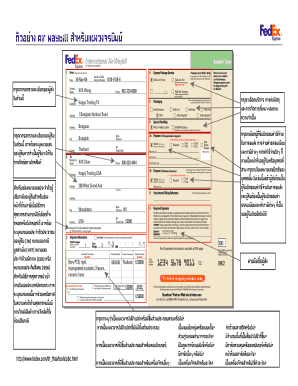

Get the free Actual Car Loan vs PayZero Comparison

Show details

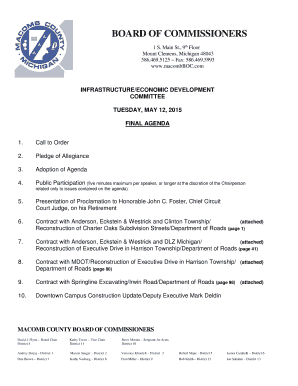

Actual Car Loan vs Payer Comparison

Without Payer

Amount:

Term:

Due Date:

Amount:$32,059

72/Mon

9th

$562.36#PMT Date111/14/1421/19/153

4

5

6

7

8

9

10

11

122/16/15

3/16/15

4/13/15

5/5/15

6/15/15

7/14/15

8/20/15

9/18/15

10/14/15

11/10/1513

14

15

16

17

18

19

20

21

22

23

2412/20/15

1/16/16

2/9/16

3/17/16

4/19/16

5/11/16

6/17/16

7/18/16

8/11/16

9/14/16

10/8/16

11/9/16Principle

$$$$$$$$423.58110.44$$371.30373.56$$375.81417.59$296.25375.99333.94374.18401.38397.53381

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign actual car loan vs

Edit your actual car loan vs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your actual car loan vs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing actual car loan vs online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit actual car loan vs. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out actual car loan vs

How to fill out actual car loan vs:

01

Research and compare loan options: Start by researching different lenders and loan options available to you. This includes comparing interest rates, repayment terms, and any additional fees or charges associated with the loan.

02

Gather necessary documents: To fill out an actual car loan application, you will typically need to gather certain documents. This may include your identification documents, proof of income, proof of residence, and any other required financial documents.

03

Fill out the application form: Once you have gathered all the necessary documents, fill out the loan application form accurately and completely. Pay attention to all the details and provide honest information.

04

Provide information about the car: In addition to personal and financial details, you will also need to provide information about the car you wish to finance. This may include the make, model, year, VIN number, and any other necessary details.

05

Submit the application: Once you have filled out the application form, review it carefully to ensure all information provided is accurate. Submit the application along with any required documents to the lender.

Who needs actual car loan vs:

01

Individuals planning to purchase a car: Anyone who intends to purchase a car but requires financial assistance can benefit from an actual car loan. It provides them with the necessary funds to make the purchase.

02

Individuals with limited savings: If you do not have enough savings to finance the purchase of a car outright, an actual car loan can be a viable option. It allows you to spread the cost of the car over a specific period while making affordable monthly payments.

03

Those seeking flexible repayment options: Actual car loans offer various repayment options that can be tailored to your financial situation. This flexibility allows borrowers to choose a repayment plan that best suits their income and budget.

04

People aiming to improve their credit score: Taking out an actual car loan and making timely payments can positively impact your credit score. If you are looking to establish or improve your credit history, responsibly managing an actual car loan can be beneficial.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find actual car loan vs?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific actual car loan vs and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I edit actual car loan vs on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute actual car loan vs from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I fill out actual car loan vs on an Android device?

Use the pdfFiller mobile app and complete your actual car loan vs and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is actual car loan vs?

Actual car loan vs is a form used to report the actual amount of car loan received by an individual or entity.

Who is required to file actual car loan vs?

Individuals or entities who have received a car loan are required to file actual car loan vs.

How to fill out actual car loan vs?

Actual car loan vs can be filled out by providing details of the car loan received, such as the amount, interest rate, and repayment terms.

What is the purpose of actual car loan vs?

The purpose of actual car loan vs is to report the accurate information about car loans received by individuals or entities.

What information must be reported on actual car loan vs?

Information such as the amount of car loan received, interest rate, and repayment terms must be reported on actual car loan vs.

Fill out your actual car loan vs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Actual Car Loan Vs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.