Get the free Schedule X Other Income

Show details

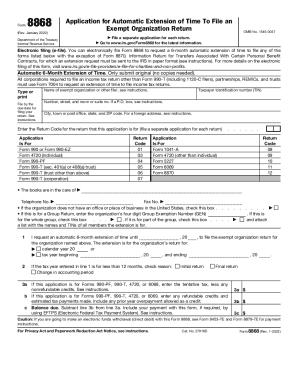

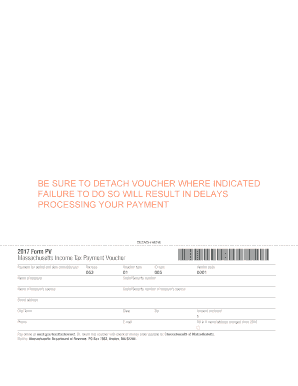

File pg. 1FIRST NAME. I.LAST ASOCIAL SECURITY NUMBERSchedule X Other Income. Enclose with Form 1 or Form 1NR/BY. Do not cut or separate these schedules.20171Alimony received (from U.S. return) (full

We are not affiliated with any brand or entity on this form

Instructions and Help about schedule x oformr income

How to edit schedule x oformr income

How to fill out schedule x oformr income

Instructions and Help about schedule x oformr income

How to edit schedule x oformr income

To edit the Schedule X of the OFormR Income, you will need to access the form digitally. Using pdfFiller, you can import the PDF directly to the platform, where you can make necessary changes. Simply upload your form, click on the relevant sections to edit, and save your modifications once completed.

How to fill out schedule x oformr income

Filling out the Schedule X of OFormR Income requires careful attention to detail. Start by gathering all necessary financial information, including income details and deductions. Use the official IRS guidelines for accurate completion, and ensure that every field is filled out correctly to avoid complications later on.

Latest updates to schedule x oformr income

Latest updates to schedule x oformr income

Keep an eye on IRS announcements for the latest updates on Schedule X of the OFormR Income. Any changes to tax laws or deadlines can affect how you complete this form. It's vital to stay informed to ensure compliance with current regulations.

All You Need to Know About schedule x oformr income

What is schedule x oformr income?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About schedule x oformr income

What is schedule x oformr income?

Schedule X of the OFormR Income is a specific tax form required for certain filers to report their financial information to the IRS. This form helps the IRS accurately assess an individual's or business's tax liability based on declared income and deductions.

What is the purpose of this form?

The purpose of Schedule X of the OFormR Income is to provide a structured way for taxpayers to report their income sources, applicable deductions, and calculate their overall tax responsibility. Accurate completion ensures compliance and prevents potential audits from the IRS.

Who needs the form?

Taxpayers who have specific types of income or deductions must use Schedule X of the OFormR Income. This usually includes individuals with complex financial situations, such as self-employed persons, or those who earned income from multiple sources that require detailed reporting.

When am I exempt from filling out this form?

You may be exempt from filling out Schedule X of the OFormR Income if your income falls below certain thresholds set by the IRS or if your income sources do not require detailed reporting. Always check the most recent IRS guidelines for specific exemptions applicable to your situation.

Components of the form

Schedule X of the OFormR Income consists of various sections that require detailed financial information. Common components include income fields, deduction categories, and specific calculations for tax owed. Each section must be filled out completely to ensure accurate assessment by the IRS.

Due date

The due date for submitting Schedule X of the OFormR Income typically aligns with the individual or business tax filing deadline. Generally, this is April 15 for individuals unless extensions are requested or if the date falls on a weekend or holiday. Always verify the specific due date for the current tax year to avoid penalties.

What payments and purchases are reported?

Schedule X of the OFormR Income requires reporting of all income sources, including wages, bonuses, and certain investments. Additionally, any significant purchases that could impact your tax liability, such as large deductible expenses, should also be documented within the appropriate sections.

How many copies of the form should I complete?

Generally, you should complete only one copy of Schedule X of the OFormR Income for submission. However, it is advisable to keep a copy for your records. If you are filing a joint return, both taxpayers must ensure that their information is accurately reported on one form.

What are the penalties for not issuing the form?

Failure to issue Schedule X of the OFormR Income can result in various penalties imposed by the IRS, including late fees or additional tax assessments. In some cases, non-compliance may lead to audits, so it is crucial to complete and submit the form accurately and on time.

What information do you need when you file the form?

When filing Schedule X of the OFormR Income, you need comprehensive financial information, including total income, potential deductions, and receipts for significant purchases. Additionally, personal identification information, such as Social Security numbers, will be required for accurate processing.

Is the form accompanied by other forms?

Schedule X of the OFormR Income may be accompanied by other IRS forms depending on your tax situation. For example, you might need to include additional schedules for specific deductions or credits, which should be referenced in the instructions provided with the form.

Where do I send the form?

Once completed, Schedule X of the OFormR Income should be mailed to the address specified in the IRS instructions for the current tax year. This address may vary depending on whether you are enclosing a payment or claiming a refund, so be sure to check the guidelines carefully.

See what our users say