OK 538-S 2017 free printable template

Show details

State of Oklahoma died in 2017 or 2018,

enter date of death:Spouses Social

Security Number died in 2017 or 2018,

enter date of death:Instructions on page 2.

Please read carefully as

an incomplete

pdfFiller is not affiliated with any government organization

Instructions and Help about OK 538-S

How to edit OK 538-S

How to fill out OK 538-S

Instructions and Help about OK 538-S

How to edit OK 538-S

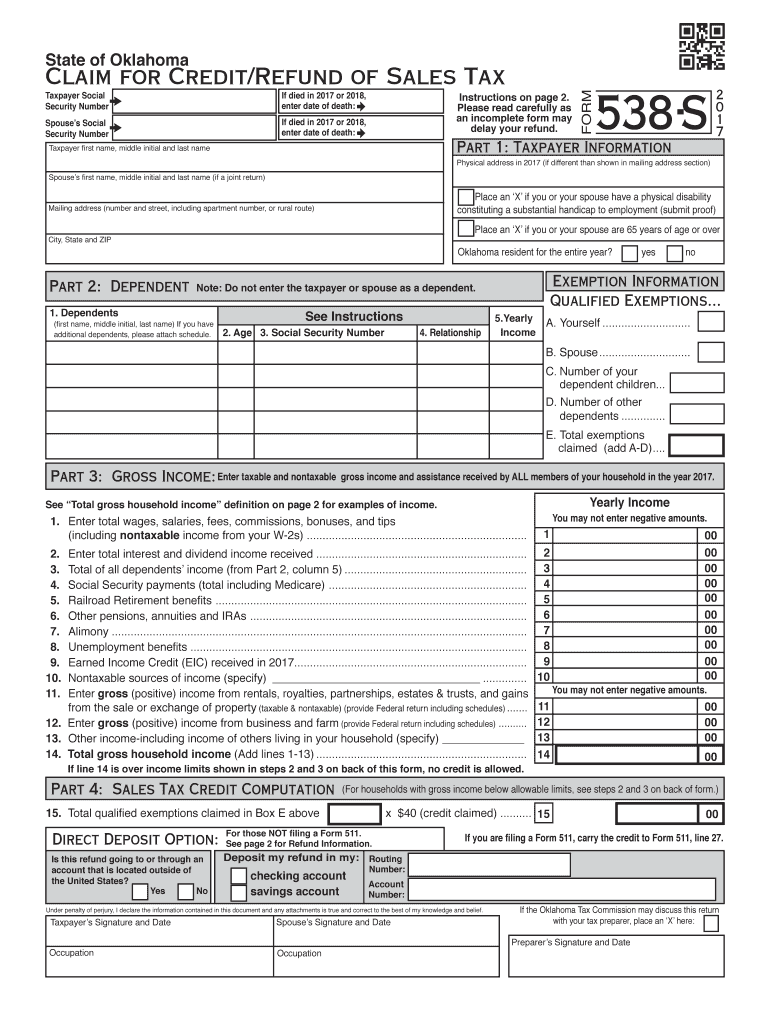

To edit the OK 538-S Tax Form, you must first obtain a copy of the form, which can often be downloaded from the appropriate state tax authority website or other official resources. Use a PDF editor such as pdfFiller to make necessary changes. This platform allows you to fill in information, correct errors, and sign the document before final submission.

How to fill out OK 538-S

Filling out the OK 538-S Tax Form involves several key steps:

01

Retrieve the latest version of the form from an official source.

02

Provide accurate personal identification information, including your name, address, and social security number.

03

Complete all sections related to income and deductions as required.

04

Review the information for accuracy before submission.

About OK 538-S 2017 previous version

What is OK 538-S?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About OK 538-S 2017 previous version

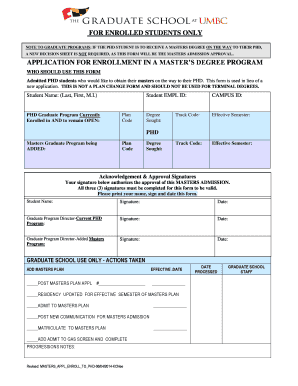

What is OK 538-S?

OK 538-S is a tax form developed by the Oklahoma Tax Commission. It is used primarily for reporting specific types of income and payments made throughout the year. This form serves as a means to ensure that both payers and recipients accurately report taxable income.

What is the purpose of this form?

The main purpose of the OK 538-S form is to report payments made to non-resident individuals for services rendered. This reporting helps the state keep accurate records of taxable income that may be subject to taxation. It facilitates compliance with Oklahoma tax laws.

Who needs the form?

The OK 538-S Tax Form is necessary for individuals or businesses that have made payments to non-resident individuals for services. Common filers include employers and contractors who engage freelancers or consultants who reside outside of Oklahoma.

When am I exempt from filling out this form?

You may be exempt from filling out the OK 538-S form if the payments made to the non-resident are below the specified threshold amount or if the services rendered are not subject to taxation in Oklahoma. Additionally, some types of payments may have separate reporting requirements, which could exempt you from using this form.

Components of the form

The OK 538-S form is structured to include sections for the payer’s information, recipient’s information, and a summary of payments made throughout the tax year. It also includes fields for necessary identification numbers, which helps streamline processing when filed with the state.

What are the penalties for not issuing the form?

Failure to issue the OK 538-S form can result in penalties assessed by the Oklahoma Tax Commission. These penalties may vary based on the severity of the noncompliance, including financial fines and potential audits. Timely and accurate filing is crucial to avoid these repercussions.

What information do you need when you file the form?

When filing the OK 538-S form, you will need the following information:

01

Payer’s name, address, and tax identification number.

02

Recipient’s name, address, and social security number or tax identification number.

03

Total amount of payments made during the reporting year.

Is the form accompanied by other forms?

The OK 538-S form is typically submitted alongside other relevant tax documents, depending on the nature of the payments. It's advisable to check with the Oklahoma Tax Commission for any specific requirements related to additional forms that may need to accompany it.

Where do I send the form?

The completed OK 538-S form should be sent to the Oklahoma Tax Commission at their designated processing address. Ensure that you check the commission's website for the most current address and filing instructions to ensure proper submission.

See what our users say