Get the free CheCk your Credit report at least onCe a year

Show details

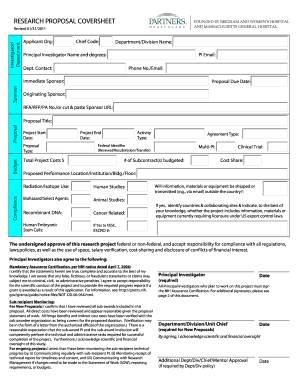

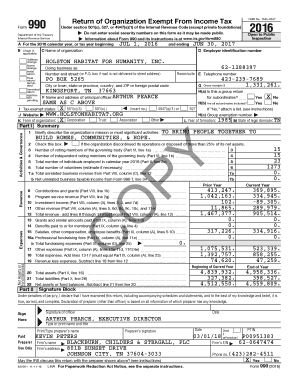

Check your credit report at least once a year The Consumer Financial Protection Bureau advises consumers to check their credit reports at least once a year. Consumers can receive free copies of their

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign check your credit report

Edit your check your credit report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your check your credit report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit check your credit report online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit check your credit report. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out check your credit report

How to fill out and check your credit report:

01

Start by requesting your credit report from all three major credit bureaus – Equifax, Experian, and TransUnion. You can do this by visiting their websites or contacting them by phone or mail.

02

Review your personal information on the credit report carefully. Make sure your name, address, and other personal details are accurate and up to date.

03

Check your credit accounts and loans listed on the report. Verify if the accounts listed belong to you and if all the information, such as credit limits and payment history, is accurate.

04

Look for any inaccuracies or errors on your credit report. If you find any, dispute them with the credit bureaus by providing supporting documents and explaining the incorrect information.

05

Pay attention to your credit utilization ratio, which is the amount of credit you have used compared to your credit limit. A lower ratio indicates responsible credit management.

06

Examine any negative information, such as late payments or collections, and determine if it accurately reflects your credit history. If there are mistakes, take steps to correct them.

07

Monitor any credit inquiries made on your report. Unauthorized inquiries could be a sign of potential identity theft.

08

Take note of the overall credit score provided on the report. Your credit score is a numerical representation of your creditworthiness and can affect your ability to obtain loans or credit in the future.

09

Regularly check your credit report, at least once a year, to ensure the information remains accurate and to catch any potential identity theft or fraud.

10

Consider seeking professional advice from a credit counselor if you need assistance understanding your credit report or improving your credit score.

Who needs to check their credit report:

01

Individuals who are planning to apply for a loan or credit card in the near future. Lenders use credit reports and scores to determine the risk associated with extending credit to individuals.

02

People who have recently experienced identity theft or suspect fraudulent activity on their accounts. Regularly checking your credit report helps identify any unauthorized accounts or inquiries.

03

Individuals with a history of financial mismanagement or those who have undergone significant financial changes, such as bankruptcy or foreclosure. Regularly monitoring credit reports can help rebuild credit and spot any potential errors.

04

Everyone, regardless of their financial situation, should periodically check their credit report to ensure accuracy and stay informed about their creditworthiness.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit check your credit report from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including check your credit report, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit check your credit report on an iOS device?

Create, edit, and share check your credit report from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete check your credit report on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your check your credit report, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is check your credit report?

Check your credit report is a process of reviewing your financial history and credit information to ensure accuracy and identify any potential issues. It is important for understanding your creditworthiness.

Who is required to file check your credit report?

Individuals who have credit accounts or loans are typically required to check their credit report regularly to monitor their financial health and ensure there are no errors or fraudulent activity.

How to fill out check your credit report?

To fill out a check your credit report, you can request a copy of your credit report from a credit bureau, review the information for accuracy, and report any errors to the credit bureau or creditor.

What is the purpose of check your credit report?

The purpose of checking your credit report is to monitor your credit history, detect any potential identity theft or fraud, and ensure the accuracy of the information being reported about your financial accounts.

What information must be reported on check your credit report?

A check your credit report must include information about your credit accounts, payment history, outstanding debts, and any inquiries made into your credit profile.

Fill out your check your credit report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Check Your Credit Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.