Get the free CHAPTER 4 SPECIAL CLAIMS FOR DEBT SERVICE VACANCY

Show details

CHAPTER 4 SPECIAL CLAIMS FOR DEBT SERVICE VACANCY

PAYMENTSSection 41 CONCEPT

Special claims for debt service vacancy payments are compensation to a property owner

for units that have been vacant beyond

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 4 special claims

Edit your chapter 4 special claims form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 4 special claims form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chapter 4 special claims online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit chapter 4 special claims. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

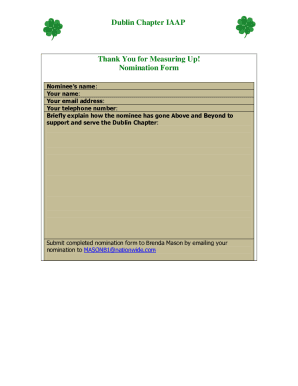

How to fill out chapter 4 special claims

How to fill out chapter 4 special claims:

01

Start by thoroughly reviewing the guidelines and instructions provided by the relevant authority or organization. This will ensure that you understand the requirements and can provide accurate and complete information.

02

Gather all the necessary documentation and information needed to support your claim. This may include medical records, receipts, invoices, or any other relevant paperwork.

03

Carefully read and fill out each section of the chapter 4 special claims form. Pay close attention to details such as dates, names, and descriptions to ensure accuracy.

04

Provide clear and concise explanations for each claim or request made in the form. Use specific examples and include supporting documents whenever possible.

05

Double-check your completed form for any errors or omissions. It is recommended to have someone else review it as well to ensure accuracy.

06

Submit the filled-out chapter 4 special claims form according to the designated instructions, whether it's through an online portal or by mail. Keep copies of all submitted documents for your records.

Who needs chapter 4 special claims:

01

Chapter 4 special claims are typically required by individuals or organizations seeking reimbursement for specific expenses or damages that fall under the jurisdiction of chapter 4 regulations.

02

This may include healthcare providers filing claims for medical services that meet the eligibility criteria defined in chapter 4.

03

Insurance companies or policyholders may need to submit chapter 4 special claims to seek reimbursement for covered losses or damages as outlined in their policies.

04

Businesses or individuals may need to file chapter 4 special claims for compensation in cases where their property or assets have incurred damages or loss due to specific circumstances covered by chapter 4 regulations.

05

Chapter 4 special claims may also be applicable to individuals seeking compensation for injuries, disabilities, or other physical or emotional harm caused by events outlined in the regulations.

It is important to note that the specific requirements for chapter 4 special claims may vary depending on the jurisdiction and the specific guidelines established by the relevant authority. It is therefore crucial to thoroughly familiarize yourself with the applicable regulations and seek professional advice if needed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get chapter 4 special claims?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific chapter 4 special claims and other forms. Find the template you need and change it using powerful tools.

How do I make changes in chapter 4 special claims?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your chapter 4 special claims and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out chapter 4 special claims using my mobile device?

Use the pdfFiller mobile app to complete and sign chapter 4 special claims on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is chapter 4 special claims?

Chapter 4 special claims refer to claims filed with the IRS by foreign entities claiming reduced withholding tax rates under Chapter 4 of the Internal Revenue Code.

Who is required to file chapter 4 special claims?

Foreign entities that are eligible for reduced withholding tax rates under Chapter 4 of the Internal Revenue Code are required to file chapter 4 special claims.

How to fill out chapter 4 special claims?

Chapter 4 special claims can be filled out using Form 1042 and must include relevant information such as the claimant's name, address, tax identification number, and the applicable withholding tax rate.

What is the purpose of chapter 4 special claims?

The purpose of chapter 4 special claims is to allow foreign entities to claim reduced withholding tax rates on income sourced in the United States.

What information must be reported on chapter 4 special claims?

Chapter 4 special claims must include information such as the claimant's name, address, tax identification number, and the amount of income subject to withholding.

Fill out your chapter 4 special claims online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 4 Special Claims is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.