Get the free original for recipient

Show details

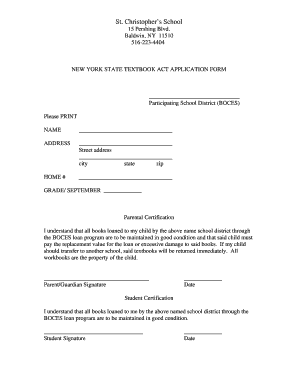

ORIGINAL FOR RECIPIENT CONTRACT NOTE CUM TAX INVOICE Tax Invoice under Section 31 of GST Act KHAJANCHI GANDHI STOCK BROKING PVT. LTD Registered Office 207 HI-SCAN HOUSE NR*MITHAKHALI U/B NAVRANGPURA AHMEDABAD-380009. Tel no 26408566 67 68 SEBI Registration No NSE-EQ INB231210734 NSE-F O INF231210734 BSE-EQ INB011210730 MCX-SX INE261210734 CIN NO U67120GJ2004PTC43876 CM ID BSE-3068 NSE-12107 MCX-SX-50900 Email Id for Investor Complaint complain2khajanchi yahoo. co. in Website Address -www....

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign original for recipient

Edit your original for recipient form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your original for recipient form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing original for recipient online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit original for recipient. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out original for recipient

How to fill out original for recipient?

01

Start by writing your name and contact information in the sender's section at the top left corner of the original. This will allow the recipient to easily identify who the document is from.

02

Next, write the recipient's name and contact information in the corresponding section on the right side of the original. Make sure to include their full name, address, and any other necessary details.

03

In the center of the original, provide a clear and concise subject line that summarizes the content of the document. This will help the recipient understand the purpose of the original at a glance.

04

Begin the body of the original with a polite greeting, such as "Dear [Recipient's Name]," or "To whom it may concern." This sets a professional tone for the document.

05

Clearly state the main purpose or message of the original in the first paragraph. Use concise language and avoid unnecessary details or jargon.

06

Use subsequent paragraphs to provide any additional information or context that is relevant to the recipient. Be clear and organized in your writing, using bullet points or numbered lists if necessary.

07

Sign off the original with a polite and professional closing, such as "Sincerely," or "Best regards." Leave enough space for your handwritten signature, if required.

08

Finally, proofread the original for any spelling or grammar errors before sending it. A well-written and error-free document reflects positively on the sender's professionalism.

Who needs original for recipient?

01

Professionals: Individuals working in various industries may need to prepare originals for recipients as part of their job responsibilities. This includes professionals such as lawyers, accountants, managers, and administrators.

02

Businesses: Companies often generate originals for recipients to communicate with clients, customers, or other businesses. Whether it is a sales proposal, a complaint response, or a formal notice, businesses rely on originals to convey important information.

03

Students: Students may need to fill out originals for recipients when submitting assignments, applications, or academic documents. These originals serve as a formal way to communicate with professors, academic institutions, or potential employers.

04

Individuals: Even in personal matters, individuals may need to prepare originals for recipients. This could include writing a letter of recommendation, a formal invitation, or a personal statement. By following the proper structure and guidelines, individuals can effectively communicate their message to the recipient.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit original for recipient from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your original for recipient into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit original for recipient on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign original for recipient. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I fill out original for recipient on an Android device?

On an Android device, use the pdfFiller mobile app to finish your original for recipient. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is original for recipient?

Original for recipient is a document that contains information pertaining to a payment made to a beneficiary.

Who is required to file original for recipient?

The individual or entity that made the payment is required to file the original for recipient.

How to fill out original for recipient?

The original for recipient can be filled out manually or electronically, following the specific guidelines provided by the tax authorities.

What is the purpose of original for recipient?

The purpose of original for recipient is to report payment information to the recipient and the tax authorities for tax reporting purposes.

What information must be reported on original for recipient?

The original for recipient must include details such as the recipient's name, address, taxpayer identification number, payment amount, and payment date.

Fill out your original for recipient online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Original For Recipient is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.