TN RV-F1320501 2016-2025 free printable template

Show details

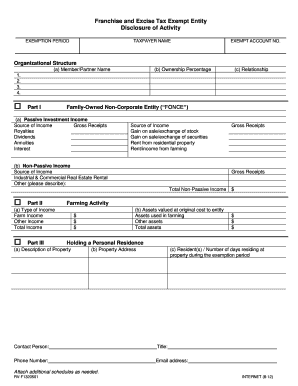

Tennessee Department of Revenue Franchise and Excise Tax Exempt Entity Disclosure of Activity Exemption Period Instructions Entity Name Print Reset Exempt Account No. Organizational Structure a Member/Partner Name b Ownership Percentage c Relationship Part I Family-Owned Non-Corporate Entity FONCE a Passive Investment Income Source of Income Receipts Royalties Dividends Annuities Interest Gain on sale/exchange of stock Rent from residential property Rent/income from farming b Non-Passive...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TN RV-F1320501

Edit your TN RV-F1320501 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TN RV-F1320501 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TN RV-F1320501 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TN RV-F1320501. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TN RV-F1320501 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TN RV-F1320501

How to fill out TN RV-F1320501

01

Obtain the TN RV-F1320501 form from the official state website or local government office.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill out your personal information at the top of the form, including your name, address, and contact details.

04

Provide any required identification numbers, such as a social security number or tax identification number.

05

Complete the sections relevant to your situation by following the prompts and providing accurate information.

06

Review all entries for accuracy and completeness before proceeding.

07

Sign and date the form at the designated section.

08

Submit the completed form according to the submission guidelines provided in the instructions.

Who needs TN RV-F1320501?

01

Individuals or businesses that are applying for a specific service or benefit within the state.

02

Anyone required to report certain information as stipulated by local regulations or authorities.

03

Applicants who are involved in a process that necessitates the use of TN RV-F1320501 for compliance purposes.

Fill

form

: Try Risk Free

People Also Ask about

Who is subject to TN franchise and excise tax?

Overview. If you are a corporation, limited partnership, limited liability company, or business trust chartered, qualified, or registered in Tennessee or doing business in this state, then you must register for and pay franchise and excise taxes.

What businesses are tax exempt in Tennessee?

Certain entities under specific circumstances are exempt from paying the business tax. These may include, but are not limited to, people acting as employees, manufacturers, religious and charitable entities selling donated items, direct-to-home satellite providers, and movie theaters.

How to file Tennessee franchise and excise tax?

Registration of Franchise Tax & Excise Taxes is available on the Tennessee Taxpayer Access Point (TNTAP). To apply, please go to the Tennessee Taxpayer Access Point (TNTAP) and select Register a New Business.

What is exempt from TN franchise and excise tax?

There are some exemptions to filing franchise and excise tax. For example, certain limited liability companies, limited partnerships and limited liability partnerships whose activities are at least 66% farming or holding personal residences where one or more of its partners or members reside are exempt.

What is F&E Form 170?

FAE170, franchise tax, excise tax, franchise & excise tax form, Franchise & Excise Tax Return, corporate taxes before 1/

What is franchise excise tax return Tennessee?

The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee. The excise tax is based on net earnings or income for the tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in TN RV-F1320501 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your TN RV-F1320501, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out the TN RV-F1320501 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign TN RV-F1320501 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit TN RV-F1320501 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as TN RV-F1320501. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is TN RV-F1320501?

TN RV-F1320501 is a form used by businesses in Tennessee to report certain financial information related to the state's revenue.

Who is required to file TN RV-F1320501?

Businesses that meet specific revenue thresholds or operate in certain industries as defined by the Tennessee Department of Revenue are required to file TN RV-F1320501.

How to fill out TN RV-F1320501?

To fill out TN RV-F1320501, gather the necessary financial information, follow the instructions provided with the form, and ensure all relevant sections are completed accurately before submission.

What is the purpose of TN RV-F1320501?

The purpose of TN RV-F1320501 is to ensure compliance with Tennessee's tax regulations by collecting financial data from businesses operating within the state.

What information must be reported on TN RV-F1320501?

Information that must be reported on TN RV-F1320501 includes gross sales, tax collected, deductions, and any other relevant financial data as required by the form.

Fill out your TN RV-F1320501 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TN RV-f1320501 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.