PA BCO-10 2017 free printable template

Show details

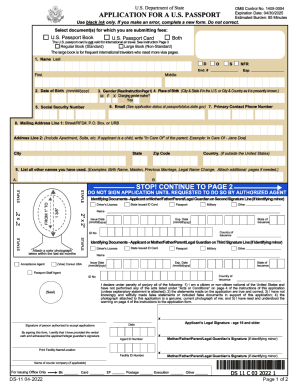

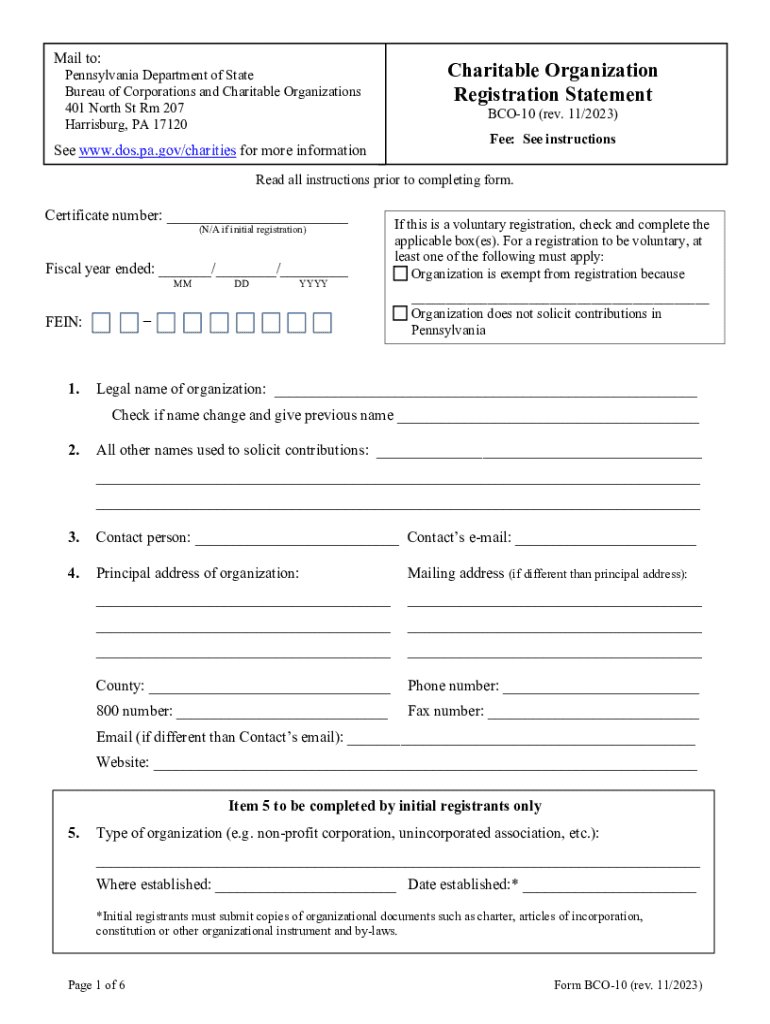

Names addresses and telephone numbers of all offices chapters branches auxiliaries affiliates or other subordinate units located in Pennsylvania Attach separate sheet if necessary Form BCO-10 Revised 7/2009 Page 1 of 6 5. Dos. state. pa.us/charities Charitable Organization Registration Statement Form BCO-10 Check if registering voluntarily Certificate Number See note under important information Renewals Only Fiscal Year Ended / / Employer Identification Number EIN 1. // Includes...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA BCO-10

Edit your PA BCO-10 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA BCO-10 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA BCO-10 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA BCO-10

How to fill out PA BCO-10

01

Obtain the PA BCO-10 form from the relevant state or local government website or office.

02

Fill in your personal information, including your name, address, and contact details in the designated sections.

03

Provide your business information, including the business name, type, and tax identification number.

04

Complete the financial sections, including income, expenses, and applicable deductions.

05

Review all information for accuracy and completeness before signing the declaration.

06

Submit the completed form as per the instructions provided, either online or via mail.

Who needs PA BCO-10?

01

Businesses operating in Pennsylvania that are required to report their business income and expenses.

02

Individuals who are self-employed or running a small business and must file for tax purposes.

03

Organizations seeking to apply for specific business licenses or permits within Pennsylvania.

Instructions and Help about PA BCO-10

Fill

form

: Try Risk Free

People Also Ask about

Is asking for donations soliciting?

Essentially, any fundraising overture made toward a person individually, a group of people, or to the public at large, that asks for a donation is considered a solicitation.

How much is to register a non profit in Pennsylvania?

Domestic Corporation/Association (Profit and Non-Profit) Articles of Incorporation or like instrument incorporating a corporation or association$125Additional fee for each association resulting from a division$125Annual Report - Benefit corporation$70Statement of Validation$75 plus amount of attached filing4 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PA BCO-10?

PA BCO-10 is a tax form used in Pennsylvania for reporting certain business profits and losses.

Who is required to file PA BCO-10?

Businesses operating in Pennsylvania that meet specific criteria regarding income and business activity are required to file PA BCO-10.

How to fill out PA BCO-10?

To fill out PA BCO-10, businesses need to provide accurate financial information, including income, expenses, and other relevant data as outlined in the instructions provided with the form.

What is the purpose of PA BCO-10?

The purpose of PA BCO-10 is to report business income and calculate the appropriate tax obligation for businesses operating in Pennsylvania.

What information must be reported on PA BCO-10?

PA BCO-10 requires reporting of gross receipts, wages, expenses, taxable income, and any pertinent deductions or credits applicable to the business.

Fill out your PA BCO-10 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA BCO-10 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.