NY DTF IT-201 2017 free printable template

Show details

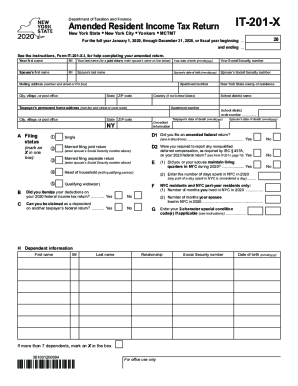

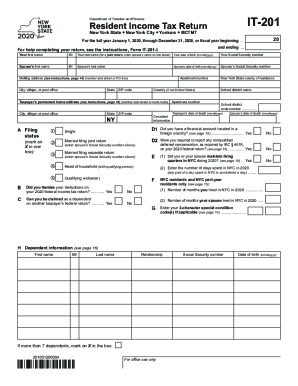

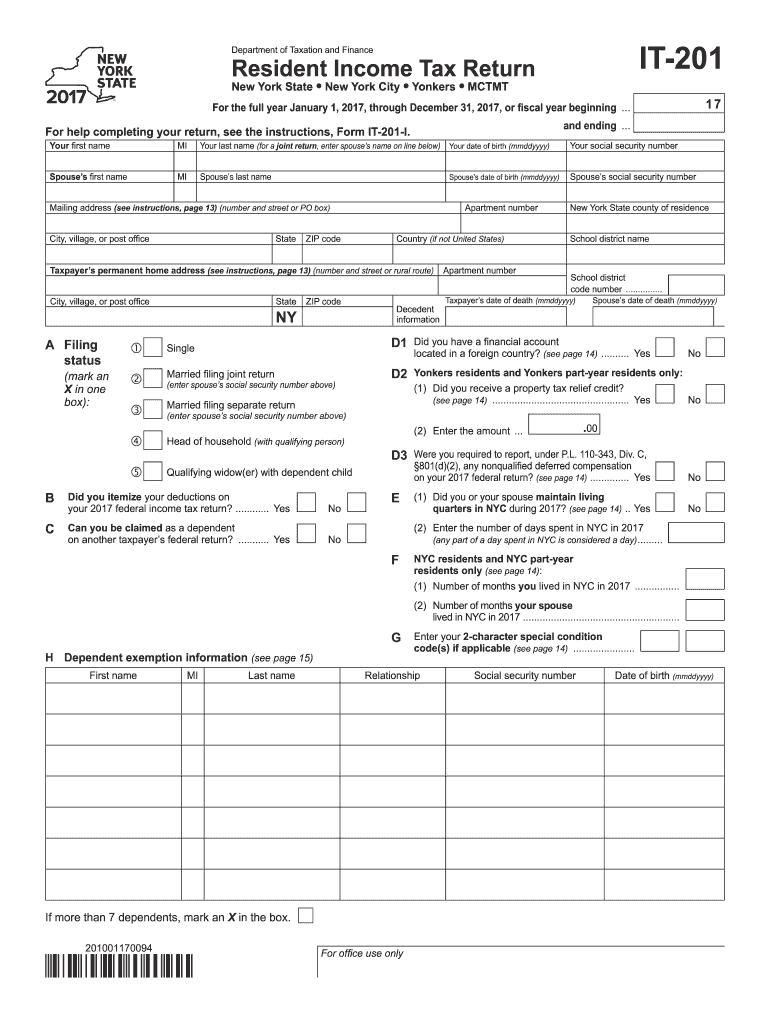

49 surcharges and MCTMT. 50 Part-year NYC resident tax Form IT-360. 1. 50 51 Other NYC taxes Form IT-201-ATT line 34. 44 45 Net other NYS taxes Form IT-201-ATT line 30. 45 46 Total New York State taxes add lines 44 and 45. 51 52 Add lines 49 50 and 51. 52 53 NYC nonrefundable credits Form IT-201-ATT line 10. 53 54a MCTMT net earnings base. 39 NYS household credit page 21 table 1 2 or 3. 40 Resident credit see page 22. 41 Other NYS nonrefundable credits Form IT-201-ATT line 7. 70a Other...refundable credits Form IT-201-ATT line 18. 71 74 Total Yonkers tax withheld. 75 Total estimated tax payments and amount paid with Form IT-370 76 Total payments add lines 63 through 75. To pay by electronic funds withdrawal mark an X in the box and fill in lines 83 and 84. If you pay by check or money order you must complete Form IT-201-V and mail it with your return.. See updated information for this form on our website IT-201 Department of Taxation and Finance Resident Income Tax Return New...York State New York City Yonkers MCTMT For the full year January 1 2017 through December 31 2017 or fiscal year beginning. 24 Add lines 19 through 23. New York subtractions see page 17 Standard deduction or itemized deduction see page 20 34 Enter your standard deduction table on page 20 or your itemized deduction from Form IT-201-D Mark an X in the appropriate box Standard - or - Itemized 34 35 Subtract line 34 from line 33 if line 34 is more than line 33 leave blank. 35 000. 00 37 Taxable...income subtract line 36 from line 35. 37 Name s as shown on page 1 IT-201 2017 Page 3 of 4 Tax computation credits and other taxes NYS tax on line 38 amount see page 21. Taxpayer s date of death mmddyyyy D1 Did you have a financial account Single Married filing joint return D2 Yonkers residents and Yonkers part-year residents only 1 Did you receive a property tax relief credit see page 14. Yes No Head of household with qualifying person Qualifying widow er with dependent child enter spouse s...social security number above B Did you itemize your deductions on your 2017 federal income tax return. Yes C Can you be claimed as a dependent on another taxpayer s federal return. Yes H Dependent exemption information see page 15 Last name 801 d 2 any nonqualified deferred compensation E 1 Did you or your spouse maintain living quarters in NYC during 2017 see page 14. Yes 2 Enter the number of days spent in NYC in 2017 any part of a day spent in NYC is considered a day. F NYC residents and NYC...part-year residents only see page 14 1 Number of months you lived in NYC in 2017. lived in NYC in 2017. G Enter your 2 character special condition code s if applicable see page 14. Relationship If more than 7 dependents mark an X in the box. 201001170094 2 Enter the amount. D3 Were you required to report under P. L* 110-343 Div* C First name located in a foreign country see page 14. 2 Ordinary dividends. 3 Taxable refunds credits or offsets of state and local income taxes also enter on line 25....4 Alimony received. 5 Business income or loss submit a copy of federal Schedule C or C-EZ Form 1040.

pdfFiller is not affiliated with any government organization

Instructions and Help about NY DTF IT-201

How to edit NY DTF IT-201

How to fill out NY DTF IT-201

Instructions and Help about NY DTF IT-201

How to edit NY DTF IT-201

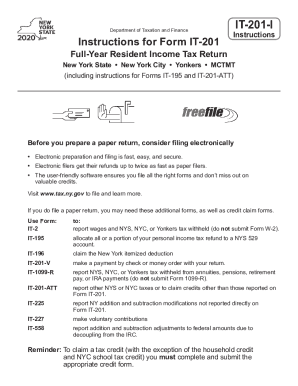

To edit the NY DTF IT-201 tax form, download a copy from the New York State Department of Taxation and Finance website. You can use pdfFiller to edit the PDF by adding text, comments, or making modifications as necessary. Once edits are made, ensure to save the updated version before filing.

How to fill out NY DTF IT-201

Filling out the NY DTF IT-201 involves several straightforward steps:

01

Collect all required financial documents and information such as W-2 forms, 1099s, and details about deductions.

02

Download the latest version of the NY DTF IT-201 form, ensuring it is the correct year for your filing.

03

Carefully enter your personal information, including name, address, and taxpayer identification number.

04

Report your income and any eligible deductions. Double-check entries for accuracy.

05

Calculate your total tax liability and if applicable, any refund amount.

06

Sign and date the form before submission.

About NY DTF IT previous version

What is NY DTF IT-201?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About NY DTF IT previous version

What is NY DTF IT-201?

NY DTF IT-201 is the New York State Individual Income Tax Return form. It is used by residents of New York to report their annual income and file their state tax returns. This form is essential for determining the amount of tax owed or refund due.

What is the purpose of this form?

The primary purpose of the NY DTF IT-201 form is to report income earned by individuals and calculate the state tax liability on that income. By completing this form, taxpayers fulfill their legal obligation to the state and can also claim deductions and credits to reduce their tax burden.

Who needs the form?

Any resident of New York who earns income and is required to file an income tax return must complete the NY DTF IT-201 form. This includes full-time residents, part-time residents, and those who meet specific income thresholds. Additionally, non-residents earning income in New York may also need to complete this form.

When am I exempt from filling out this form?

You may be exempt from filing the NY DTF IT-201 form if your income falls below certain thresholds set by the state. Additionally, if you qualify for specific exemptions or file under group returns (such as for dependents), you may not be required to file this form. Always verify with the latest tax guidance to confirm your filing requirements.

Components of the form

The NY DTF IT-201 includes various sections that require information about your total income, payment methods, and any applicable deductions. Key components often include personal information, income details, tax credits, and a final calculation of taxes owed or refund due. Attention to detail in these components is crucial for accurate filing.

What are the penalties for not issuing the form?

Failure to file the NY DTF IT-201 form can result in significant penalties, including but not limited to late filing fees and accrued interest on unpaid taxes. New York State imposes penalties that can increase the longer you delay filing your tax return. Filing the form timely is essential to avoid these consequences.

What information do you need when you file the form?

When filing the NY DTF IT-201, gather essential information such as your Social Security number, W-2 and 1099 forms detailing your income, records of any tax-deductible expenses, and prior year tax returns for reference. Having this information ready facilitates a smoother filing process and helps avoid mistakes.

Is the form accompanied by other forms?

Depending on your financial situation, the NY DTF IT-201 may need to be submitted alongside supplementary forms such as the NYS IT-196 (Itemized Deduction Schedule) or other relevant schedules. Ensure to review the most recent tax regulations to determine if additional forms are necessary for your submission.

Where do I send the form?

The completed NY DTF IT-201 form should be submitted to the New York State Department of Taxation and Finance. Depending on whether you are filing electronically or via mail, different submission addresses may apply. Refer to the form instructions or the state tax website for the most accurate destination of your forms.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.