Get the free ET HANDBOOK NO. 407 TAX PERFORMANCE SYSTEM FIELD AUDIT - wdr doleta

Show details

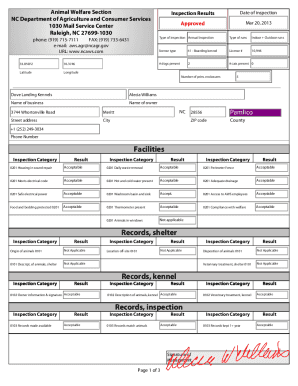

This handbook outlines the procedures, methodologies, and performance measures for conducting field audits to ensure employer compliance with tax regulations and state laws.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign et handbook no 407

Edit your et handbook no 407 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your et handbook no 407 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing et handbook no 407 online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit et handbook no 407. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out et handbook no 407

How to fill out ET HANDBOOK NO. 407 TAX PERFORMANCE SYSTEM FIELD AUDIT

01

Gather all necessary financial documents including tax returns, bookkeeping records, and any correspondence with the IRS.

02

Review the specific sections of the ET HANDBOOK NO. 407 that apply to your situation.

03

Complete each section of the audit form accurately, ensuring all information is consistent with your records.

04

Highlight any discrepancies or additional information that may need clarification.

05

Attach supporting documentation as required for each item being reported.

06

Submit the completed form by the specified deadline to the appropriate authority.

Who needs ET HANDBOOK NO. 407 TAX PERFORMANCE SYSTEM FIELD AUDIT?

01

Businesses and organizations subjected to federal tax performance audits.

02

Tax professionals and accountants responsible for filing and managing tax performance systems.

03

Internal Revenue Service (IRS) agents conducting the audits.

Fill

form

: Try Risk Free

People Also Ask about

What is tax audit in English?

Meaning of tax audit in English an official examination of the information that a person or a business provides to the tax authority to check that it is accurate and legal: The firm handles complex state tax audits for large companies.

What does TPS stand for in Paychex?

Paychex TPS, or Tax Payment Service, is a service offered by Paychex, a leading provider of payroll and HR solutions. It is designed to simplify the tax payment process for employers, ensuring that federal, state, and local taxes are accurately calculated and paid on time.

What is the red flag for the IRS audit?

Not reporting all of your income is an easy-to-avoid red flag that can lead to an audit. Taking excessive business tax deductions and mixing business and personal expenses can lead to an audit. The IRS mostly audits tax returns of those earning more than $200,000 and corporations with more than $10 million in assets.

What is a TPS audit?

The Tax Performance System (TPS) is intended to assist State administrators in improving their Unemployment Insurance (UI) programs by providing objective information on the quality of existing revenue operations.

What are TPS taxes?

The Tax Performance System (TPS) Computed Measures are gathered from data that are electronically reported by each state to the US Department of Labor. These measures provide information on the timeliness and "completeness" of state tax activity.

What is TPS audit?

The Tax Performance System (TPS) is intended to assist State administrators in improving their Unemployment Insurance (UI) programs by providing objective information on the quality of existing revenue operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ET HANDBOOK NO. 407 TAX PERFORMANCE SYSTEM FIELD AUDIT?

ET HANDBOOK NO. 407 is a guide that outlines the procedures and standards for conducting field audits as part of the Tax Performance System, ensuring compliance and effectiveness in tax administration.

Who is required to file ET HANDBOOK NO. 407 TAX PERFORMANCE SYSTEM FIELD AUDIT?

Entities and individuals involved in tax reporting and compliance processes, specifically those who fall under the jurisdiction of the tax performance audit requirements.

How to fill out ET HANDBOOK NO. 407 TAX PERFORMANCE SYSTEM FIELD AUDIT?

To fill out the handbook, individuals must provide necessary information regarding their tax performance, following the guidelines and forms included in the handbook, ensuring accuracy and completeness.

What is the purpose of ET HANDBOOK NO. 407 TAX PERFORMANCE SYSTEM FIELD AUDIT?

The purpose is to assess the effectiveness and compliance of tax practices among entities, aiming to improve overall tax system performance and integrity.

What information must be reported on ET HANDBOOK NO. 407 TAX PERFORMANCE SYSTEM FIELD AUDIT?

The report must include financial data, tax liabilities, detailed records of tax payments, and any related documentation that meets the audit criteria specified in the handbook.

Fill out your et handbook no 407 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Et Handbook No 407 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.