CA RI-FL679 2017 free printable template

Show details

SUPERIOR COURT OF CALIFORNIA, COUNTY OF RIVERSIDE BLYTHE 265 N. Broadway, Blythe, CA 92225 HEMET 880 N. State St., Hemet, CA 92543INDIO 46200 Oasis St., Indio, CA 92201 RIVERSIDE 4175 Main St., Riverside,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA RI-FL679

Edit your CA RI-FL679 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA RI-FL679 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA RI-FL679 online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA RI-FL679. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA RI-FL679 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA RI-FL679

How to fill out CA RI-FL679

01

Obtain the CA RI-FL679 form from the California Department of Tax and Fee Administration website.

02

Fill out the identification section with your name, address, and other required personal information.

03

Provide the details of the transaction or issue that the form addresses.

04

Ensure all necessary supporting documents are attached as instructed.

05

Review the form for accuracy and completeness before submission.

06

Submit the form by the specified deadline to the appropriate agency.

Who needs CA RI-FL679?

01

Individuals or businesses involved in certain tax or compliance situations in California.

02

Taxpayers seeking a resolution regarding tax issues or adjustments.

03

Those who have received a notice requiring the completion of CA RI-FL679.

Fill

form

: Try Risk Free

People Also Ask about

What does form I-797C Notice of Action mean?

I-797B, Notice of Action. Issued for approval of a noncitizen worker petition. I-797C, Notice of Action. Issued to communicate receipt or rejection of an applications or petitions; transfer of files; fingerprint biometric, interview and re-scheduled appointments; additional actions, and re-opening of cases.

Can I enter the U.S. with I 797 Notice of Action?

Can I Travel With I-797 Notice of Action? Yes, your I-797F allows you to travel to the U.S. if you are overseas. USCIS will send the form to your overseas address so that you may travel (back) to the United States.

What is a notice of action?

Form I-797, Notice of Action, is a letter sent to those who have recently filed an immigrant or non-immigrant application. This notice of action will either confirm that the government has received the application or it will contain the immigration officer's decision to approve an application or petition.

What happens after I receive my form 1 797C notice of action?

Form I-797, Notice of Action, is a letter sent to those who have recently filed an immigrant or non-immigrant application. This notice of action will either confirm that the government has received the application or it will contain the immigration officer's decision to approve an application or petition.

What is i 797 approval notice?

You may also hear people refer to it as an “approval notice.” The Form I-797 Notice of Action is an official letter of approval that can serve as proof of certain immigration benefits and may be used as evidence in some cases. It's an important document that you should save in a safe place.

What happened after receiving I-797C?

If you receive an I-797C receipt letter, it will contain a receipt number. Use the receipt number to check the status of your case. The receipt letter is a letter that proves an applicant has submitted a benefit request; USCIS has not determined whether that applicant is eligible for an immigration benefit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CA RI-FL679 directly from Gmail?

CA RI-FL679 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I execute CA RI-FL679 online?

Filling out and eSigning CA RI-FL679 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit CA RI-FL679 in Chrome?

CA RI-FL679 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

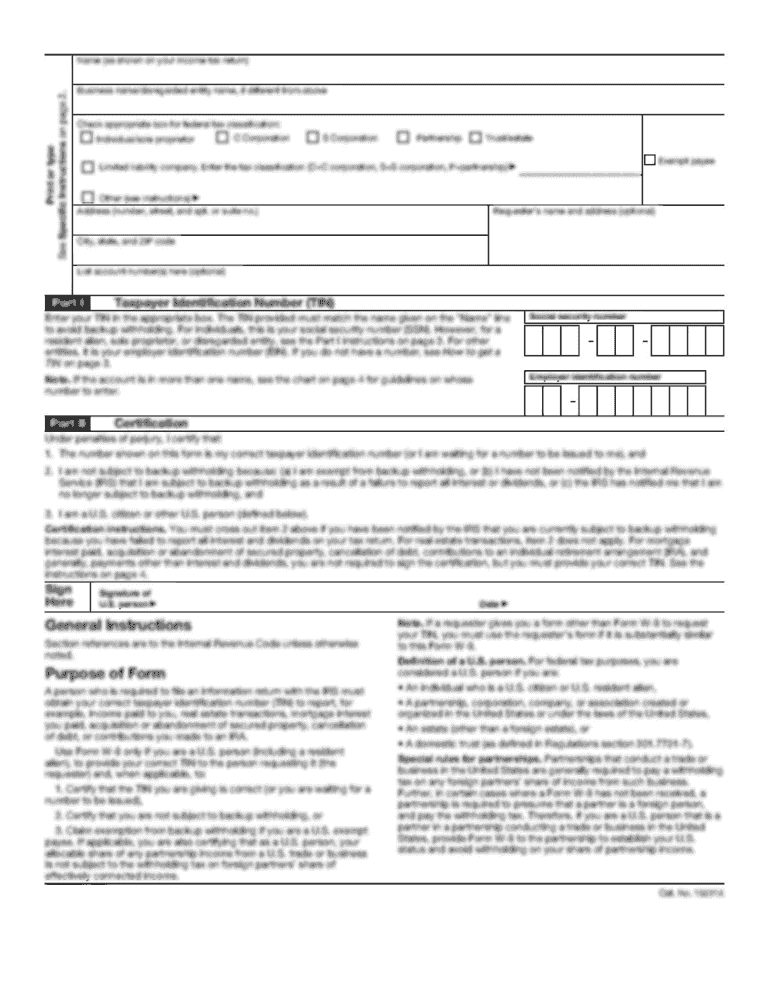

What is CA RI-FL679?

CA RI-FL679 is a form used for reporting income and withholding information for certain California tax purposes.

Who is required to file CA RI-FL679?

Entities that have made payments subject to California withholding tax requirements are required to file CA RI-FL679.

How to fill out CA RI-FL679?

To fill out CA RI-FL679, you must provide your entity information, report the total amounts withheld, and disclose the recipients' information accurately.

What is the purpose of CA RI-FL679?

The purpose of CA RI-FL679 is to ensure proper reporting of withholding taxes to the California tax authorities and to reconcile the withheld amounts with the income earned.

What information must be reported on CA RI-FL679?

On CA RI-FL679, you must report the payer's and recipient's names, taxpayer identification numbers, the amounts paid, and the amounts withheld.

Fill out your CA RI-FL679 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA RI-fl679 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.