Get the free Fixed 1 Year Saver - Summary Box

Show details

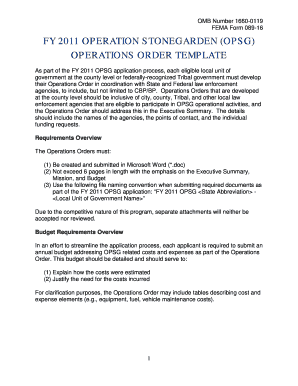

Fixed 1 Year Saver Summary Box Annual Gross*/AER**Monthly Gross*/AER**1.85% / 1.85%Can Kano Bank change the interest rate? What would be the estimated balance on maturity date based on a 1,000 deposit?

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fixed 1 year saver

Edit your fixed 1 year saver form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fixed 1 year saver form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fixed 1 year saver online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fixed 1 year saver. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fixed 1 year saver

How to fill out fixed 1 year saver:

01

Start by gathering all the necessary documents and information. You will typically need your identification documents, proof of address, and your bank account details.

02

Visit the bank or financial institution where you intend to open the fixed 1 year saver account. This can usually be done either in person or online, depending on the options available.

03

Fill out the application form provided by the bank or financial institution. Make sure to provide accurate and up-to-date information, as any discrepancies may cause delays or issues with your account.

04

Specify the term as "fixed 1 year saver" to indicate your preference for a one-year fixed-term account. This means that your deposited funds will be inaccessible for the duration of the term and usually earn a fixed interest rate.

05

Depending on the bank or financial institution, you may have the option to choose between different types of fixed 1 year savers, such as with or without a minimum deposit requirement. Select the one that best fits your financial goals and requirements.

06

Decide on the amount you wish to deposit into your fixed 1 year saver. Ensure you comply with any minimum or maximum deposit limits set by the bank or financial institution.

07

Review the terms and conditions associated with the fixed 1 year saver account, including any fees, penalties, or restrictions that may apply. It is essential to have a clear understanding of what you are committing to.

08

Submit the completed application form along with any required documents to the bank or financial institution. If applying online, follow the instructions provided for uploading or sending the necessary documents electronically.

09

Once your application is processed and approved, the bank or financial institution will open the fixed 1 year saver account for you. You will receive an account number and the details of the account, including interest rate and maturity date.

10

Make your initial deposit into the fixed 1 year saver account within the specified timeframe. This can usually be done through a bank transfer or depositing cash directly at the branch, depending on the bank's policies.

Who needs fixed 1 year saver:

01

Individuals who prefer the security and stability of fixed-term savings with guaranteed returns.

02

People who have a specific financial goal in mind that aligns with the one-year term, such as saving for a down payment on a house or funding a vacation.

03

Anyone who wants to earn a higher interest rate compared to regular savings accounts, as fixed 1 year savers typically offer more attractive interest rates.

04

Individuals with a surplus of funds that they do not require immediate access to and are willing to lock them away for a year to earn interest.

05

Investors who want to diversify their financial portfolio by allocating some of their funds to fixed 1 year saver accounts.

06

Those who find it challenging to save money regularly and prefer the discipline enforced by a fixed-term account structure.

07

Individuals looking for a low-risk investment option to store their money temporarily.

Note: It's essential to consult with a financial advisor or banker before making any investment decisions to ensure it aligns with your financial needs and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fixed 1 year saver directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your fixed 1 year saver and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I create an electronic signature for the fixed 1 year saver in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your fixed 1 year saver in minutes.

How do I complete fixed 1 year saver on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your fixed 1 year saver. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is fixed 1 year saver?

Fixed 1 year saver is a type of savings account where the deposited funds are locked in for a period of one year.

Who is required to file fixed 1 year saver?

Individuals or entities that open a fixed 1 year saver account with a financial institution are required to file it.

How to fill out fixed 1 year saver?

To fill out a fixed 1 year saver, you need to provide your personal information, deposit amount, and agree to the terms and conditions set by the financial institution.

What is the purpose of fixed 1 year saver?

The purpose of fixed 1 year saver is to earn a higher interest rate compared to regular savings accounts by keeping the funds deposited for a specific period of time.

What information must be reported on fixed 1 year saver?

The information reported on fixed 1 year saver includes the account holder's name, account number, deposit amount, interest rate, maturity date, and any penalties for early withdrawal.

Fill out your fixed 1 year saver online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fixed 1 Year Saver is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.