Get the free STATEMENT OF ESTIMATED FISCAL IMP ACT

Show details

SOUTH CAROLINA REVENUE AND FISCAL AFFAIRS OFFICE STATEMENT OF ESTIMATED FISCAL IMP ACT (803)7340640 RF A.SC.GOV/IMP ACTS Bill Number: Author: Requestor: Date: Subject: RFA Analyst(s):H. 3037 Dating

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign statement of estimated fiscal

Edit your statement of estimated fiscal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your statement of estimated fiscal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit statement of estimated fiscal online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit statement of estimated fiscal. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out statement of estimated fiscal

How to fill out statement of estimated fiscal:

01

Begin by gathering all relevant financial information for the fiscal period in question. This includes income statements, balance sheets, cash flow statements, and any other pertinent documents.

02

Organize the financial information into categories, such as revenue, expenses, assets, and liabilities. Ensure that all data is accurate and up to date.

03

Calculate the estimated revenue for the fiscal period based on historical data, market trends, and any other relevant factors. Consider any anticipated changes in sales, pricing, or customer behavior.

04

Estimate the expenses for the fiscal period, taking into account fixed costs, variable costs, and any planned investments or expenditures. Be sure to include all necessary expenses, such as payroll, rent, utilities, and taxes.

05

Calculate the net income by subtracting the estimated expenses from the estimated revenue. This will give you an idea of the overall financial performance for the fiscal period.

06

Analyze the statement of estimated fiscal to identify any discrepancies, potential risks, or opportunities. Consider the financial health of the business and make any necessary adjustments or strategic decisions.

Who needs statement of estimated fiscal:

01

Small business owners: Statement of estimated fiscal is crucial for small business owners who want to plan their financial activities and make informed decisions based on projected revenues and expenses. By having a clear estimate of their fiscal performance, they can adjust their strategies, budgets, and resource allocations accordingly.

02

Investors: Investors often require a statement of estimated fiscal before making any investment decisions. This document helps them gauge the potential profitability and financial stability of a company, allowing them to assess the risk and reward of their investment.

03

Financial institutions: Banks and lenders often request a statement of estimated fiscal when evaluating loan applications or creditworthiness. This document provides insight into the borrower's financial health and ability to repay the loan.

In summary, filling out a statement of estimated fiscal involves organizing financial information, estimating revenues and expenses, calculating net income, and analyzing the results. This document is essential for small business owners, investors, and financial institutions to make informed decisions and assess the financial health and performance of a company.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get statement of estimated fiscal?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific statement of estimated fiscal and other forms. Find the template you need and change it using powerful tools.

How do I execute statement of estimated fiscal online?

pdfFiller makes it easy to finish and sign statement of estimated fiscal online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I complete statement of estimated fiscal on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your statement of estimated fiscal. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

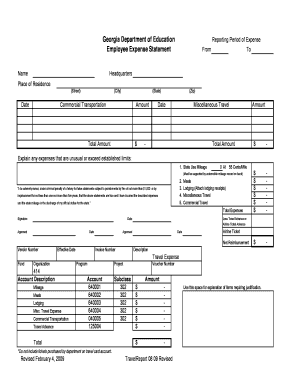

What is statement of estimated fiscal?

The statement of estimated fiscal is a document that taxpayers use to report their estimated income and taxes for the current tax year.

Who is required to file statement of estimated fiscal?

Taxpayers who expect to owe at least $1,000 in taxes when they file their tax return are required to file a statement of estimated fiscal.

How to fill out statement of estimated fiscal?

Taxpayers can fill out the statement of estimated fiscal by providing information about their estimated income, deductions, and tax payments for the current tax year.

What is the purpose of statement of estimated fiscal?

The purpose of the statement of estimated fiscal is to help taxpayers avoid underpayment penalties by making quarterly estimated tax payments throughout the year.

What information must be reported on statement of estimated fiscal?

Taxpayers must report their estimated income, deductions, tax credits, and tax payments on the statement of estimated fiscal.

Fill out your statement of estimated fiscal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Statement Of Estimated Fiscal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.