MY CP207 2010-2026 free printable template

Show details

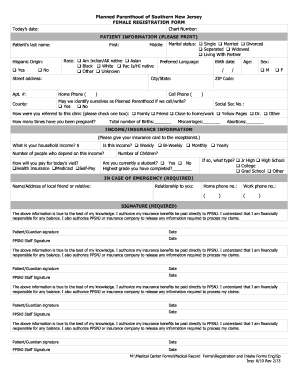

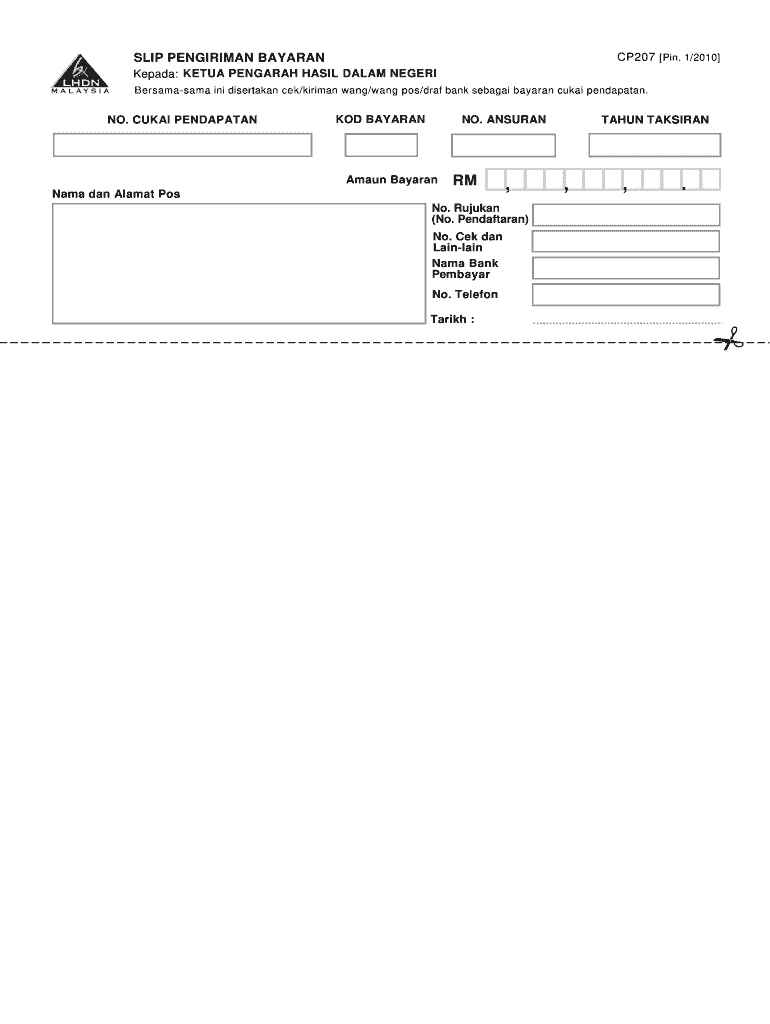

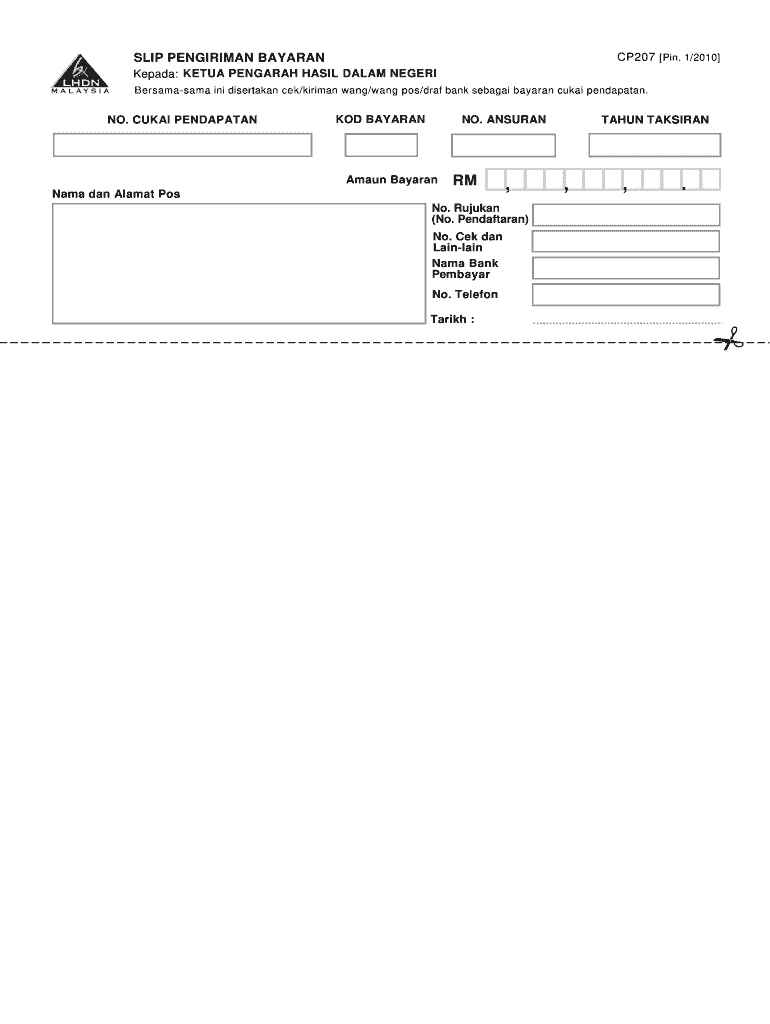

CP207 Pin. 1/2010 SLIP PENGIRIMAN BAYARAN Kepada KETUA PENGARAH HASIL DALAM NEGERI Bersama-sama ini disertakan cek/kiriman wang/wang pos/draf bank sebagai bayaran cukai pendapatan. NO. Gunakan Slip Pengiriman Bayaran CP207 apabila membuat bayaran. 1. 3 Pos Malaysia Berhad - kaunter dan Pos Online SEMENANJUNG MALAYSIA SABAH WP LABUAN SARAWAK Alamat Pos Lembaga Hasil Dalam Negeri Malaysia Cawangan Pungutan Tingkat 15 Blok 8A Kompleks Bangunan Kerajaan Jalan Duta Karung Berkunci 11061 50990...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign cwp renewal sc form

Edit your cp207 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sc sled cwp renewal online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing malaysia cp207 printable online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit slip bayaran download form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bayaran cp207 get form

How to fill out MY CP207

01

Download MY CP207 form from the official website.

02

Fill in your personal details, including your name, address, and identification number.

03

Specify the income period for which you are reporting.

04

Declare all income earned during that period.

05

Include any deductions or allowances applicable to your situation.

06

Review the information for accuracy.

07

Sign and date the form.

08

Submit the completed MY CP207 to the appropriate tax authority.

Who needs MY CP207?

01

Individuals or entities that need to report tax liabilities.

02

Business owners who are required to declare their income and deductions.

03

Employers that need to report employee earnings for tax purposes.

Fill

lhdn slip download

: Try Risk Free

People Also Ask about

How do I calculate my late 941 penalty?

If you fail to File your Form 941 or Form 944 by the deadline: Your business will incur a penalty of 5% of the total tax amount due. You will continue to be charged an additional 5% each month the return is not submitted to the IRS up to 5 months.

What is the penalty for failure to make timely deposits?

If the business fails to make its deposits as scheduled, in the correct amount or in the manner required, the IRS will charge a federal tax deposit penalty. The penalty rates are: 2% for 1-5 days late; 5% for 6-15 days late; 10% for deposits made more than 15 days late.

What is the penalty rate for a payroll tax deposit that was made 10 days late to the IRS?

The penalty for paying late is initially ½% of the unpaid tax shown on the return. It is charged each month or part of a month following the payment due date until the tax is paid. The penalty increases to 1% of the unpaid tax for any tax that is not paid within 10 days after we issue a notice of intent to levy.

What is Roftl on Form 941?

Your deposit schedule, the Record of Federal Tax Liability (ROFTL), had missing or incorrect information. We need additional information from you.

What form is used to report backup withholding?

A Form 1099 includes your name and TIN such as a social security number (SSN), employer identification number (EIN), or individual taxpayer identification number (ITIN). The Form 1099 will also report any amounts withheld under the backup withholding rules.

What is CT 945 form?

About Form 945, Annual Return of Withheld Federal Income Tax.

How do I send backup withholding to the IRS?

If you withhold or are required to withhold federal income tax (including backup withholding) from nonpayroll payments, you must file Form 945. See Purpose of Form 945, earlier. You don't have to file Form 945 for those years in which you don't have a nonpayroll tax liability.

What are the 941 deposit requirements?

You're required to deposit 100% of your tax liability on or before the deposit due date. Penalties may apply for depositing late, depositing less than the required amount, or for mailing payments directly to the IRS instead of depositing the amounts. The IRS may waive penalties in certain cases.

What is Form 945a?

Annual Record of Federal Tax Liability.

What penalty increases failure to make a proper federal tax deposit?

The amount of the FTD penalty is as follows: 2% of the unpaid deposit for payments that are 1 to 5 days late. 5% for tax payments that are 6-15 days late. 10% for deposits that are more than 15 days late or made within ten days of receiving the first IRS notice requesting a tax payment.

What is FTD penalty?

If the business fails to make its deposits as scheduled, in the correct amount or in the manner required, the IRS will charge a federal tax deposit penalty. The penalty rates are: 2% for 1-5 days late; 5% for 6-15 days late; 10% for deposits made more than 15 days late.

How are penalties for failure to make timely payroll tax deposits calculated?

The penalty is two percent for deposits made up to five days late; five percent of deposits made six to 15 days late and 10 percent for deposits made 16 or more days late. If the IRS issues a notice asking for the tax and it remains unpaid at 10 days after receipt, a 15 percent penalty is added.

What is the maximum amount of tax that can be due and paid with the Form 941 without incurring a penalty?

To avoid a penalty, payments should be made with Form 941 only if: (1) the total taxes for either the current or preceding quarter are less than $2,500 (and didn't incur a $100,000 next-day deposit obligation) or (2) the employer is a monthly depositor making a payment in ance with the Accuracy of Deposits Rule.

What is CP207?

All payments are to be accompanied by the remittance slips (CP207). 1.6. The difference between the actual tax liability and the total installments paid must be settled on or before the last day of the sixth month from the date following the close of its accounting period.

What is the 941 tax code?

Employers use Form 941 to: Report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. Pay the employer's portion of Social Security or Medicare tax.

What is backup withholding rate?

What is backup withholding? There are situations when the payer is required to withhold at the current rate of 24 percent. This 24 percent tax is taken from any future payments to ensure the IRS receives the tax due on this income.

What are FTD payments?

Federal Tax Deposits (FTDs) for Form 941 are made up of withholding taxes or trust funds (income tax and Federal Insurance Contributions Act (FICA) taxes, which are Social Security and Medicare held in trust), that are actually part of your employee's wages, along with the employer's share of FICA.

How are penalties for failure to make timely deposits calculated?

The penalty is two percent for deposits made up to five days late; five percent of deposits made six to 15 days late and 10 percent for deposits made 16 or more days late. If the IRS issues a notice asking for the tax and it remains unpaid at 10 days after receipt, a 15 percent penalty is added.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit MY CP207 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including MY CP207, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send MY CP207 for eSignature?

MY CP207 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Where do I find MY CP207?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the MY CP207 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

What is MY CP207?

MY CP207 is a form used in Malaysia for the purpose of declaring and reporting income for tax purposes. It is typically related to the income tax system.

Who is required to file MY CP207?

Individuals and entities who have taxable income, including those who earn income from business activities, employment, or other specified sources, are required to file MY CP207.

How to fill out MY CP207?

To fill out MY CP207, one must provide accurate information regarding their income, expenses, and any deductions applicable. The form needs to be completed according to specific guidelines issued by the tax authorities.

What is the purpose of MY CP207?

The purpose of MY CP207 is to facilitate the reporting and assessment of income tax for individuals and businesses in Malaysia, ensuring compliance with tax regulations.

What information must be reported on MY CP207?

MY CP207 requires reporting of various details including total income earned, allowable expenses, tax deductions, and ultimately, the taxable income derived during the assessment year.

Fill out your MY CP207 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MY cp207 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.