Get the free FILL YOUR COVERAGE GAPS

Show details

FILL YOUR COVERAGE GAPS

WITH INLAND MARINE INSURANCE was once used strictly in the ocean marine industry to protect against property losses

before, during and after water transfers. As the nonocean

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fill your coverage gaps

Edit your fill your coverage gaps form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fill your coverage gaps form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fill your coverage gaps online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fill your coverage gaps. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fill your coverage gaps

How to Fill Out Your Coverage Gaps:

01

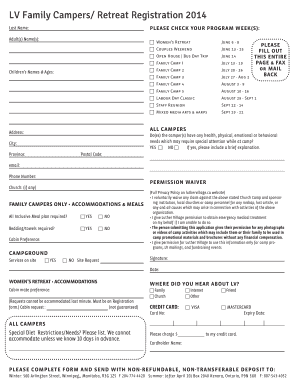

Assess your current coverage: Start by reviewing your existing insurance policies to identify any gaps in coverage. This could include areas such as health, auto, home, or liability insurance.

02

Determine your specific needs: Once you have identified the coverage gaps, assess your individual needs. Consider factors such as your lifestyle, financial situation, and potential risks you may face. This will help you determine the type and level of coverage you require.

03

Research insurance providers: Next, research different insurance providers to find ones that offer policies that fill your coverage gaps. Look for reputable companies with a strong track record for customer service and reliable claims handling. Consider obtaining multiple quotes to compare their offerings and prices.

04

Consult with an insurance agent: If you're unsure about the coverage options or need guidance, it may be beneficial to consult with an insurance agent. They can assess your needs, explain different policy options, and help you find the most suitable coverage for your situation.

05

Purchase additional policies: Once you have done your research and consulted with an agent if needed, it's time to purchase additional insurance policies to fill your coverage gaps. Pay attention to the policy terms, coverage limits, exclusions, and deductibles to ensure you have adequate protection.

06

Regularly review and update your coverage: Insurance needs can change over time, so it's crucial to regularly review and update your coverage. This could involve reevaluating your policies, adjusting coverage limits, or adding new policies to address any emerging gaps in your insurance protection.

Who Needs to Fill Their Coverage Gaps?

01

Individuals with changing life circumstances: Life events such as getting married, having children, or purchasing a new home can create a need for additional coverage. Reviewing and filling any coverage gaps is especially important during these transitional periods.

02

Small business owners: Entrepreneurs or owners of small businesses should carefully assess their insurance needs to protect their professional ventures from potential risks. Ensuring adequate coverage in areas like liability, property, or workers' compensation is essential for their business's long-term stability.

03

Freelancers and gig workers: Those who work independently and rely on contract jobs should also consider filling their coverage gaps. As independent workers, they do not receive employer-provided benefits like health insurance or workers' compensation, making it crucial to consider individual policies to protect their income, health, and assets.

By following these steps and considering your individual circumstances, you can effectively fill out your coverage gaps and protect yourself, your family, or your business from potential financial losses and uncertainty.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit fill your coverage gaps on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing fill your coverage gaps, you need to install and log in to the app.

Can I edit fill your coverage gaps on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign fill your coverage gaps on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I edit fill your coverage gaps on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute fill your coverage gaps from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is fill your coverage gaps?

Fill your coverage gaps is a form used to report information on individuals who do not have health insurance coverage.

Who is required to file fill your coverage gaps?

Employers and health insurance providers are required to file fill your coverage gaps.

How to fill out fill your coverage gaps?

Fill your coverage gaps can be filled out electronically using the appropriate forms provided by the IRS.

What is the purpose of fill your coverage gaps?

The purpose of fill your coverage gaps is to track individuals who do not have health insurance coverage and ensure compliance with the Affordable Care Act.

What information must be reported on fill your coverage gaps?

Information such as the individual's name, Social Security number, and whether they had health insurance coverage during the year must be reported on fill your coverage gaps.

Fill out your fill your coverage gaps online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fill Your Coverage Gaps is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.