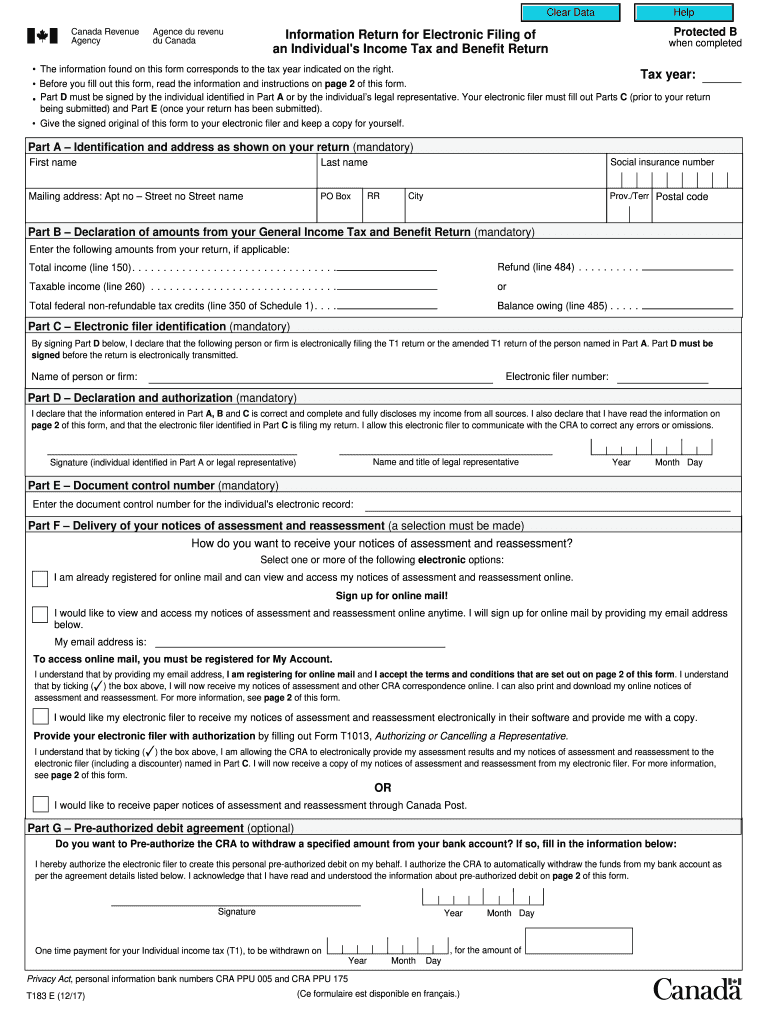

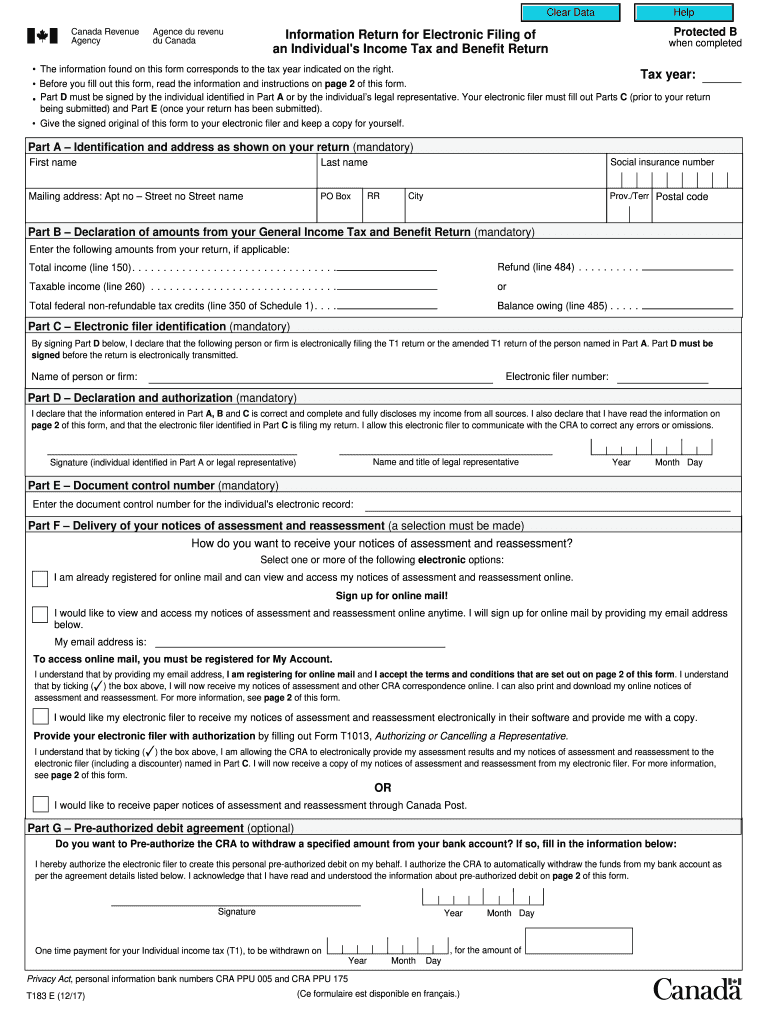

Canada T183 E 2017 free printable template

Get, Create, Make and Sign Canada T183 E

Editing Canada T183 E online

Uncompromising security for your PDF editing and eSignature needs

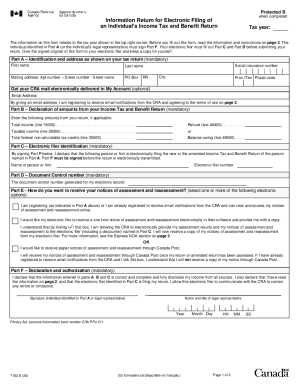

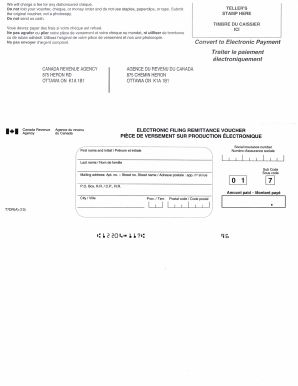

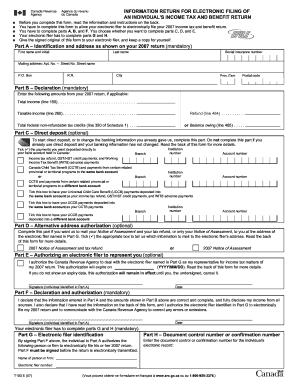

Canada T183 E Form Versions

How to fill out Canada T183 E

How to fill out Canada T183 E

Who needs Canada T183 E?

Instructions and Help about Canada T183 E

Almost every day you can pick up a newspaper and see the word tax in the headlines So why has the issue of corporate tax become so contentious We met with Wilbert Annexes from KPMG and asked him to explain Well I think we first need to answer a simple question And that's a question I will admit even tax professionals like myself don't often consider and the question is What is tax Of course we can find the definition in the dictionary, but the dictionary only tells half the story In reality the definition of tax is better understood through a tax-payers relationship to it What do people get for their money People living in China for example may have a completely different view of taxation to people living in France or Germany The nations cultural background and history will surely influence the way people see the role and the responsibility of the government However I do believe that tax around the globe can be defined by three general characteristics First all taxes are levied through laws Second taxes are not voluntary payments If a payment is voluntary we should call it something else And finally tax is not a payment for a particular service You can't link what you pay to how you want it to be spent Once we appreciate that tax means different things to different people we can move on to trying to better understand corporate tax If we consider a history of tax we can see that corporate tax is only a fairly recent development In the simplest terms when a business sells goods and services to a customer you deduct the business costs from the sales and what is left is what we call the profit And it is only from this profit that a government can take a prescribed percentage for corporate tax Seems fairly straightforward right So what is it about corporate tax that causes this confusion When corporate taxes were introduced in the early 1900s this was the model And because businesses were largely based in a single country there was a very clear supply chain Taxes were simple to collect they were easy to legislate easy to explain and easy for everyone to understand However as we move ahead in time the corporations began to change Traditional bricks and mortar businesses began to evolve, and they become multinationals with a desire for cost efficiency different functions of a business could now be operated across many countries Also it became possible to buy and sell internationally And what we see is that all of a sudden these corporations were dealing with more governments with different regulations different incentives and with different tax systems We need to understand that the government of each country is now claiming their own percentage of the profit and this potentially could lead or even would lead to double taxation To avoid these governments and international organizations developed tax treaties These tax treaties provided tax income between countries and many of these treaties still govern today's corporate tax payments in the world But...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Canada T183 E from Google Drive?

How can I edit Canada T183 E on a smartphone?

How do I fill out Canada T183 E using my mobile device?

What is Canada T183 E?

Who is required to file Canada T183 E?

How to fill out Canada T183 E?

What is the purpose of Canada T183 E?

What information must be reported on Canada T183 E?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.