Get the free borrowing for investment property - Make money from home - Speed ...

Show details

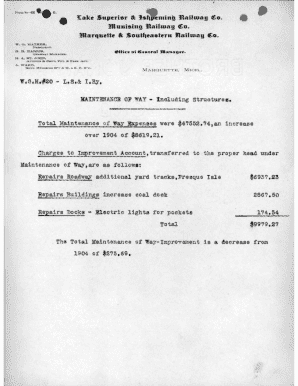

FINANCING SOLUTIONS FOR RESIDENTIAL REAL ESTATE INVESTORSEfficient

We get the deal done. Our

streamlined closing process and

dedicated support allows you to

focus on your business, not

our paperwork.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign borrowing for investment property

Edit your borrowing for investment property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your borrowing for investment property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing borrowing for investment property online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit borrowing for investment property. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out borrowing for investment property

How to fill out borrowing for investment property?

01

Research and understand the lending options available for investment properties. This includes traditional bank loans, private lenders, or government-backed programs.

02

Calculate your budget and determine how much you can afford to borrow for the investment property. Consider factors such as your income, expenses, and the potential return on investment.

03

Gather all the necessary financial documents required by lenders, such as income statements, tax returns, bank statements, and property appraisal documents.

04

Fill out the loan application accurately and thoroughly. Provide all the requested information, including personal details, property information, employment history, and financial statements.

05

Consult with a mortgage broker or financial advisor if you need assistance with the loan application process. They can provide guidance, answer your questions, and help you find the best borrowing options for your investment property.

Who needs borrowing for investment property?

01

Real estate investors who want to expand their portfolio by purchasing additional properties may need to borrow money for the investment property. This allows them to leverage their existing capital and increase their potential returns.

02

Individuals looking to generate passive income through rental properties often need to borrow money to finance the purchase. By using borrowed funds to acquire the property, they can preserve their cash reserves for other investments or emergencies.

03

House flippers, who buy distressed properties, renovate them, and sell them for a profit, may require borrowing to fund the purchase and renovation costs. This allows them to take advantage of lucrative opportunities without tying up their own capital.

In summary, filling out a borrowing application for an investment property involves thorough research, accurate documentation, and careful budgeting. Real estate investors, individuals seeking rental income, and house flippers are common examples of those who may need to borrow for investment properties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit borrowing for investment property online?

With pdfFiller, it's easy to make changes. Open your borrowing for investment property in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit borrowing for investment property on an Android device?

You can edit, sign, and distribute borrowing for investment property on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I fill out borrowing for investment property on an Android device?

On an Android device, use the pdfFiller mobile app to finish your borrowing for investment property. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is borrowing for investment property?

Borrowing for investment property is the process of taking out a loan to purchase real estate with the intention of earning a return on the investment, such as through rental income or capital appreciation.

Who is required to file borrowing for investment property?

Individuals or entities that have taken out a loan to finance the purchase of an investment property are required to file borrowing for investment property.

How to fill out borrowing for investment property?

To fill out borrowing for investment property, one must provide details of the loan amount, interest rate, term, purpose of the borrowing, property details, and any other relevant information requested by the lender or financial institution.

What is the purpose of borrowing for investment property?

The purpose of borrowing for investment property is to leverage funds to purchase real estate assets that have the potential for income generation or long-term appreciation.

What information must be reported on borrowing for investment property?

Information that must be reported on borrowing for investment property includes loan amount, interest rate, term, property details, purpose of borrowing, and any other relevant financial information.

Fill out your borrowing for investment property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Borrowing For Investment Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.