income tax?

A Trust must register with SARS for the taxes that it may be liable for.

How do I register a trust in Ontario?

How to set up a trust in Canada Draft an agreement. A lawyer or other legal entity drafts a formal trust agreement. Establish the trust's property. The settlor makes an irrevocable donation into the trust, which becomes the trust property. Open a trust account(s) Complete the process.

Do trusts file tax returns in Canada?

1. Currently, when does a trust have to file an income tax return? Generally, a trust has to file an annual income tax (T3) return if the trust has tax payable or it distributes all or part of its income or capital to its beneficiaries.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my it77 directly from Gmail?

how to find your tax identification number and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send entry form format for eSignature?

When your sars forms is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get ZA SARS IT77TR?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the ZA SARS IT77TR in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

What is ZA SARS IT77TR?

ZA SARS IT77TR is a tax return form used in South Africa by individuals to report their income and calculate their tax liability.

Who is required to file ZA SARS IT77TR?

Individuals who earn income above a certain threshold, such as employees and self-employed persons, are required to file ZA SARS IT77TR.

How to fill out ZA SARS IT77TR?

To fill out ZA SARS IT77TR, individuals must provide personal information, income details, deductions, and credits according to the guidelines provided by the South African Revenue Service (SARS).

What is the purpose of ZA SARS IT77TR?

The purpose of ZA SARS IT77TR is to enable the South African Revenue Service to assess individual taxpayers’ income and determine the amount of tax owed.

What information must be reported on ZA SARS IT77TR?

Information that must be reported includes personal details, sources of income (salary, business income, investments), allowable deductions, and tax credits.

Fill out your ZA SARS IT77TR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ZA SARS it77tr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.