Get the free Parent PLUS Borrower Deferment Request - StudentLoans.gov

Show details

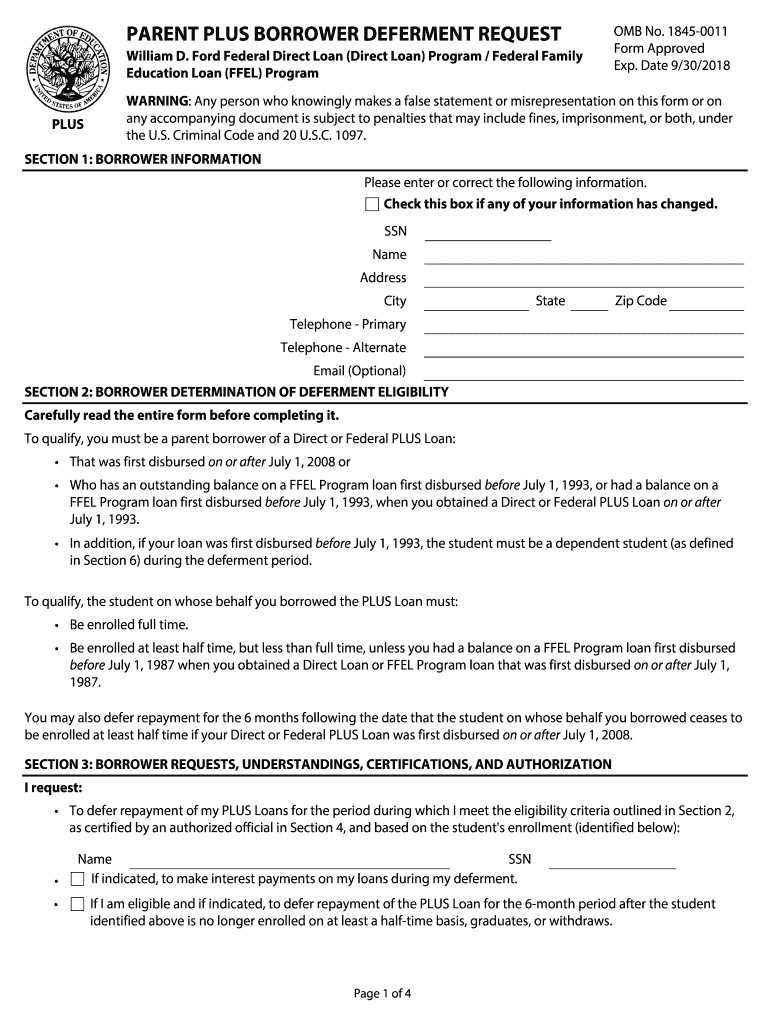

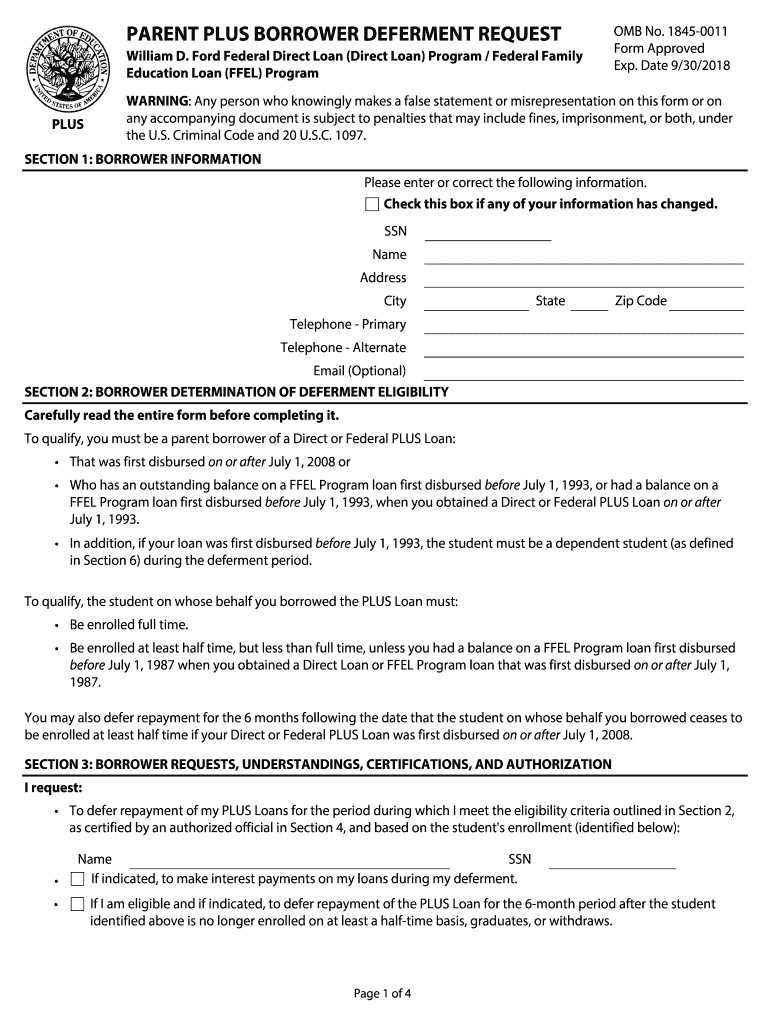

PARENT PLUS BORROWER DEFERMENT REQUEST

William D. Ford Federal Direct Loan (Direct Loan) Program / Federal Family

Education Loan (FEEL) Program

PLUS OMB No. 18450011

Form Approved

Exp. Date 9/30/2018WARNING:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign parent plus borrower deferment

Edit your parent plus borrower deferment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your parent plus borrower deferment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing parent plus borrower deferment online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit parent plus borrower deferment. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out parent plus borrower deferment

How to fill out parent plus borrower deferment:

01

Obtain the necessary forms - To apply for a parent plus borrower deferment, you will need to download or request the deferment form from your loan servicer's website. Make sure to choose the correct form that specifies parent plus borrower deferment.

02

Complete personal information - Fill in your personal information accurately on the deferment form. This may include your name, address, social security number, and contact information.

03

Provide loan details - Indicate the details of your parent plus loan on the form, such as the loan account number and the loan servicer's contact information. You may need to refer to your loan documents or statements to find these details.

04

Select deferment type - Choose the appropriate deferment type that applies to your situation, which in this case would be parent plus borrower deferment. Read the instructions carefully to ensure that you select the correct option.

05

Sign and date the form - After completing all the required fields, make sure to sign and date the deferment form. Failure to sign the form may result in a delay in the processing of your deferment request.

06

Gather supporting documentation - Some deferment forms require additional documentation to support your request. Determine if any supporting documents are necessary and include them with your completed form. Examples may include proof of unemployment, income documentation, or documentation of military service.

07

Submit the form - Once you have completed the deferment form and gathered all required documentation, submit the form to your loan servicer. This can typically be done by mail, email, or through an online portal. Make sure to follow the instructions provided by your loan servicer for submitting the deferment form.

Who needs parent plus borrower deferment:

01

Parent plus loan borrowers who are facing financial hardship or unable to make loan payments may need to apply for a deferment.

02

Individuals who are unemployed or underemployed and unable to meet their financial obligations may seek a parent plus borrower deferment.

03

Borrowers returning to school on at least a half-time basis may be eligible for a parent plus borrower deferment to temporarily postpone loan payments.

04

Individuals experiencing economic hardship due to health issues, disability, or other circumstances may require a parent plus borrower deferment to alleviate financial strain.

05

Military servicemembers who are on active duty or serving in certain other capacities may be eligible for a parent plus borrower deferment.

Fill

form

: Try Risk Free

People Also Ask about

What is a loan deferment form?

A deferment is a period during which you are not required to make payments (in-school student, internship/residency, military service). Most deferments are not automatic and you will need to submit a request to each of your loan servicers.

Do parent PLUS loans have a grace period?

PLUS loans do not have a grace period; but if you received a PLUS loan as a graduate or professional student, you'll automatically get a six-month deferment after you graduate, leave school, or drop below half-time enrollment. No payments are required during this six-month deferment period.

Do students have to pay back parent PLUS Loans?

A Direct PLUS Loan made to you as a parent cannot be transferred to your child. You are responsible for repaying the loan. Can I ever postpone making loan payments? Yes, under certain circumstances you may receive a deferment or forbearance, which allows you to temporarily stop or lower your payments.

Can you defer student loan payments?

Sometimes, you just need to suspend your student loan payments for a short period. If you're in a short-term financial bind, you may qualify for a deferment or a forbearance. With either of these options, you can temporarily suspend your payments. On Nov. 22, 2022, the student loan payment pause was extended.

What is the grace period for parent PLUS loans?

Loans and Their Grace Periods No payments are required during this six-month deferment period. If you're a parent borrower who took out a PLUS loan to pay for your child's education, you can request a six-month deferment after your child graduates, leaves school, or drops below half-time enrollment.

How do I defer my parent PLUS loan payment?

You must request separate deferments for each loan period through your federal loan servicer. Upon disbursement,you will receive repayment and deferment information from your loan servicer and may need to provide a copy of your student's enrollment verification along with the in-school deferment form.

Can you get a deferment on a parent PLUS loan?

Parent PLUS Borrower Deferment You may qualify for this deferment if you're a parent who received a Direct PLUS Loan to help pay for your child's education, and the student you took the loan out for is enrolled at least half-time at an eligible college or career school.

Can parent PLUS loans be deferred during graduate school?

All federal student loan payments — including parent PLUS loans taken out on your behalf — can be deferred if you go to graduate school at least half-time. You can also defer federal loans during an eligible full-time graduate fellowship.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send parent plus borrower deferment for eSignature?

Once your parent plus borrower deferment is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete parent plus borrower deferment online?

pdfFiller makes it easy to finish and sign parent plus borrower deferment online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit parent plus borrower deferment on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign parent plus borrower deferment. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is parent plus borrower deferment?

Parent plus borrower deferment is a period during which a borrower can temporarily postpone making payments on their Parent PLUS loan.

Who is required to file parent plus borrower deferment?

The borrower of a Parent PLUS loan is required to file for deferment if they are facing financial hardship or meet other eligibility criteria.

How to fill out parent plus borrower deferment?

To fill out parent plus borrower deferment, the borrower needs to contact their loan servicer and request the appropriate deferment form. They will then need to provide documentation to support their request.

What is the purpose of parent plus borrower deferment?

The purpose of parent plus borrower deferment is to provide temporary relief to borrowers who are unable to make payments on their Parent PLUS loan due to financial hardship or other reasons.

What information must be reported on parent plus borrower deferment?

The borrower must report their financial situation and provide documentation to support their request for deferment.

Fill out your parent plus borrower deferment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Parent Plus Borrower Deferment is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.