Get the free IFTA Quarterly Fuel Use Tax Schedule

Show details

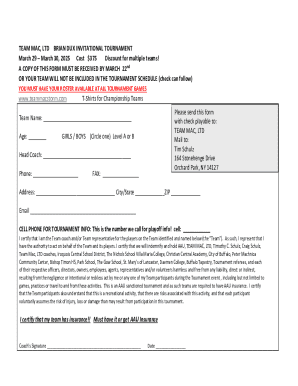

Maine Bureau of Motor VehiclesFuel Type: Diesel2Q/17IFTA Quarterly Fuel Use Tax Schedule SSN/VEIN: Carrier Name: Return Due Date: July 31, 2017IFTA101 (page 1)Use this form to report operations for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ifta quarterly fuel use

Edit your ifta quarterly fuel use form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ifta quarterly fuel use form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ifta quarterly fuel use online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ifta quarterly fuel use. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ifta quarterly fuel use

How to fill out ifta quarterly fuel use:

01

Gather all necessary information: Before starting to fill out the ifta quarterly fuel use, make sure you have all the required information at hand. This includes your total miles traveled, total gallons of fuel purchased, and fuel type for each jurisdiction you operated in during the quarter.

02

Calculate your fuel usage: Use the gathered information to calculate the total gallons of fuel used for each jurisdiction. This can be done by dividing the total miles traveled in a jurisdiction by the average miles per gallon for your fleet, specific to that jurisdiction.

03

Determine the total fuel tax owed: Multiply the total gallons of fuel used for each jurisdiction by the corresponding tax rate. This will give you the total fuel tax owed to each jurisdiction.

04

Complete the ifta quarterly fuel use form: Enter all the calculated information into the ifta quarterly fuel use form. Make sure to accurately record the total miles traveled, total gallons used, and fuel type for each jurisdiction separately.

05

Submit the form and pay the tax owed: After completing the ifta quarterly fuel use form, submit it to the appropriate authority along with the payment for the fuel tax owed. This is usually done online or through mail, depending on the jurisdiction's requirements.

Who needs ifta quarterly fuel use?

01

Trucking companies and operators: Ifta quarterly fuel use is required for commercial carriers and operators who have vehicles weighing over 26,000 pounds or vehicles with three or more axles. This includes interstate carriers as well as those who operate in multiple jurisdictions.

02

Operators with vehicles traveling across jurisdictions: If you operate a vehicle that travels across multiple jurisdictions, the ifta quarterly fuel use becomes necessary. It allows for the simplification and uniformity of reporting and payment of fuel taxes, making it convenient for operators.

03

Government authorities: Ifta quarterly fuel use is required by government authorities to ensure accurate reporting and payment of fuel taxes. It helps in the allocation and distribution of fuel tax revenues among the jurisdictions involved, ensuring fair taxation for all carriers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my ifta quarterly fuel use in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your ifta quarterly fuel use and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit ifta quarterly fuel use straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing ifta quarterly fuel use.

How do I fill out ifta quarterly fuel use using my mobile device?

Use the pdfFiller mobile app to fill out and sign ifta quarterly fuel use on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is ifta quarterly fuel use?

The IFTA Quarterly Fuel Use is a report that tracks the amount of fuel consumed by qualified motor vehicles traveling in multiple jurisdictions.

Who is required to file ifta quarterly fuel use?

Motor carriers operating commercial vehicles over 26,000 pounds or with three or more axles are required to file the IFTA Quarterly Fuel Use report.

How to fill out ifta quarterly fuel use?

To fill out the IFTA Quarterly Fuel Use report, motor carriers must track the total miles driven and total gallons of fuel consumed in each jurisdiction.

What is the purpose of ifta quarterly fuel use?

The purpose of the IFTA Quarterly Fuel Use report is to calculate and distribute fuel tax payments among multiple jurisdictions based on fuel consumption.

What information must be reported on ifta quarterly fuel use?

Information such as total miles traveled, total fuel consumed, and fuel tax rates for each jurisdiction must be reported on the IFTA Quarterly Fuel Use report.

Fill out your ifta quarterly fuel use online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ifta Quarterly Fuel Use is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.