Get the free MISSISSIPI INCOME TAX INSTRUCTIONS 2017

Show details

Form 801001781000 (Rev. 01/18)RESIDENT, NONRESIDENT

AND

PARTNER RESIDENT

INCOME TAX INSTRUCTIONS2017INDIVIDUAL INCOME TAX BUREAU

PO BOX 1033

JACKSON, MISSISSIPPI 392151033

WWW.FOR.MS.NOTABLE

We are not affiliated with any brand or entity on this form

Instructions and Help about mississipi income tax instructions

How to edit mississipi income tax instructions

How to fill out mississipi income tax instructions

Instructions and Help about mississipi income tax instructions

How to edit mississipi income tax instructions

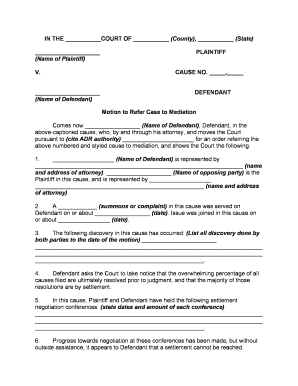

To edit the Mississippi income tax instructions form, utilize pdfFiller’s tools that allow for seamless editing. Open the form on the platform, and use available features to update any necessary fields such as income, deductions, or credits. Once changes are made, ensure all information is correct before proceeding to the next steps.

How to fill out mississipi income tax instructions

Filling out the Mississippi income tax instructions form requires careful attention to detail. Start by gathering all relevant financial documents, including W-2s, 1099s, and receipts for deductions. Follow the step-by-step prompts on the form and ensure that each line is completed accurately to avoid delays in processing.

Latest updates to mississipi income tax instructions

Latest updates to mississipi income tax instructions

It's important to stay informed about any recent changes to the Mississippi income tax instructions. Updates may include changes in tax rates, credits, or deductions for the current tax year. Regularly check the Mississippi Department of Revenue’s official website for the most current information.

All You Need to Know About mississipi income tax instructions

What is mississipi income tax instructions?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About mississipi income tax instructions

What is mississipi income tax instructions?

Mississippi income tax instructions refer to the guidelines provided for completing tax forms required by the Mississippi Department of Revenue. These instructions assist taxpayers in properly reporting their income and calculating the amount of tax owed. Adhering to these instructions is crucial for ensuring compliance with state tax laws.

What is the purpose of this form?

The primary purpose of the Mississippi income tax instructions form is to provide taxpayers with the necessary information to accurately report their income and claim applicable deductions and credits. This ensures that individuals meet their tax obligations and avoid potential penalties or audits.

Who needs the form?

Individuals who reside or earn income in Mississippi generally need to complete the income tax instructions form. This includes full-time residents as well as non-residents with Mississippi-sourced income. Additionally, individuals claiming certain credits or deductions must also adhere to these instructions.

When am I exempt from filling out this form?

Exemptions from filling out the Mississippi income tax instructions form typically apply to individuals whose income falls below the state’s filing thresholds or to certain specific groups such as dependents of taxpayers. Additionally, some low-income earners may be eligible for exemptions depending on their circumstances.

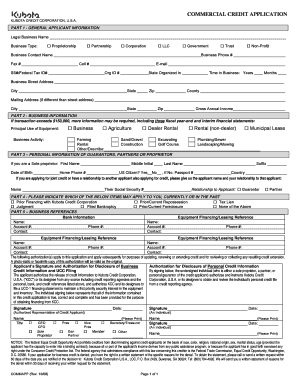

Components of the form

The Mississippi income tax instructions form includes several components, such as sections for income reporting, deductions, credits, and tax calculations. Each component requires specific information, such as details about employment income, investment income, and allowable deductions. Familiarity with these components ensures accurate completion of the form.

Due date

The due date for filing the Mississippi income tax instructions form is generally April 15 each year. However, taxpayers can request an extension, allowing additional time to file their returns. It is essential to adhere to this deadline to avoid penalties and interest on any tax due.

What payments and purchases are reported?

Mississippi income tax instructions require taxpayers to report all forms of income, including wages, salaries, dividends, and interest. Additionally, certain purchases may need to be reported if they impact taxable income, such as the sale of assets or real property. Knowing what to report is critical for compliance.

How many copies of the form should I complete?

Typically, a taxpayer must complete one copy of the Mississippi income tax instructions form for personal filing. However, if you are filing jointly or if you have multiple forms of income, additional copies may be necessary for accurate reporting. Review instructions carefully for any specific requirements.

What are the penalties for not issuing the form?

Failure to file the Mississippi income tax instructions form can result in significant penalties, including fines and interest on unpaid taxes. Additionally, the Mississippi Department of Revenue may initiate audits or investigations for noncompliance, which can cause further complications for the taxpayer.

What information do you need when you file the form?

Before filing the Mississippi income tax instructions form, gather information such as your Social Security number, income statements (W-2s, 1099s), and documentation for deductions and credits. Having this information readily available ensures a smooth filing process and helps prevent errors that could delay processing.

Is the form accompanied by other forms?

Depending on individual tax situations, the Mississippi income tax instructions form may need to be filed alongside other forms, such as schedules for specific deductions or credits. It is vital to check the instructions for guidance on which additional forms may be required for your filing.

Where do I send the form?

The completed Mississippi income tax instructions form should be submitted to the Mississippi Department of Revenue. Depending on the filing method—mail or electronic submission—the specific address or submission guidelines can vary. Always verify the latest mailing address or e-file options from the state’s official website.

See what our users say