Get the free Insurance Institute of London

Show details

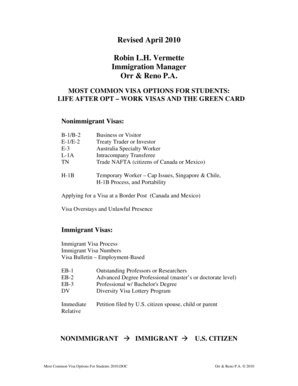

THE CHARTERED INSURANCE INSTITUTEAF7 Advanced Diploma in Financial Planning Unit AF7 Pension transfers EXEMPLAR 2017/2018 Based on the 2017/2018 syllabus and 2017/2018 Tax Tables examined until 31

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance institute of london

Edit your insurance institute of london form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance institute of london form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing insurance institute of london online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit insurance institute of london. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance institute of london

Point by point steps on how to fill out the Insurance Institute of London application:

01

Visit the official website of the Insurance Institute of London (IIL): Start by opening your preferred internet browser and searching for the official website of the Insurance Institute of London. Once you find it, click on the link to access their website.

02

Navigate to the application section: Once you are on the IIL website, navigate to the section that is dedicated to applications. This section will typically be labeled as "Application" or "Join Us." Look for any available links or buttons that will direct you to the application page.

03

Read the instructions carefully: On the application page, you will find detailed instructions on how to fill out the form. It is essential to read these instructions thoroughly to understand the requirements and any specific information needed to complete the application accurately.

04

Provide personal information: Begin filling out the application form by providing your personal information. This can include your full name, contact details, address, date of birth, and any other relevant information requested by the IIL.

05

Select your membership type: The Insurance Institute of London offers various membership types, such as student, associate, or fellow. Choose the membership type that aligns with your qualifications and experience level.

06

Include educational and professional background: Provide details about your educational and professional background, including any relevant qualifications, certifications, or accreditations you have obtained in the insurance or related fields.

07

Answer additional questions: The application form may include additional questions regarding your interests, career goals, or reasons for joining the Insurance Institute of London. Take the time to answer these questions thoughtfully to demonstrate your commitment and passion for the industry.

08

Review and submit your application: Before submitting your application, review all the information you have entered to ensure its accuracy. Double-check for any missing or incomplete sections. Once you are confident with the information provided, click on the submission button or follow any further instructions provided on the application page.

Who needs the Insurance Institute of London?

01

Insurance professionals and practitioners: The Insurance Institute of London primarily serves individuals working in the insurance industry. This includes insurance brokers, underwriters, claims handlers, risk managers, and any other professionals involved in the insurance sector.

02

Students and aspiring insurance professionals: The Insurance Institute of London also caters to students and individuals who aspire to have a career in insurance. By joining the institute, they can gain access to resources, networking opportunities, and educational programs to enhance their knowledge and skills in the field.

03

Those seeking professional development: Individuals who are already working in the insurance industry and aim to enhance their professional development can benefit from becoming a member of the Insurance Institute of London. The institute offers continuous professional development (CPD) programs, seminars, workshops, and conferences that provide industry insights and foster growth opportunities.

04

Professionals looking for networking opportunities: The Insurance Institute of London provides a platform for professionals to connect and network with like-minded individuals in the insurance industry. Through events, conferences, and social gatherings organized by the institute, members can establish valuable connections and collaborations.

05

Those interested in staying updated with industry trends: The insurance industry is constantly evolving, and staying up-to-date with the latest trends, technologies, and regulatory changes is vital. The Insurance Institute of London offers access to industry publications, research papers, webinars, and expert-led presentations to keep members informed about the latest developments in the field.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my insurance institute of london directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your insurance institute of london and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I create an eSignature for the insurance institute of london in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your insurance institute of london and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out insurance institute of london using my mobile device?

Use the pdfFiller mobile app to fill out and sign insurance institute of london on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is insurance institute of london?

The Insurance Institute of London is a professional body for insurance and financial services professionals in London.

Who is required to file insurance institute of london?

Insurance professionals and financial services providers in London are required to file the Insurance Institute of London.

How to fill out insurance institute of london?

You can fill out the Insurance Institute of London by providing accurate information about your insurance activities and financial services in London.

What is the purpose of insurance institute of london?

The purpose of the Insurance Institute of London is to regulate and monitor insurance activities and financial services in London.

What information must be reported on insurance institute of london?

Information such as insurance premiums, claims, policy details, and financial statements must be reported on the Insurance Institute of London.

Fill out your insurance institute of london online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Institute Of London is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.