Get the free Arizona Form 301 Nonrefundable Individual Tax Credits and Recapture 2017

Instructions and Help about arizona form 301 nonrefundable

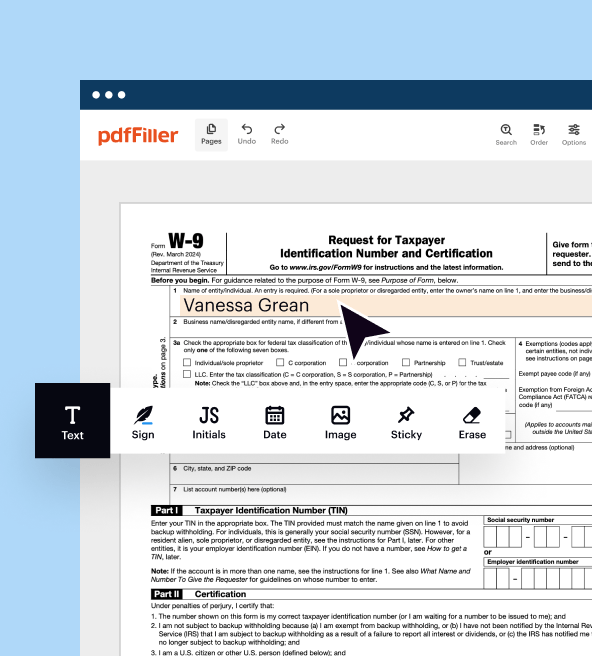

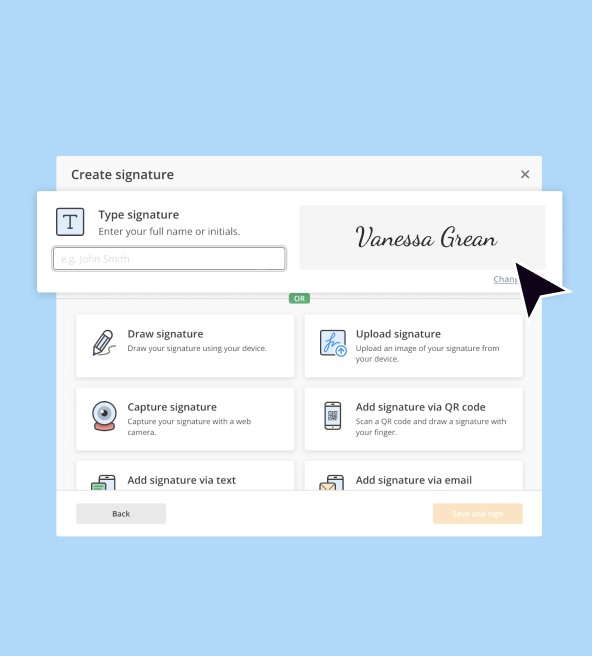

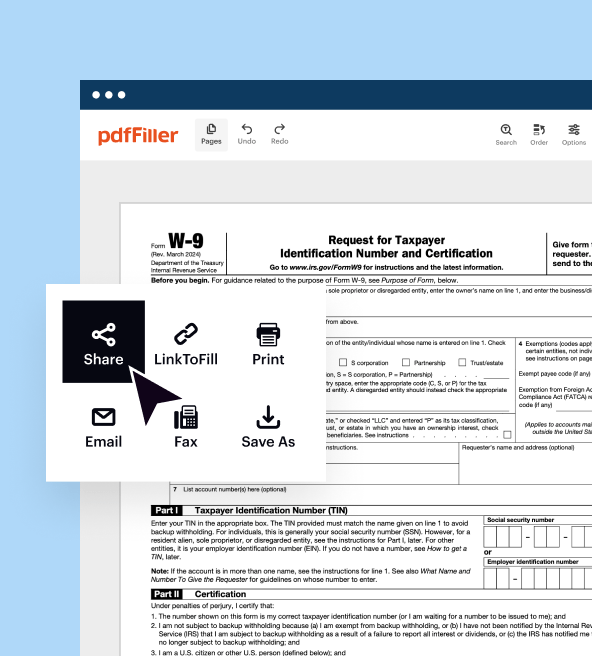

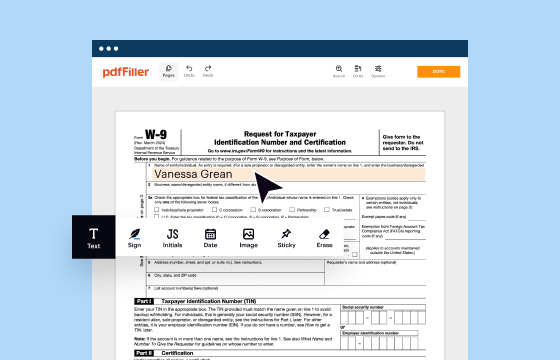

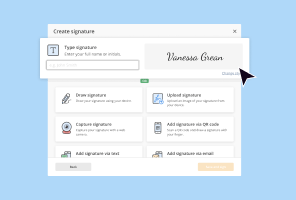

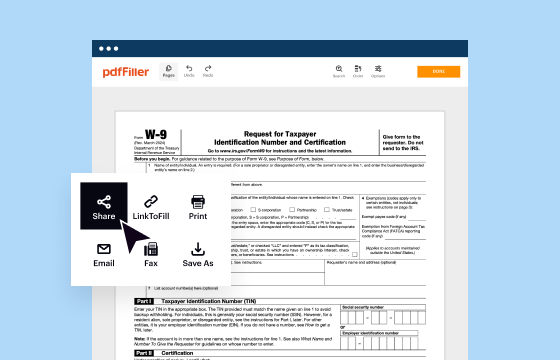

How to edit arizona form 301 nonrefundable

How to fill out arizona form 301 nonrefundable

Latest updates to arizona form 301 nonrefundable

All You Need to Know About arizona form 301 nonrefundable

What is arizona form 301 nonrefundable?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

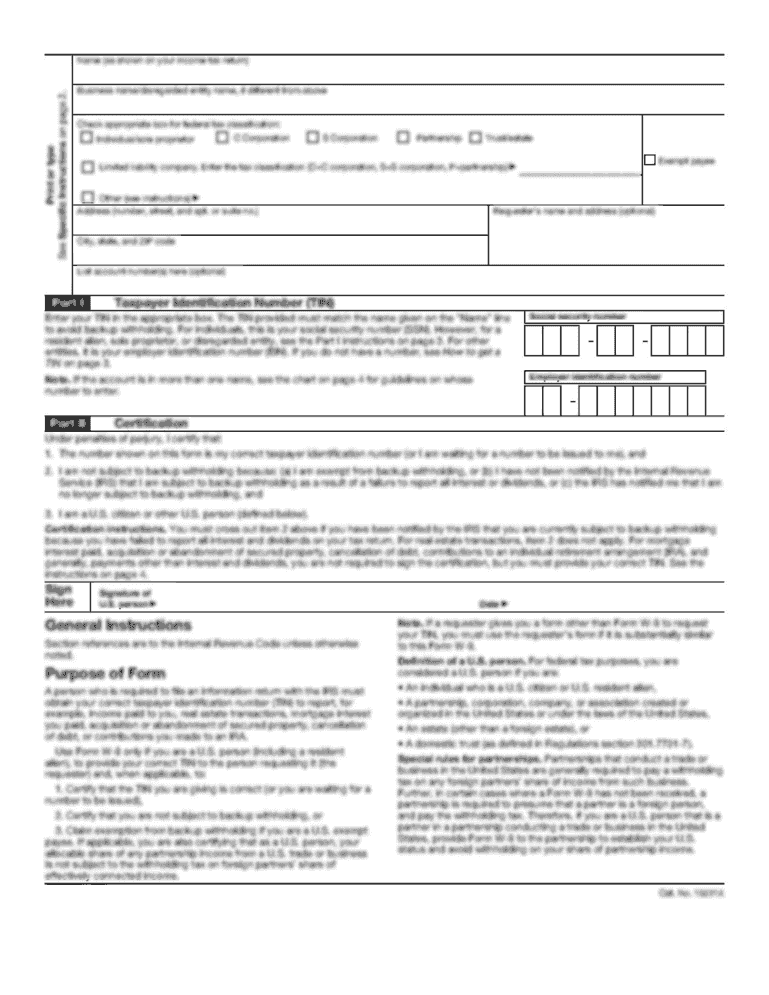

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about arizona form 301 nonrefundable

What should I do if I made an error on my arizona form 301 nonrefundable after submission?

If you discover an error after submitting your arizona form 301 nonrefundable, you have the option to file an amended form to correct the mistake. Be sure to clearly indicate that it's an amended submission and include the original form's details to ensure proper processing. Always keep copies for your records.

How can I check the status of my arizona form 301 nonrefundable after filing?

To verify the status of your arizona form 301 nonrefundable, you can reach out to the Arizona Department of Revenue's customer service or check their online portal if available. Have your submission details handy to help expedite the tracking process.

Are there any specific record retention guidelines for my arizona form 301 nonrefundable?

It’s important to keep a copy of your arizona form 301 nonrefundable and any related documentation for at least three years after filing. This period is crucial in case of audits or inquiries from the tax authorities. Ensure that your records are stored securely to protect any sensitive information.

What are common mistakes to avoid when submitting the arizona form 301 nonrefundable?

Common errors include failing to sign the form, incorrect tax identification numbers, and not including required backup documentation. Double-checking each section and confirming that all materials are included can help mitigate these mistakes, ensuring smoother processing of your arizona form 301 nonrefundable.