Get the free MI-1040-V 2017 Michigan Individual Income Tax e-file Payment Voucher

Show details

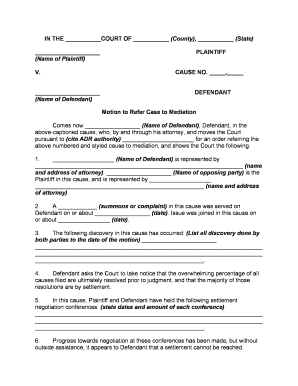

Instructions for Form MI1040V

2017 Michigan Individual Income Tax file Payment Voucher

Payment can be made using Michigan's payments service by direct debit (check) from your checking or savings

account,

We are not affiliated with any brand or entity on this form

Instructions and Help about mi-1040-v 2017 michigan individual

How to edit mi-1040-v 2017 michigan individual

How to fill out mi-1040-v 2017 michigan individual

Instructions and Help about mi-1040-v 2017 michigan individual

How to edit mi-1040-v 2017 michigan individual

You can edit the mi-1040-v 2017 michigan individual tax form using pdfFiller. Upload the form to the platform, and utilize the provided editing tools to make necessary changes, such as correcting information or adding annotations. After editing, you can save or print the updated document for submission.

How to fill out mi-1040-v 2017 michigan individual

To fill out the mi-1040-v 2017 michigan individual tax form, gather all required information such as your total income, tax liability, and any credits you may qualify for. Follow the form instructions closely, entering your data in the designated fields. If you are unsure about any section, refer to accompanying guidelines or consult a tax professional for assistance.

Latest updates to mi-1040-v 2017 michigan individual

Latest updates to mi-1040-v 2017 michigan individual

No significant updates have been reported for the mi-1040-v 2017 michigan individual tax form. However, it is essential to verify any new regulations or changes by visiting the Michigan Department of Treasury website.

All You Need to Know About mi-1040-v 2017 michigan individual

What is mi-1040-v 2017 michigan individual?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About mi-1040-v 2017 michigan individual

What is mi-1040-v 2017 michigan individual?

The mi-1040-v 2017 michigan individual is a payment voucher form used by Michigan residents to submit their income tax payments. Taxpayers utilize this form when they owe taxes to ensure that their payments are correctly allocated to their account with the state.

What is the purpose of this form?

The purpose of the mi-1040-v 2017 michigan individual is to facilitate the payment of state income taxes owed by individuals. This form helps the Michigan Department of Treasury track payments and ensures that taxpayers meet their obligations accurately and on time.

Who needs the form?

Individuals who owe taxes on their income and are filing a Michigan individual income tax return must complete the mi-1040-v 2017 michigan individual form. It is necessary for any taxpayer who has an outstanding balance due after calculating their tax liability for the year.

When am I exempt from filling out this form?

You may be exempt from filling out the mi-1040-v 2017 michigan individual if you do not owe any taxes to the state of Michigan. Additionally, if you are due a refund or have no taxable income, there is no need to submit this payment voucher.

Components of the form

The mi-1040-v 2017 michigan individual consists of several key components, including your personal information, total amount due, and payment details. Ensure all fields are filled out accurately to avoid complications during processing.

What are the penalties for not issuing the form?

Failure to submit the mi-1040-v 2017 michigan individual when taxes are owed can result in penalties and interest charges from the Michigan Department of Treasury. It is crucial to adhere to all filing requirements to prevent additional financial burdens.

What information do you need when you file the form?

When filing the mi-1040-v 2017 michigan individual form, you will need pertinent information such as your full name, address, Social Security Number, and the total amount of tax you owe. Additionally, you should have a record of your income and any deductions or credits that may affect your tax liability.

Is the form accompanied by other forms?

The mi-1040-v 2017 michigan individual form is typically submitted along with your mi-1040 tax return. Ensure that all necessary forms are included with your submission to prevent processing delays.

Where do I send the form?

The completed mi-1040-v 2017 michigan individual form should be sent to the appropriate address indicated on the form, which typically varies based on the method of payment. For those making payments by mail, check the Michigan Department of Treasury’s guidelines for the correct mailing address.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.